In the past, we have experienced some problems with subscribers not receiving our newsletter from our normal e-mail account. If you do not receive our newsletter by 7PM Eastern, please e-mail us and we will resend you the newsletter.

Our system has adapted over the twenty years of trading (and decade writing the newsletter) and the best way to really understand how to use our services is to watch us trade. Please read the following and go through our Best of Blog to understand how we trade and to read details on the three intraday strategies we have created over the years, the base and break, the overshoot, and the Indy. The main daily patterns we trade are the ones that are in the toolbox of most traders — ascending triangles, cup and handles, etc.

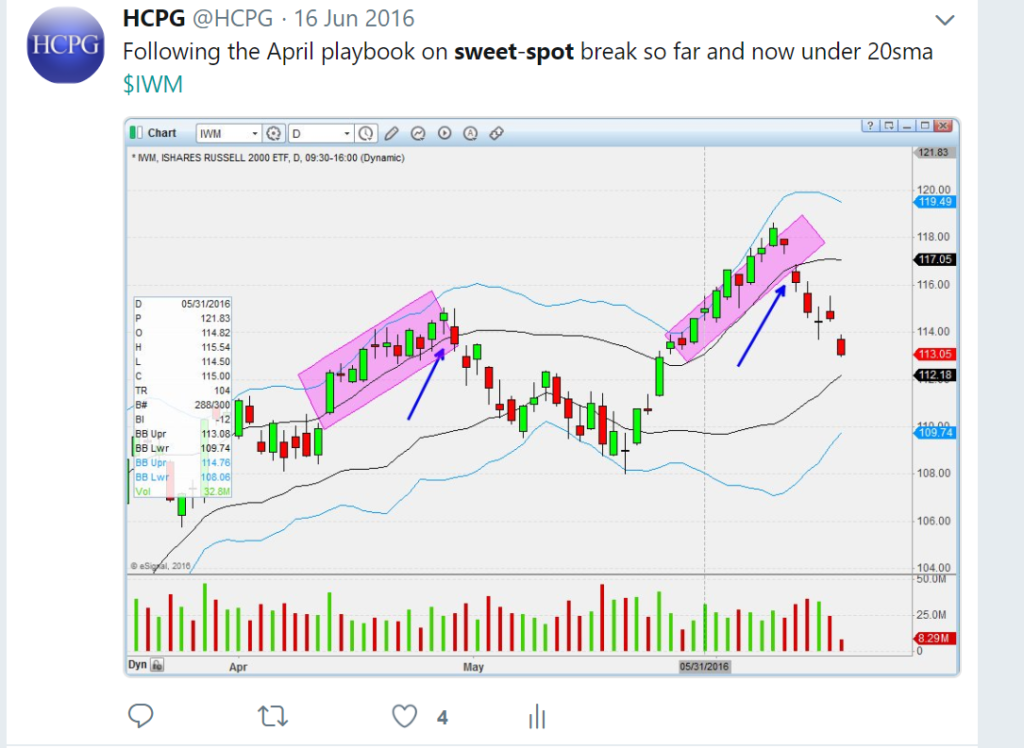

