#IBDPartner

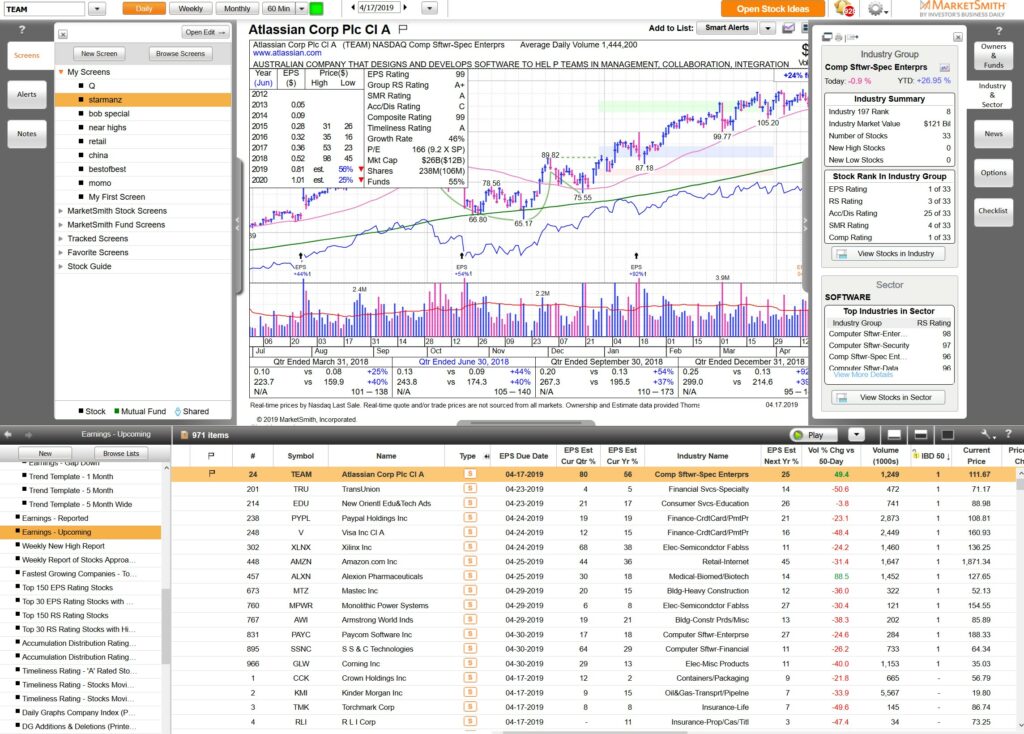

Our job as traders depend on constantly finding new ideas/set-ups. We are swing traders who often have 3-5 positions on for several weeks. Most of the time it’s like a revolving door with some older positions hitting trailing stops/goals and other new ones being added. One strategy that has helped us to find new ideas is going through MarketSmith’s Near Pivot Scan looking for new ideas BEFORE they breakout. Let’s review a few and look at some fresh ideas:

