#IBDPartner

Our best guess is that market is not going back to highs anytime soon — our favorite momentum/growth stocks have been clobbered bloody and the technical damage is not going to be healed easily. So we need to be ready for a few things according to different time frames:

- active traders look for oversold quick rallies

- active traders look for shorting into support/shorting breakdowns

- swing trades in new defensive leaders

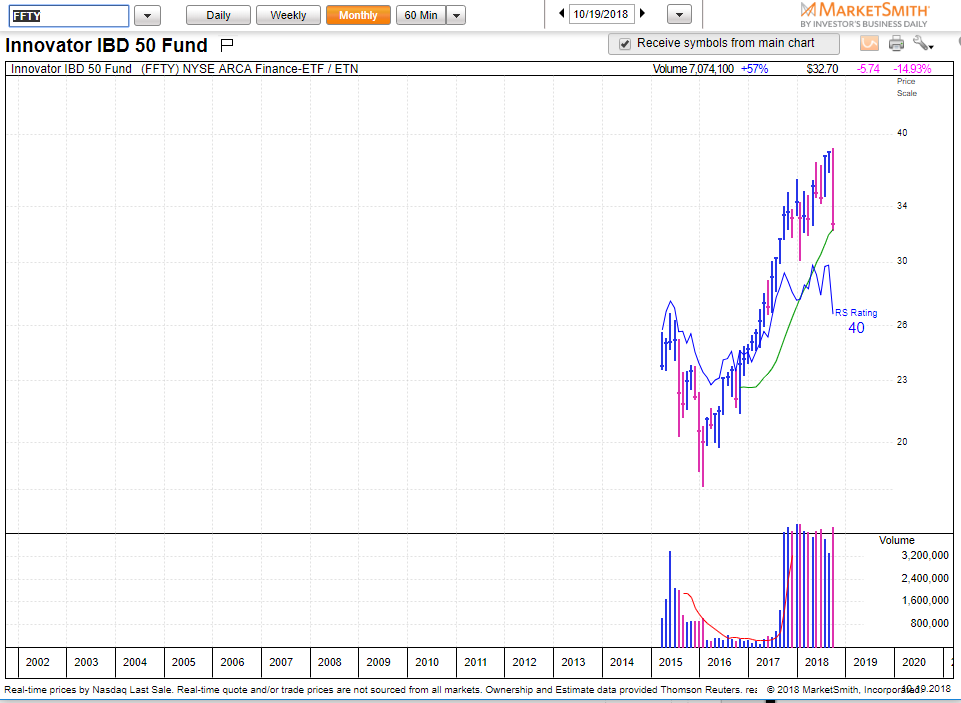

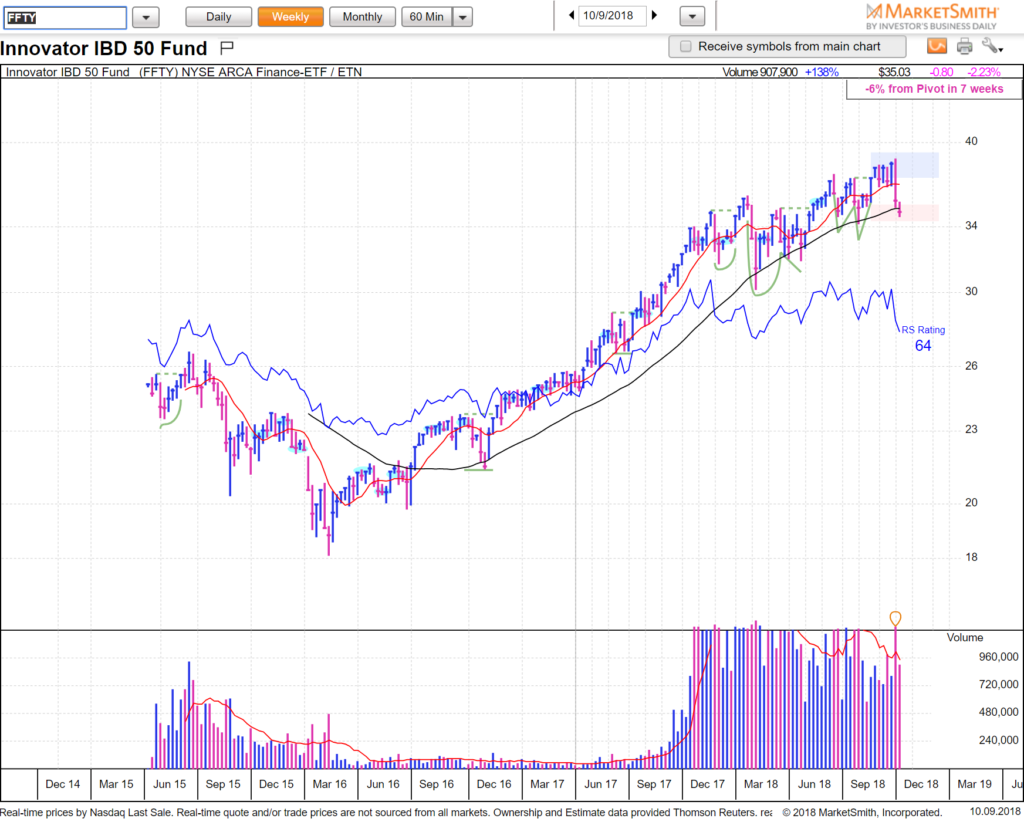

While SPY was flat on Friday one of the best tells for momentum was down almost 3%. FFTY, the IBD50 ETF sitting on 20SMA on monthly. Huge spot.