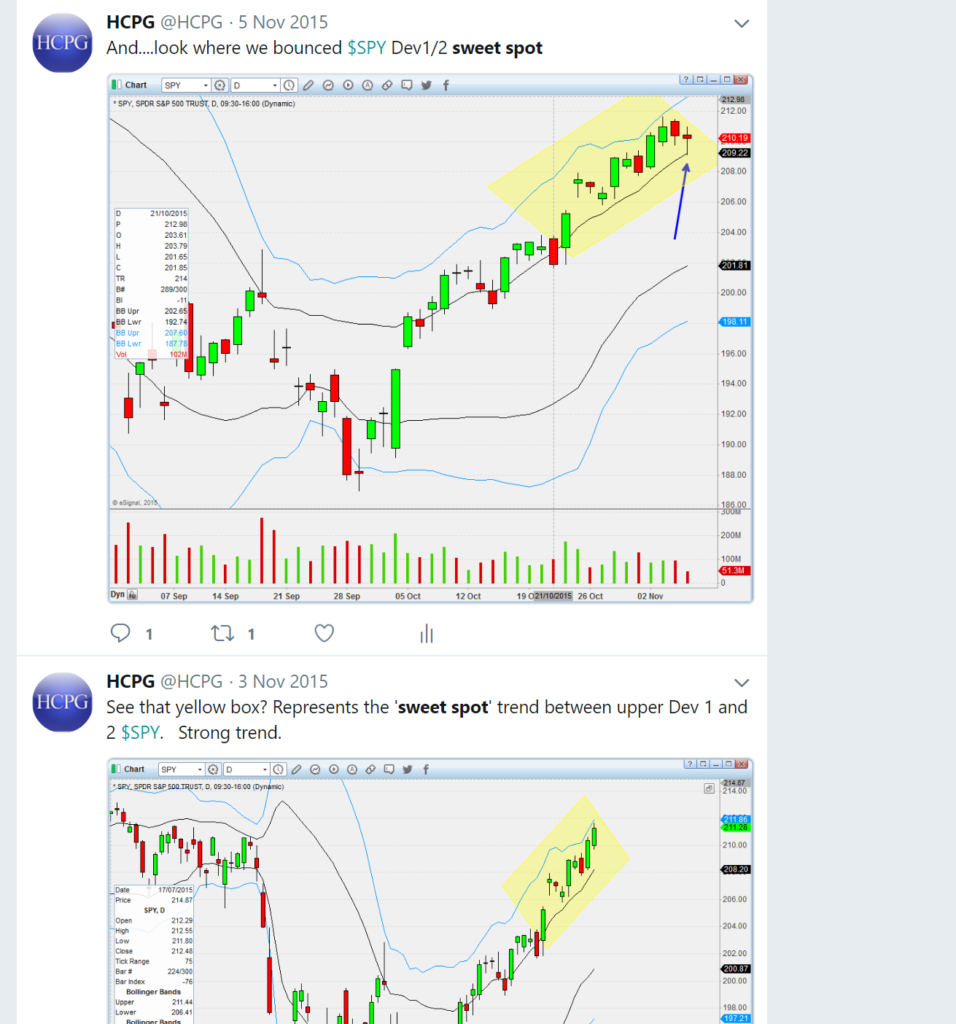

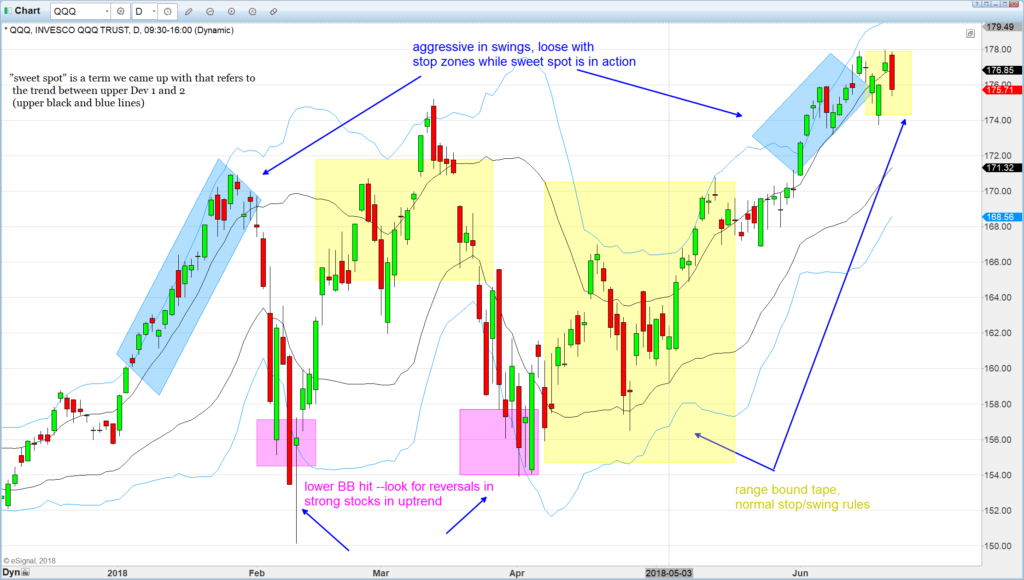

The main trending pattern we use we call the “sweet spot” — a trend we noticed back in 2013 when price trends along between upper Dev 1 and 2 (in our charts upper black and blue lines). Sweet spot concept is self-explanatory once you look at the following:

We have two central strategies around which we trade: 1) buying break-outs/shorting break-downs and 2) buying support/shorting resistance.

The two methods are the inverse of each other — in buying break-outs we buy the break of the base (our base and break method) or a dip to an ascending EMA (or SMA on daily), and in buying support we buy the reversal on an extended move away from the base.