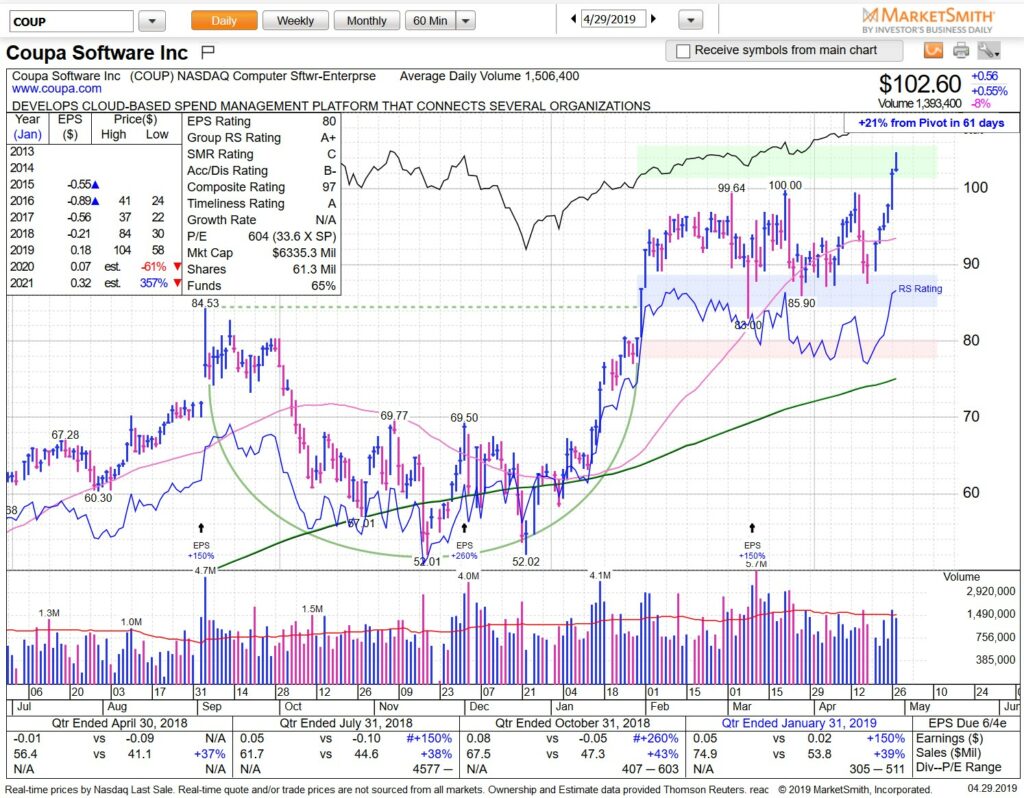

COUP from Near Pivot scan under 100 that we had featured several times in our newsletter with the big breakout. Note TWLO earnings after the close which will likely have some affect on the software sector.

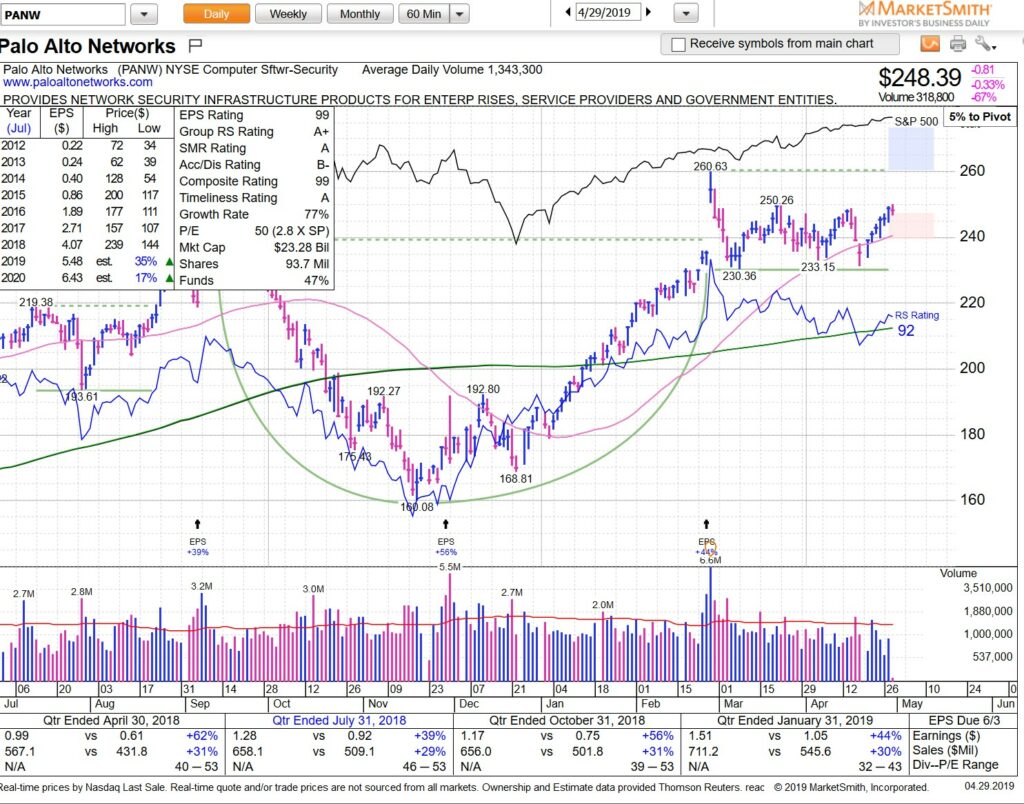

PANW currently in the Near Pivot scan and IBD # 14 with a gorgeous base. We find this stock can be tough to trade with tight stops but works well in swing with wider play area.