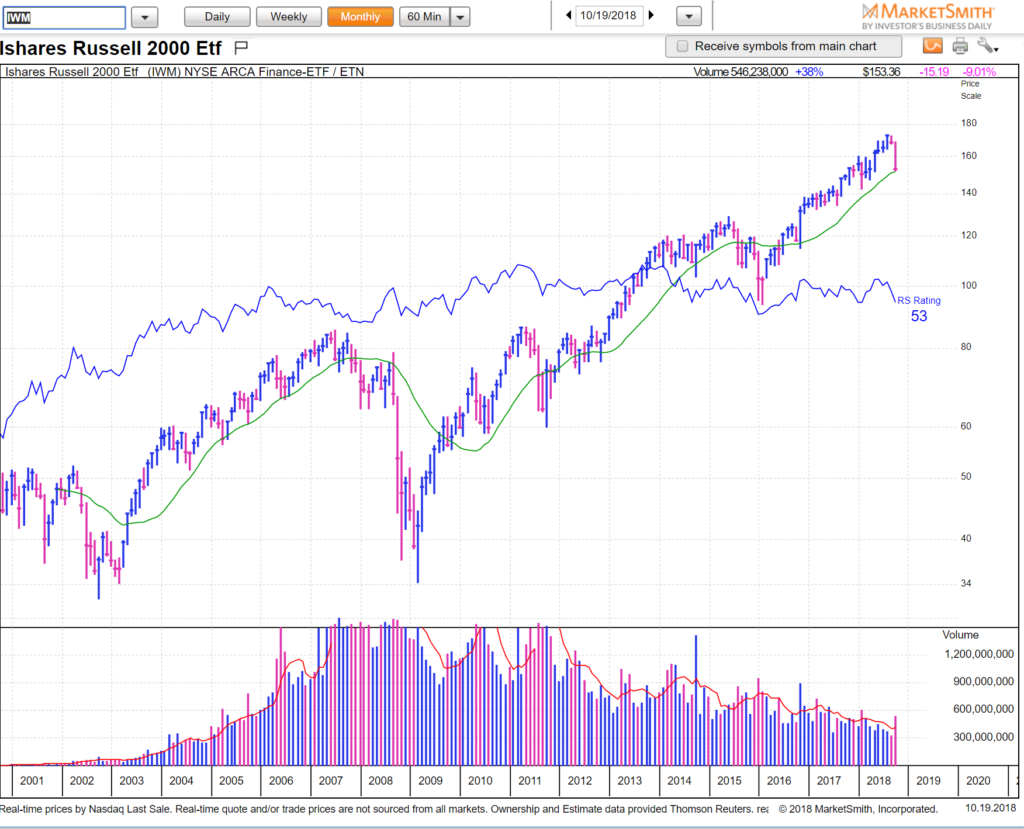

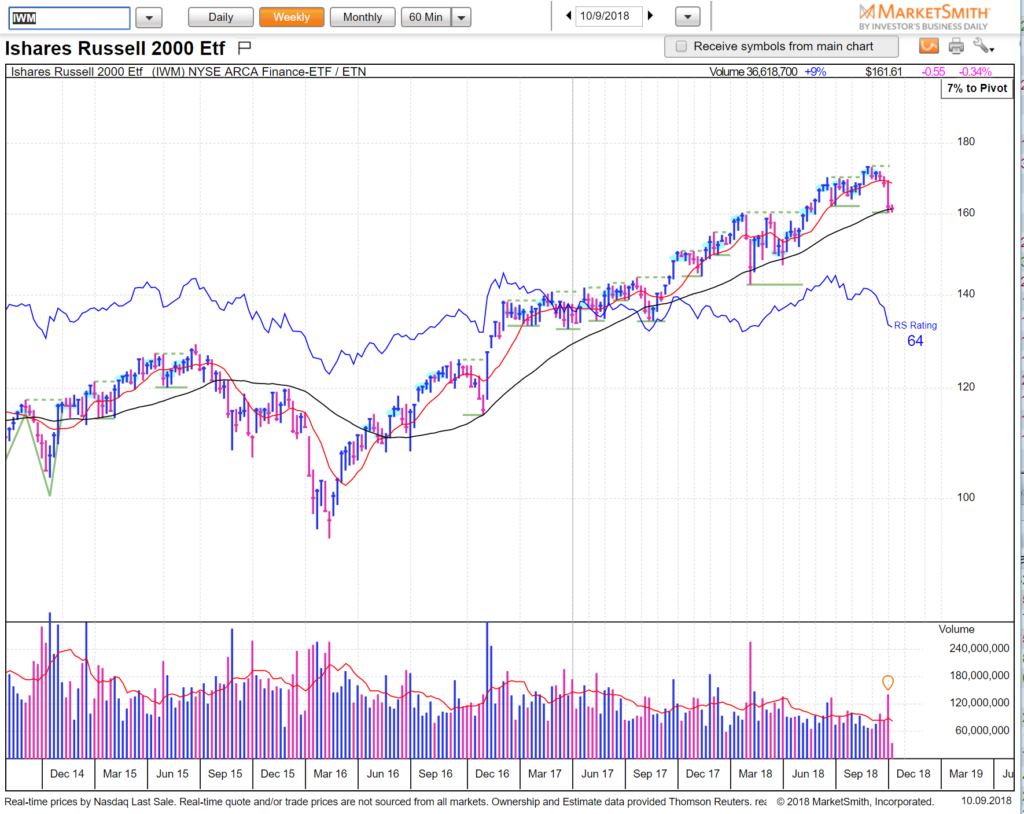

IWM same thing — let’s see how the rest of October plays out.