The base is your friend when buying a break-out through resistance or shorting a break-down through support. However, when doing the opposite — buying support, selling resistance– then you want to logically also be doing the inverse, buying the reversal on the extended spike down to support away from the base or selling resistance on a vertical spike up away from the base.We’ve gone over the difference in how to buy breakout longs versus support buys many times in the newsletter however we still get questions on this often. Hopefully the following (very crude) diagrams will clarify the matter:

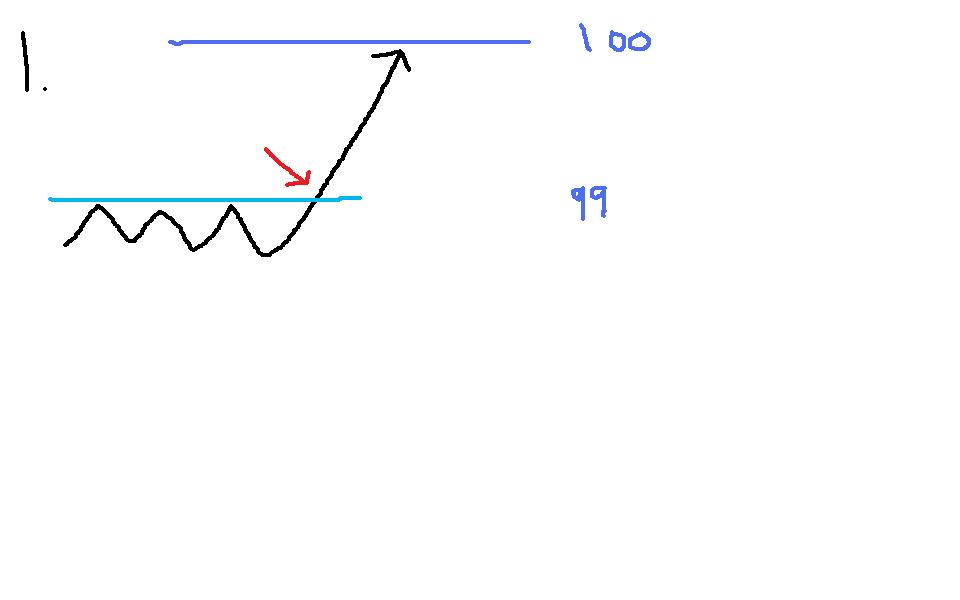

1. A text-book break-out long base and break through resistance. The daily number is 100; the stock bases one point under at 99 and then breaks the base. Do not wait for 100 to buy, but rather buy the break-out of the base below, say at 99.2.