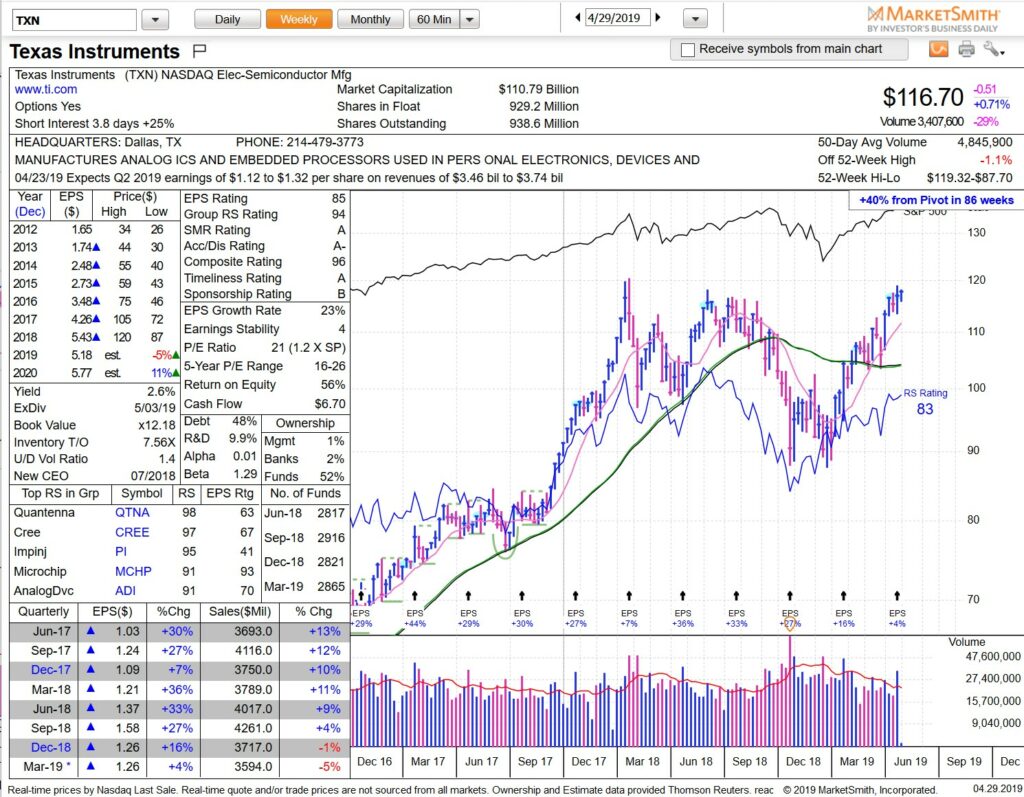

TXN from the “Tight Areas” under the G250 Pattern Recognition scan

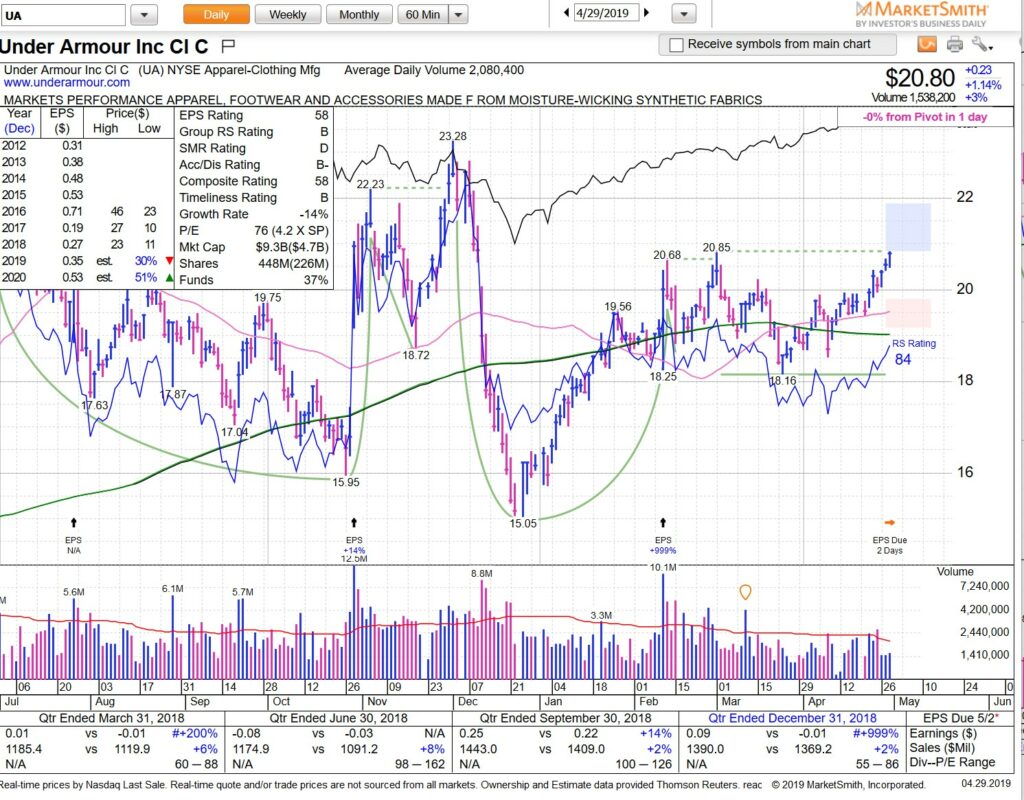

UA from the Breaking Out scan leaving daily congestion.