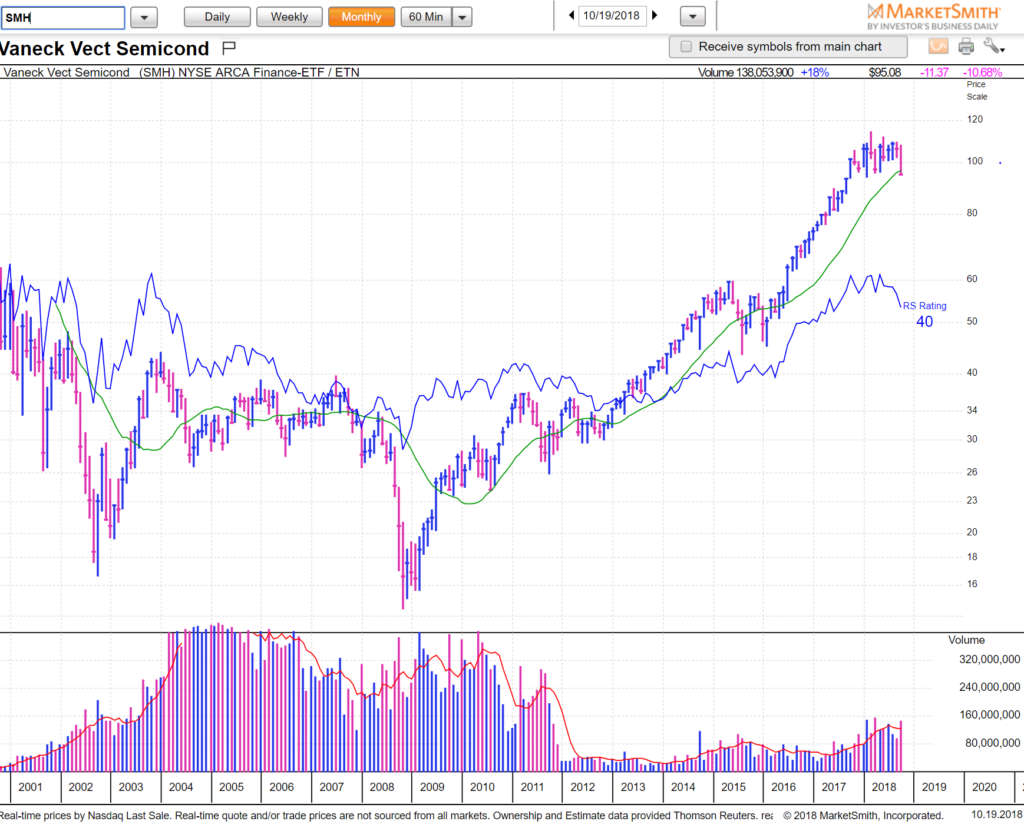

SMH also sitting on 20sma monthly — our favorite canary in coal mine ETFs (FFTY IWM SMH) all sitting on pivotal support.

We’re trying to prepare for different potential scenarios, including #3: defensive stock longs.