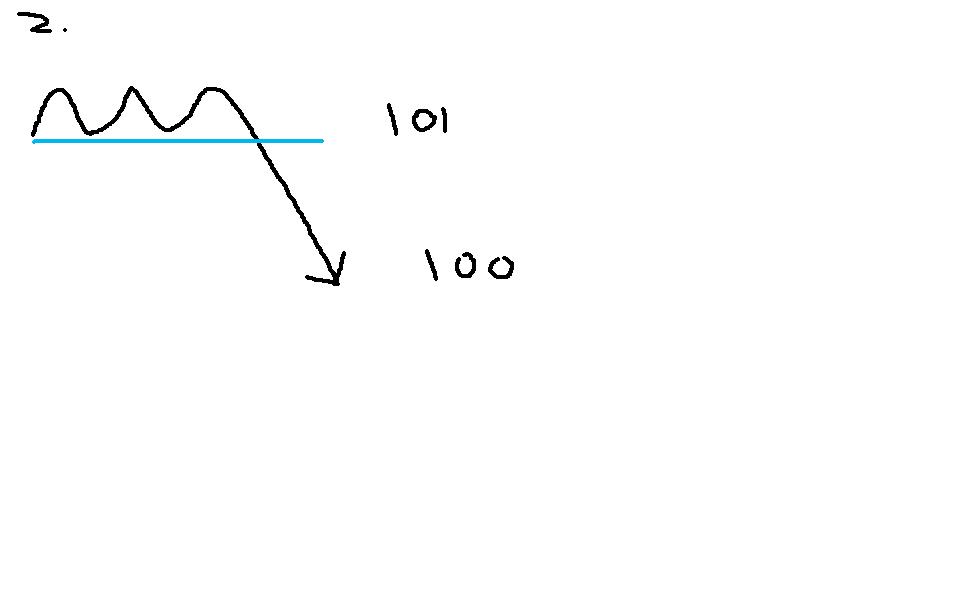

2. A text-book break-down short base and break. The daily spot is 100, you see a base with good volume at 101 and you short the break-down through the base for the dive down to the 100 daily spot support. Fill would be around 100.8 with stop on any reversal back to the base over 101.

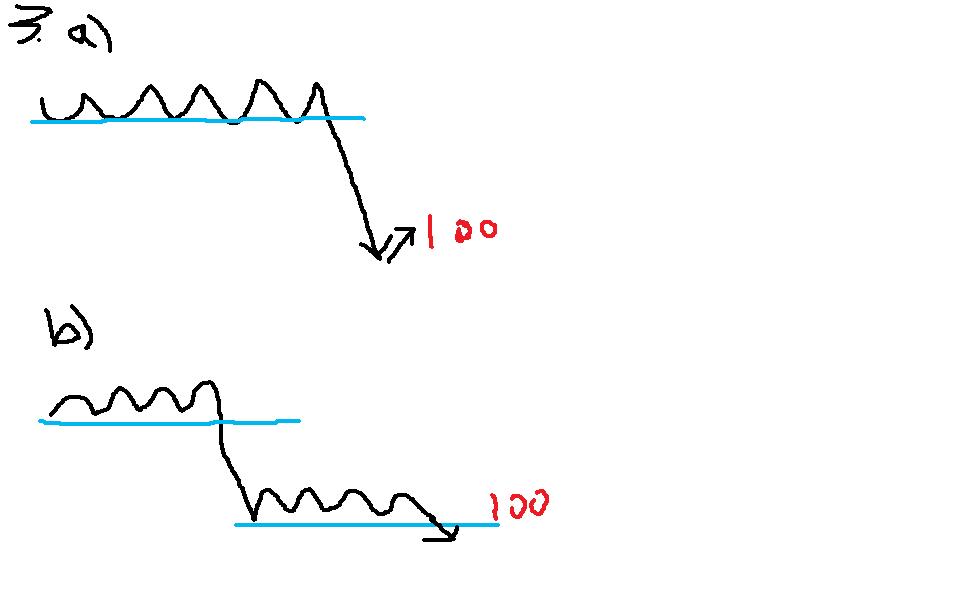

3. a) At 100 there is formidable support and you want to buy this support for a bounce. The stock breaks 100 and then reverses up — you buy it. b) Then you notice that it is forming a secondary base right at support. This is bad news if you’re long — exit as there is a high chance that the stock will go lower. Sometimes the base turns into a cup and the support long still works, but don’t take any chances and keep your stop as is.  4. At 100 there is formidable support and you want to buy this support for a bounce. The stock breaks 100 and then reverses up — you buy it. The stock does not form any secondary base and instead bounces hard. This is exactly what you want — buying the stock at daily support but extended away from intraday base.

