#IBDPartner

Earnings season is a time of adjustments for us: we have fewer swings as we don’t hold into earnings in the trading accounts (but yes in retirement accounts) and we are constantly looking for post earning swing ideas.

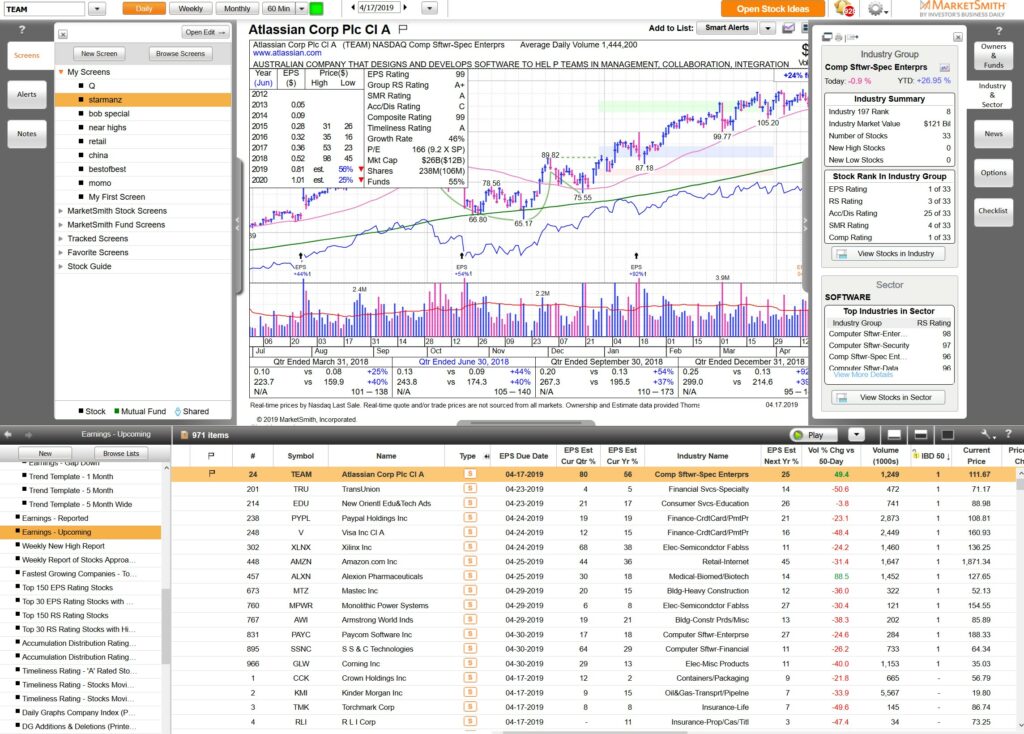

We go through MarketSmith earnings-upcoming and first sort thru IBD:

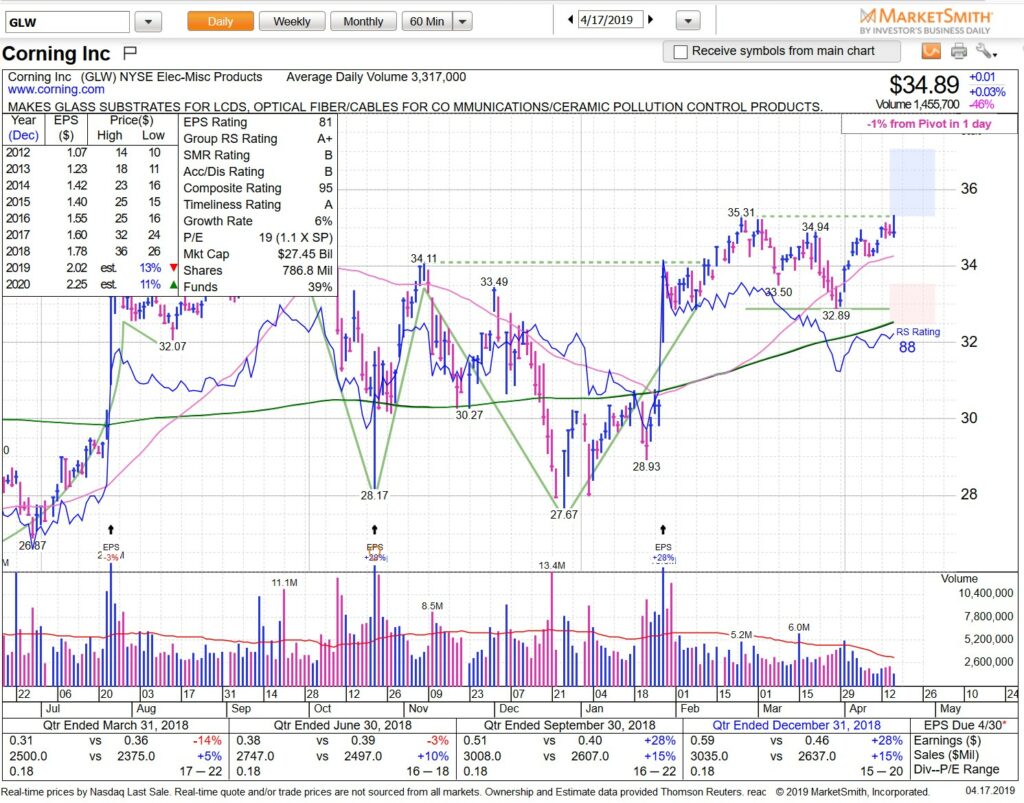

Next we look for solid bases and potential gap and go from those zones. GLW a great example with earnings coming up April 30. IBD #46

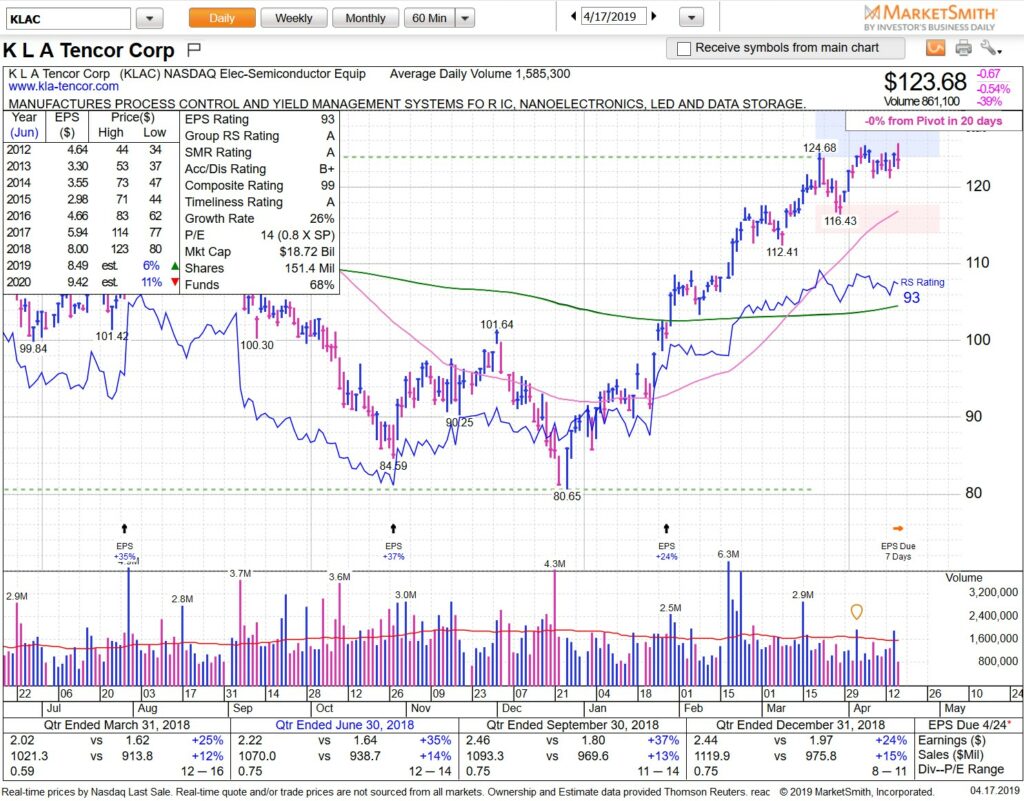

Next we hit “View stocks in industry” of our favorite sectors and go through those charts. Semis priced for perfection but small base here in KLAC worth a spot on your watch-list.