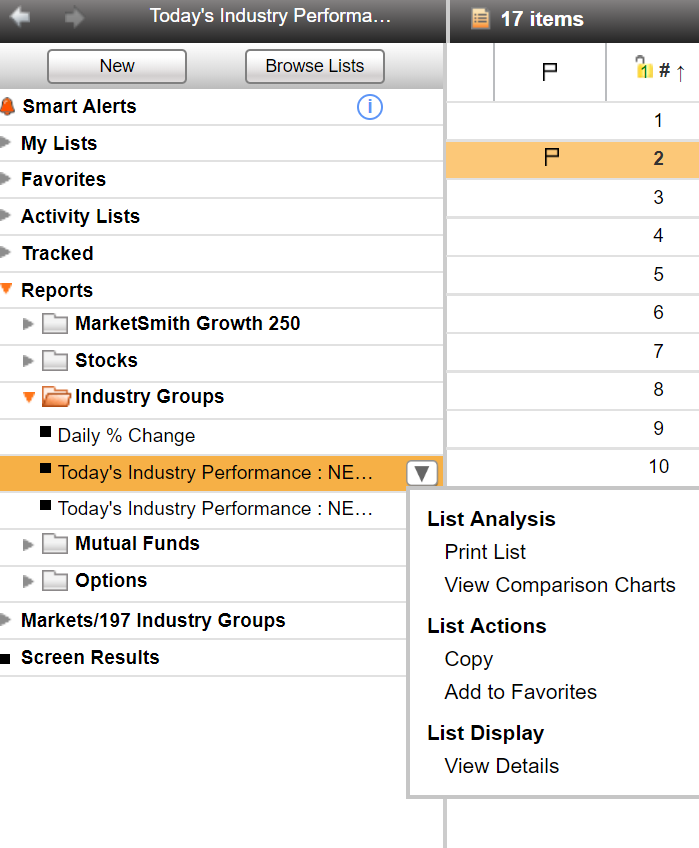

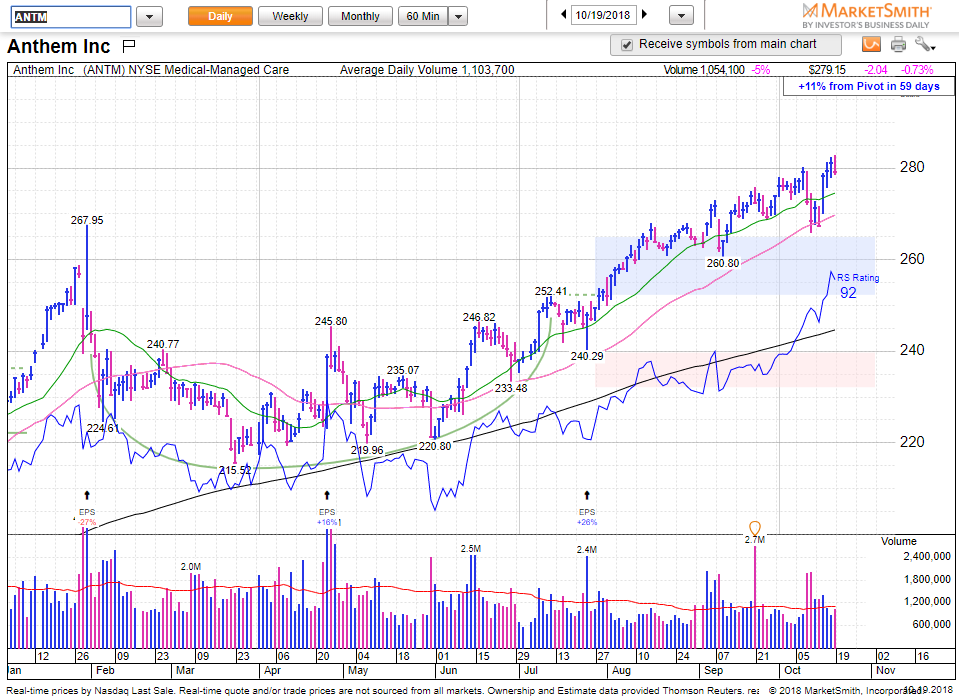