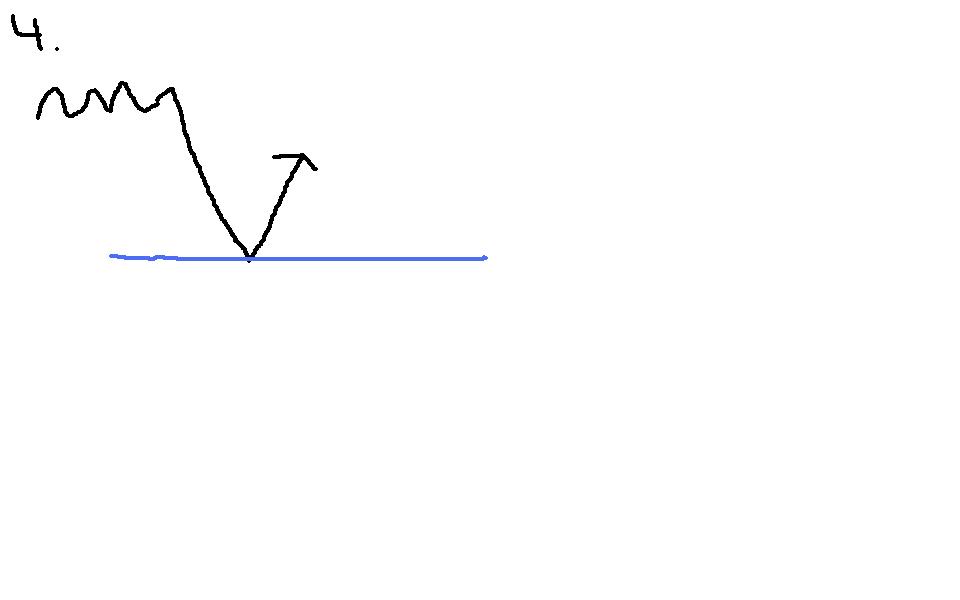

4. At 100 there is formidable support and you want to buy this support for a bounce. The stock breaks 100 and then reverses up — you buy it. The stock does not form any secondary base and instead bounces hard. This is exactly what you want — buying the stock at daily support but extended away from intraday base.

Remember: Base is your friend when you are buying break-outs through resistance/shorting breakdowns through support. But if you are doing the inverse, as is logical the opposite is true: it’s your enemy when you are buying support, or shorting resistance.GOOG was a buy in our newsletter at 600. The stock comes down to our spot (600.62) and S1 and bounces for 6 points. Great trade with buy on reversal over the spot/S1.

Couple hours later GOOG comes to test the area again — remember what we have always said “buy the first test, but never the second”or look for Indy short. With the second test comes a base at support — exactly what you DON’T want to see when buying support (but yes when you are buying break-outs). Notice where the EMA is on second test — it’s pushing it down and the support set-up has now become a short set-up because of the lack of distance between price and EMA. This is now turned into an Indy short.

Always remember, whether you’re looking at intraday charts or daily charts, the more ducks line up in your favor, the higher the chance of success. Intraday – base/EMA/R1/ coinciding near daily spot is almost always a win. Daily: oversold going into support meeting trend-line and an important moving average is almost always a win. The problem of course is that most trades do not have everything all lined up nice and neat, and that’s OK, but at least when they do then do put on more size and be more aggressive.Note how the trend-line coincides with an oversold status, and the 200 SMA. This is the exact type of chart we are looking for going forward for potential swing trades.