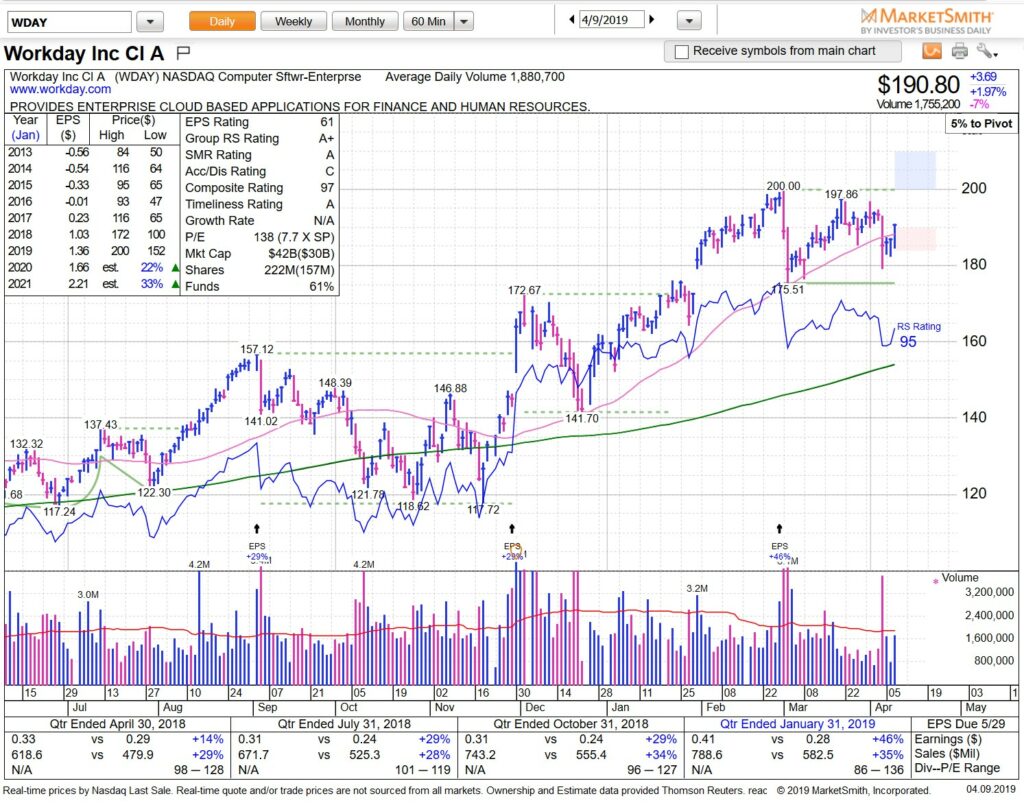

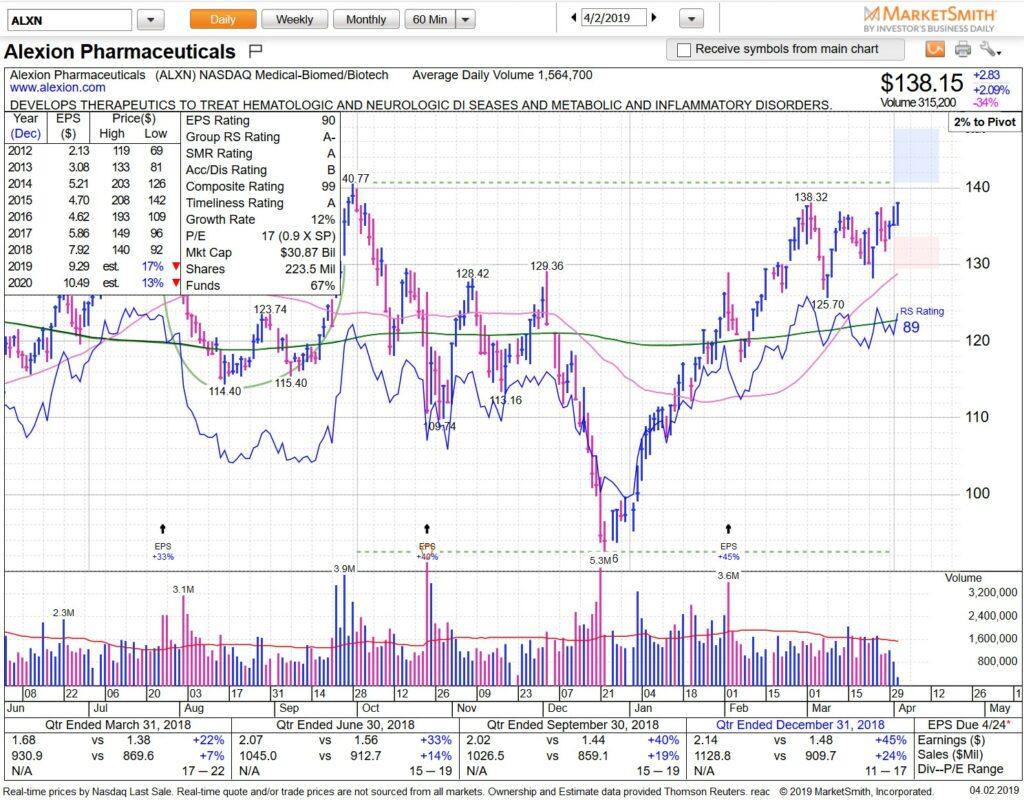

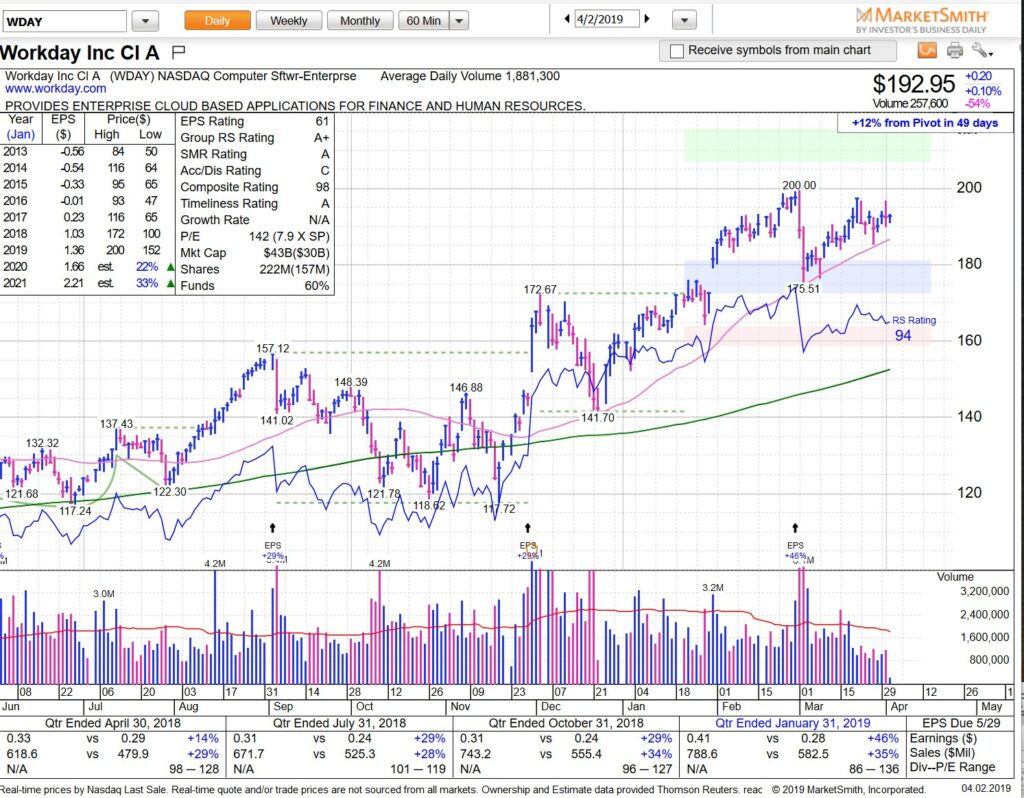

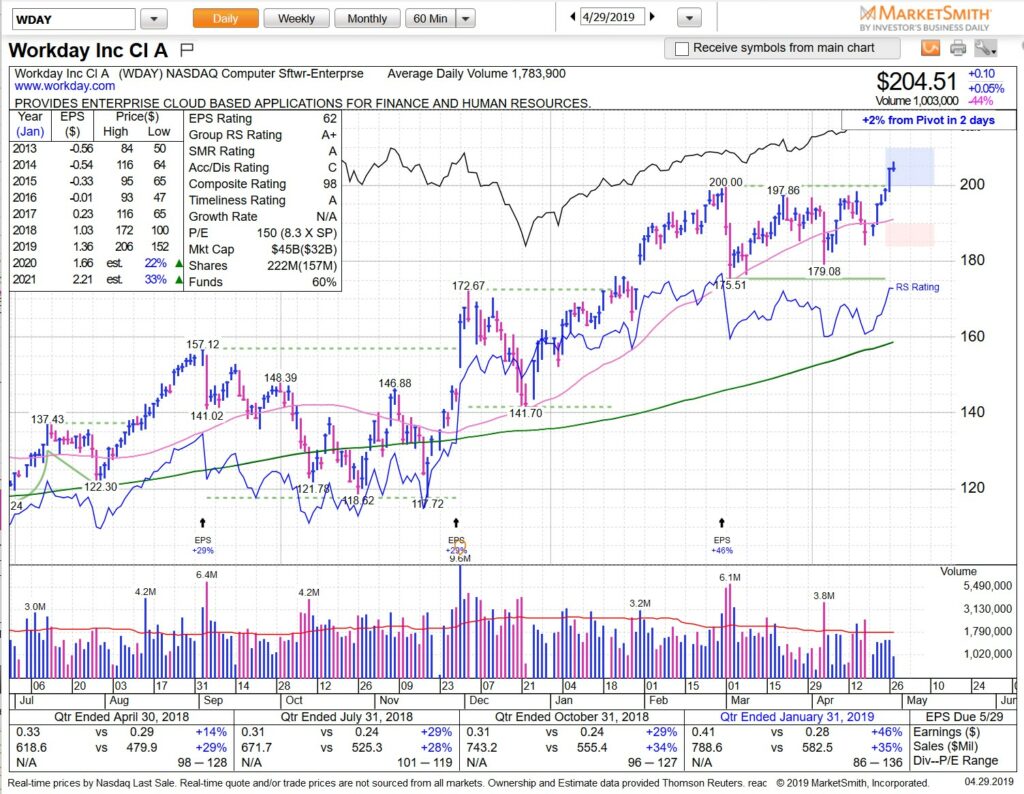

WDAY another example of a Near Pivot candidate that we had stalked (and currently long partial swing).

Stalk them BEFORE they breakout and have plans in place the night before. We like keeping the decisions that we have to make intraday to as few as possible. We do everything we can possibly do in terms of preparation outside of market hours.

See you on the streams. HCPG