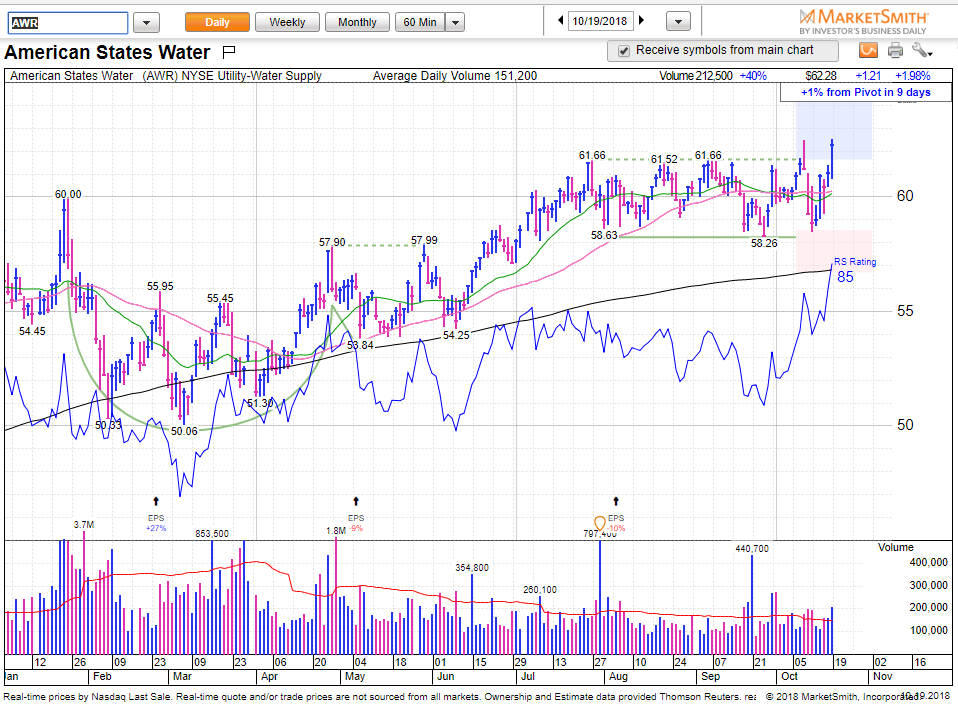