Why is it that the more balls line up in a trade the more chance of success? Because some traders specialize in buying stocks that reach a certain oversold status, other like to buy off of the 200 SMA, others only look at trend-line support, — once you get all these groups together buying at the same time and the same level, chances of a bounce are excellent. Think of being on top of a cliff and wanting to bungee jump. The first group (buyers of the 200 SMA) are like one thin rope on your ankle. It might hold your fall, or it might not as your weight might be too heavy for the supportive rope. The second group (buyers of trend-line support) are like a second rope on your ankle. Now the chances of bouncing as you hit the end of the rope are greater. The third group is like an additional supportive rope on your body, and so on and so on.

And why do we say avoid buying support when there is news/heavy volume? Because that changes the play-book — suddenly someone added a backpack with 100 kilos of rocks to your bungee jump and the chances of those ropes holding just got a lot less. If there is specific news on a stock we completely avoid support trades. If there is no news but heavy volume on a sector getting smashed then we change our strategy from buying on support to waiting for an extreme oversold move through support and then buying on a reversal with the support as the target for the bounce.

With break-out long swings you can to a great extent still use day-trade stops with swing trade positions. A good break-out should obey the usual rules of heavy volume, not coming back to the base, etc. However this is not true of swing trades on support where often the stock closes down right on support but gaps up the next morning. With swing trades on support you will often have to endure some pain but in a benign bull market there probably is nothing more profitable than buying an oversold up-trending stock into daily support.Buy the break-out or buy support, but do nothing in between and whatever you do, never combine both.

What is combining both? Buying a break-out (i.e. resistance), seeing it fail, and then holding until support. When is the only time we would add to a loser? When a stock is close to two support levels — we start a starter position on the first, and add on the second — note the difference that you are combining two of the same, two support levels, and not mixing up buys on resistance and support. How do we decide on size? The closer the first support is to the second, the bigger the starter position.

We trade a lot around the EMA/R1 combo, be it buying a move on a lift-off from the EMA/R1, buying a dip to an ascending EMA meeting R1 or what we call “the Indy”.

Another strategy we use often and which is important for every HCPG reader to know well is what we have affectionately dubbed, “the Indy”. The name comes from a description of the strategy in which the stock is being held from above by R1 and is slowly getting squeezed from below by the ascending EMA. Indiana Jones would often find himself in similar situations and would always find a way to break out of the impending squeeze, thus “the Indy”.

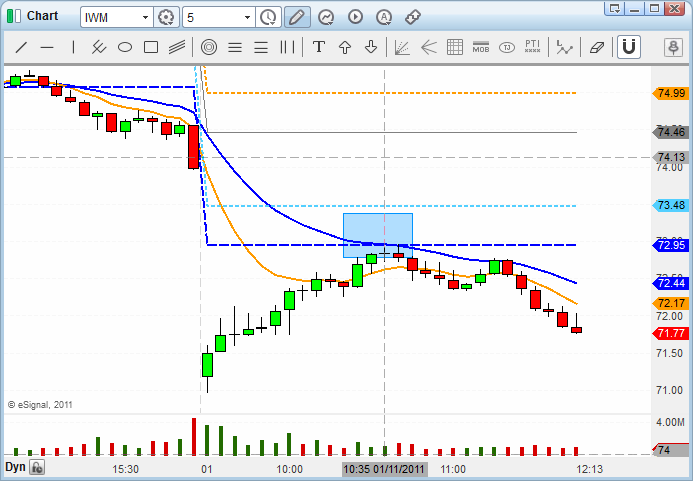

Note that reverse Indy is the exact opposite. Stock bases on either S1/S2 (or daily spot) and waits for descending EMA. When the EMA catches up the stock starts a new leg down.

Let’s take a look at a typical Indy set-up. First you have the stock rally almost to the alert/ R1 zone (alert was 46) and then pull-back. The stock’s range is wide as it bobs between the alert and the ascending EMA (blue line). As time passes the price pattern tightens up as it waits for EMA to catch up with R1. Once the EMA catches up the the stock is free to break-out. Stop is under EMA/R1 (usually very tight stop which gives you great risk-reward).At 10AM the set-up looked OK and worth watching; and 11 AM the set-up was much tighter and intriguing with the ascending EMA and basing at R1; by 12:25 the ascending EMA crossed over R1 and stock lifted out of base the pattern became a lay up. BHI was a HCPG alert pick at 46.