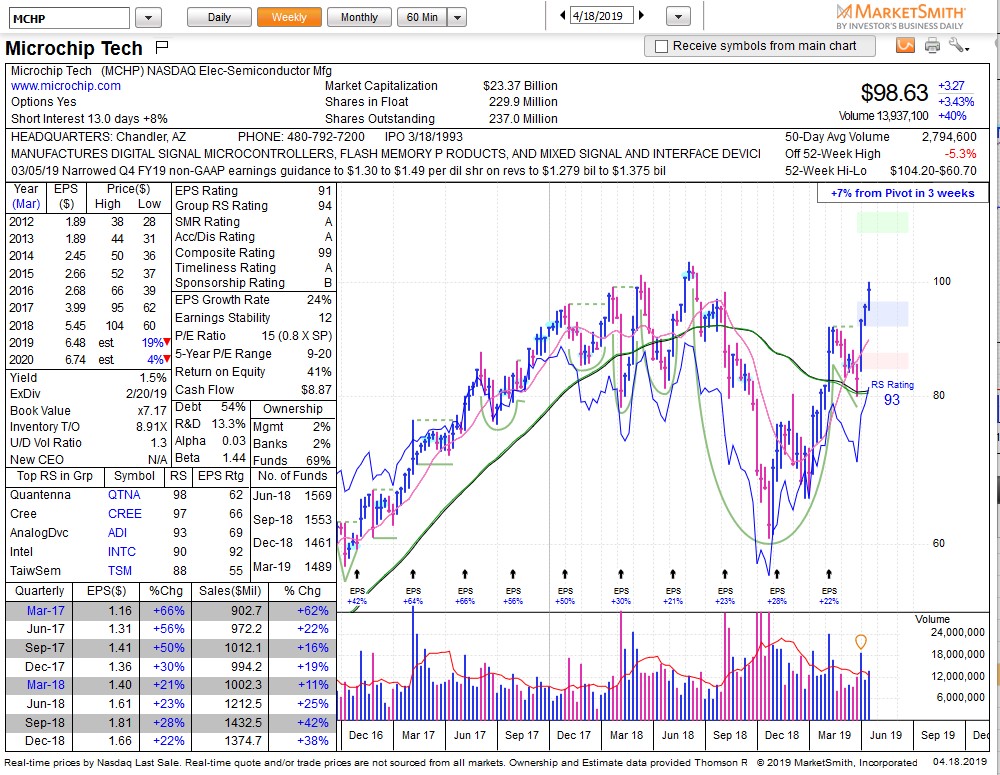

$MCHP #50 on IBD near highs — weekly shows a pretty severe cup. Would love a base here but if gap and go with decent risk/reward post earnings we will give it a shot.

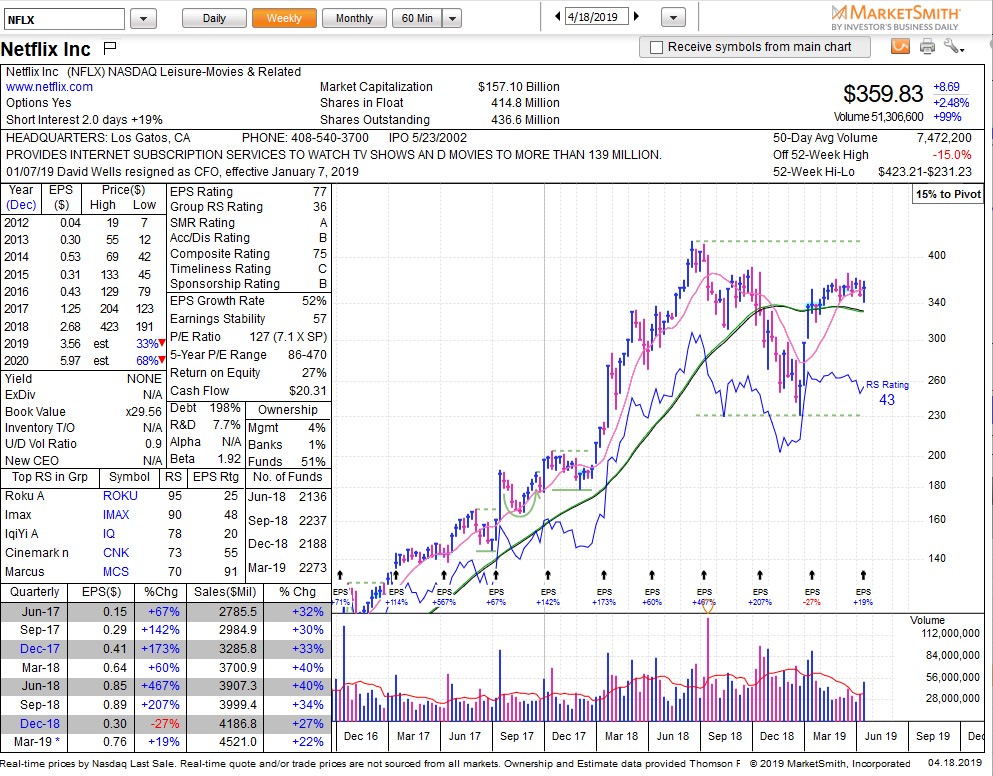

Post earning trades can be fantastic but they don’t set up as often as watch-list candidates (with no earnings). NFLX good example — we would have loved a gap and go near 380 but it had no such plans.

But as we always write in our newslettters, alerts are free. Prepare for different scenarios and take them as they trigger. See you on the streams. HCPG