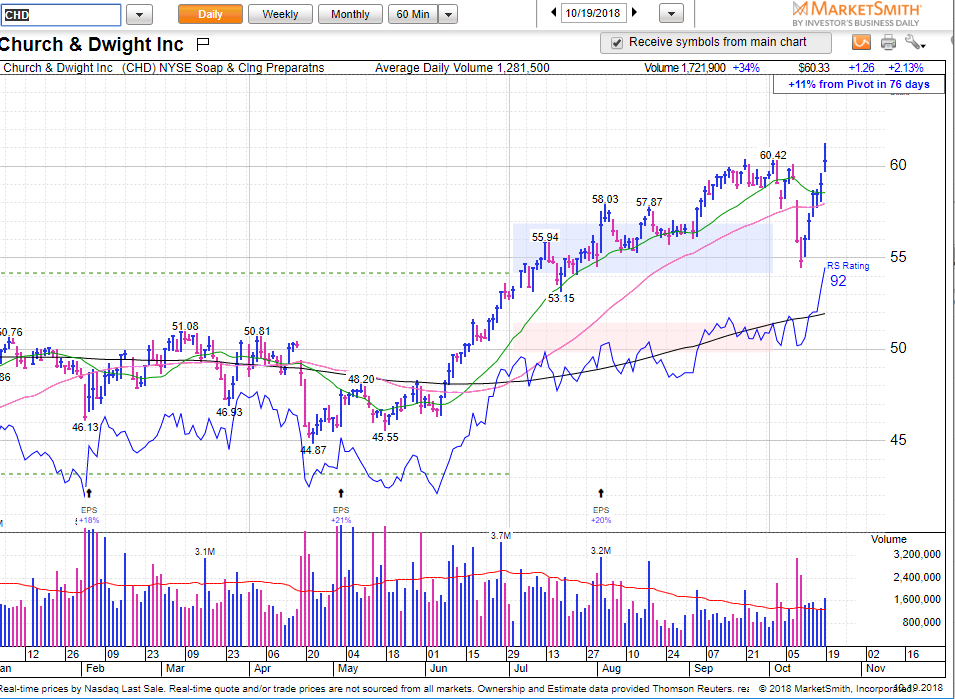

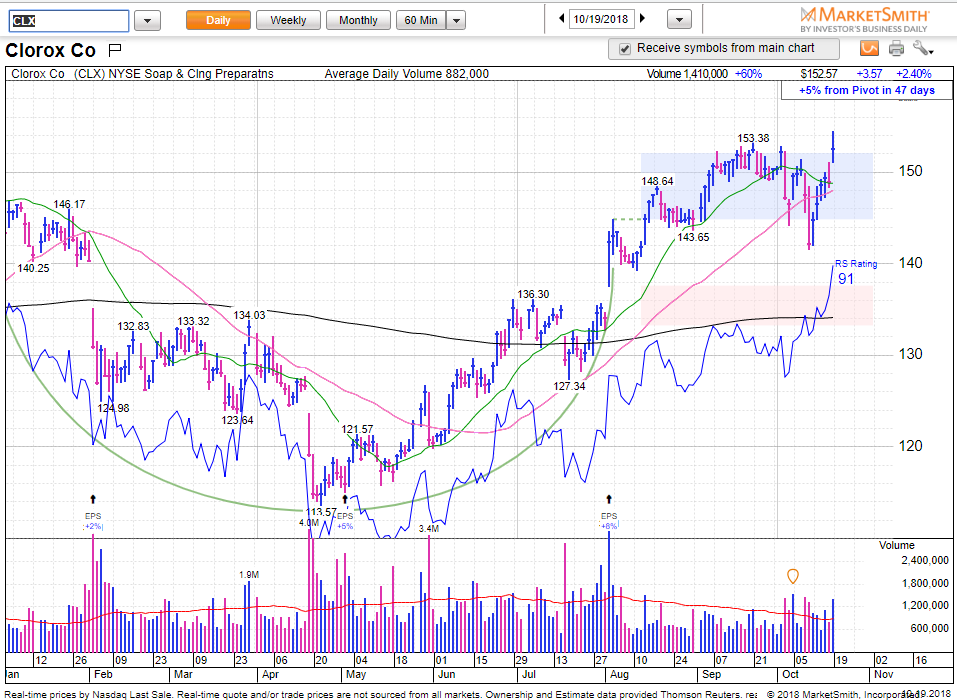