As you can see, pain free trade as the stock never returns to the 46 base.

Here’s another great example of the Indy strategy from October/2010:

On the newsletter the night before the stock triggered we wrote “NFLX a bit far away now meaning that if it wants to go most likely it will be base and break well under the number”. Indeed that was the case as it set up base and break 2.5 points under. Stock based under R2 (red line) and waited for the 20EMA (blue line) on the 5 min chart to catch up. Note how stock just sits under R2 and waits for ascending EMA to catch up. Once this occurs stock is free to break out of the base. Perfect example of the Indy.

Excellent continuation on a great risk-reward trade.

Note that the top of the Indy range can also be daily resistance, that is, our own alert. GS alert 164 –note how it was slowly pushed up by the ascending EMA until it had no more room. Do or die. Perfect.

Reverse Indy is a short set-up:

What is overshoot: let’s say you want to buy stock ABCD at support at 50. However stock grinds down following a descending EMA with no reversal at 50 so you pass. Next support is 48 on daily. Stock starts extending away from EMA/base as panic starts to enter and reaches 48, scums (meaning just goes lower to hit stops, and then reverses). You buy 48.15 with stop on low 47.9. This is an overshoot support. Your target? Your original support alert of 50.

There are two general strategies for entering support longs– the one most discussed in the newsletter are the ones that come down quickly extended from EMA, make a hammer at our number and reverse up sharply. This gives us a very defined trade—get in on reversal with stop on the low and take profits on the move back to the EMA (which by definition means you don’t buy support when stock is simply trending closely below EMA). The second type is harder to game – these are the ones that base and make rounded cup and then go higher – we find these more difficult to trade because a ) there is no immediate stop that comes to the eye and b) we get worried when a stock bases on reversion to mean trades. The best way to deal with this second type of set-up when it’s a slow grind to the number is to either just pass, or get in at number with a set stop under, for example .5% under alert (40 cents on a $80 stock, 20 cents on a $40 stock, etc)

The problem of course is that sometimes you don’t know which type of set-up it will be – stock will come down sharply but then just base at number. It’s quite possible that to reach the largest amount of support plays it’s best to bid the number with a set stop (say .4-.5% ) under. We use both techniques, but over time have started to gravitate towards the second strategy—bid number with pre-defined stop under. The advantage also of using the second strategy is that you get a better fill than waiting for a reversal candle, however, likely more stops. Both strategies are useful but in the end strategy number two probably would work out the most – bid the alert number with a pre-defined .4-.5% stop under the alert. The one big exception for us is when a stock is trending lower right under the 9 or 20ema on 5 minute – we always pass (or look for next level of support for overshoot) when we see that happen.

Other notes:

1) as our long-term readers know we like to trade off our own pre-determined list (newsletter selections from previous night) and not look elsewhere during the day. This helps us focus on charts we already know well and reduces the number of mistakes we make. We don’t use any scans intraday.

2) once the stock has broken-out and after you have made your exit, don’t stop watching the stock. Drag it to a “triggered” portfolio and keep an eye on all stocks that have broken out. Why? a) if break-outs are working, buy the dip to EMA/pivot point and b) as a tell since watching triggered alerts gives you a very good idea whether you’re in a trend day (break-outs/break-downs working) or range-bound day (multiple failures)

3) EMA’s can be a valuable tool if you know how to use them — find out which EMA is important each day. The most important to us are the 5 min, 15 min ,and 60 min charts and their respective 20 EMAs. We make our decisions based on the 5 min chart but if stock is triggering near the open then we do watch the 1 min to place our entry. Also keep an eye on which EMA meets up with pivot points (especially R1). An ascending EMA combined with R1 usually makes for a very nice pull-back entry on a stock that has or is close to breaking out.

Note about EMA’s: The 20 min EMA/5 min chart is incredibly useful in the first part of the day but the relevance fades in the afternoon as longer timeframe EMAs (15min) come into focus. Basically we like to look at the 20EMA on 1 min/3 min/5 min from the open to say first hour of the day. Then 3 min and 5 min for next hour. Then 5 min for the next few hours. After around 2 PM the 20EMA on the 5 min becomes less relevant and we don’t use the EMA as much as a tool for trading If you want at this time to still watch the EMA then switch to 15 min chart.

4) there is nothing better than a trend-day for buying pull-backs to the alert price or to the EMA (or even better a combination of the two if they line up).

5) we find EMA dip-buying works better earlier in the day than later in the day

6) for buying the pull-back always look for the ascending EMA — flat EMAs have a much higher failure rate

7) (a) Trend days up buy breakouts, buy pull-backs to EMA (b) Trend day down short break-downs on daily, short rallies to EMA intraday (c) Range bound days buy pull-backs to daily support, short daily resistance. Don’t get these two mixed up! Do your homework and always have alerts on your list for they serve as tells on market behavior. You don’t want to be caught trying to buy support on first day of trend day down – you might now know by 10AM but by noon you should have a good idea and adjust accordingly. On trend days our rule is to always stay on the side of the trend.

So how do we know when it’s a trend day? 1. Breadth – you want all the lead sectors pointing in same direction. 2. EMA – market has to stair step down the EMA, being sold on every little rally (or bought on every pullback for trend day ups), and 3. support/resistance not holding. Sometimes support holds initially on trend day down, has a small bounce, and then goes through on second time (which is why our rule is to always buy first test, but never the second).

8) mechanical percent based stops are useless for our type of trading — look for the base and trade around that. The base is everything.

9) if a stock gaps up above our alert we never chase it up — we wait for it to either pull-back to re-test our spot or to make a low risk base before entering. Often it bases until the ascending 20EMA/5 min catches up and then takes off.

10) If you want to get in and stock has tested same support then zoom out and go to the next EMA IF you can find an ascending one, but don’t buy the same EMA test. Do not buy the second test of the 20EMA on the 5 min chart but look for EMA bounce for example on the 15 min chart IF IT IS ASCENDING. Flat EMAs are irrelevant. We have at all times the 20EMA plotted on the 3 min, 5 min, 15 min, and 60 min time-frame (as well as daily chart of course but there we use SMA). We like having these charts side by side and not have to switch from one to another can take up valuable time in the heat of a trade.

11) In range bound markets focus on reversion to mean strategy (buy support/sell resistance instead of buy breakout/short breakdown) the day AFTER a trend-day.

12) We try to not employ reversion-to-mean strategies on trend-days. If you recognize a trend day then stay on the side of the EMA and forget about going contra. This little rule has saved us countless dollars over the years. Key of course is recognizing a trend-day early. Two things to look for: EMA should acts as a wall of support (on trend days up) or a wall of resistance (on trend days down), and breadth should be heavily skewed to one side.

13) if an alert is far away but you see a decent set-up on a stock, treat the alert as target. This means that instead of buying at the alert, you buy on an intraday set-up below the alert with the intention of selling into the alert. This also happens often on gap down days. Market gaps down but one of our stocks sets up with good relative strength — the move from gap down to alert is the target. Often these stocks move to alert and then stall because due to the gap down they become extended by the time they reach the alert.

14) On surprise market moves that invalidate your plan from the previous night, overcome the emotion of disappointment and wait for the pitch. Almost always a good opportunity will emerge sometime in the day. In our experience spontaneous/panic trades based on fear of missing a move have very low success rates. It’s also best to stay away from the open on these type of days when your plan has become obsolete — emotions are running high and it’s a good idea to step back and wait for patterns to develop.

Highchartpatterns.com HCPG/BTG (Base Trading Group)