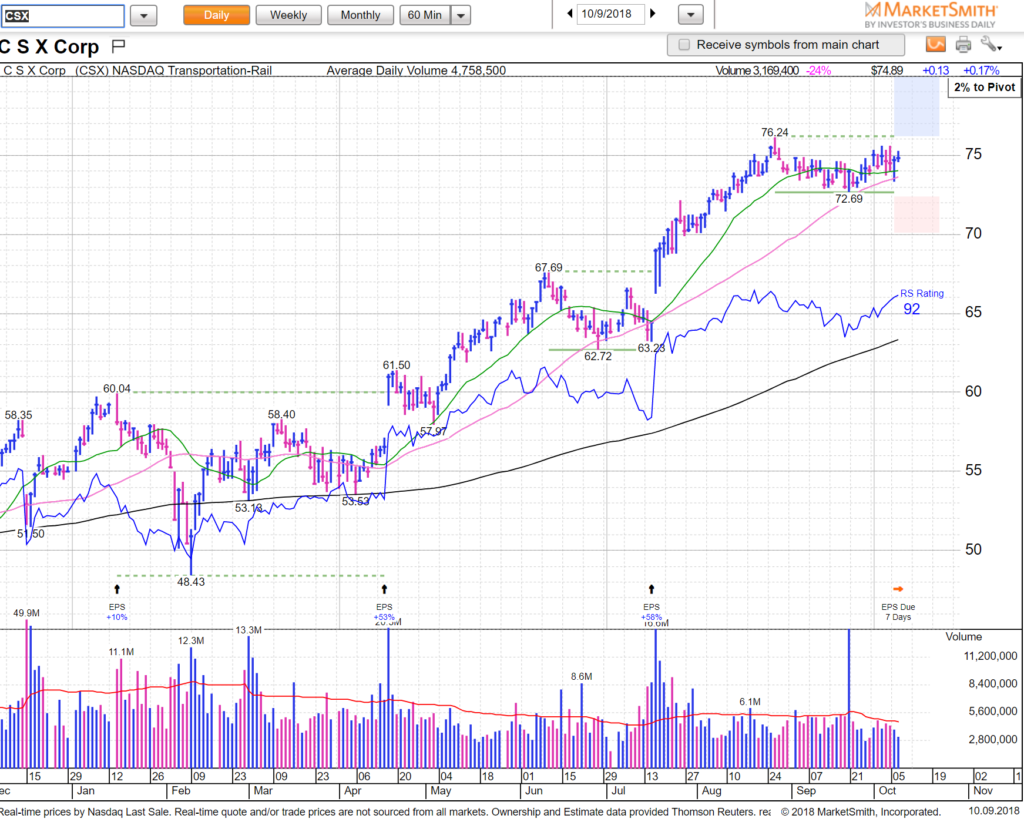

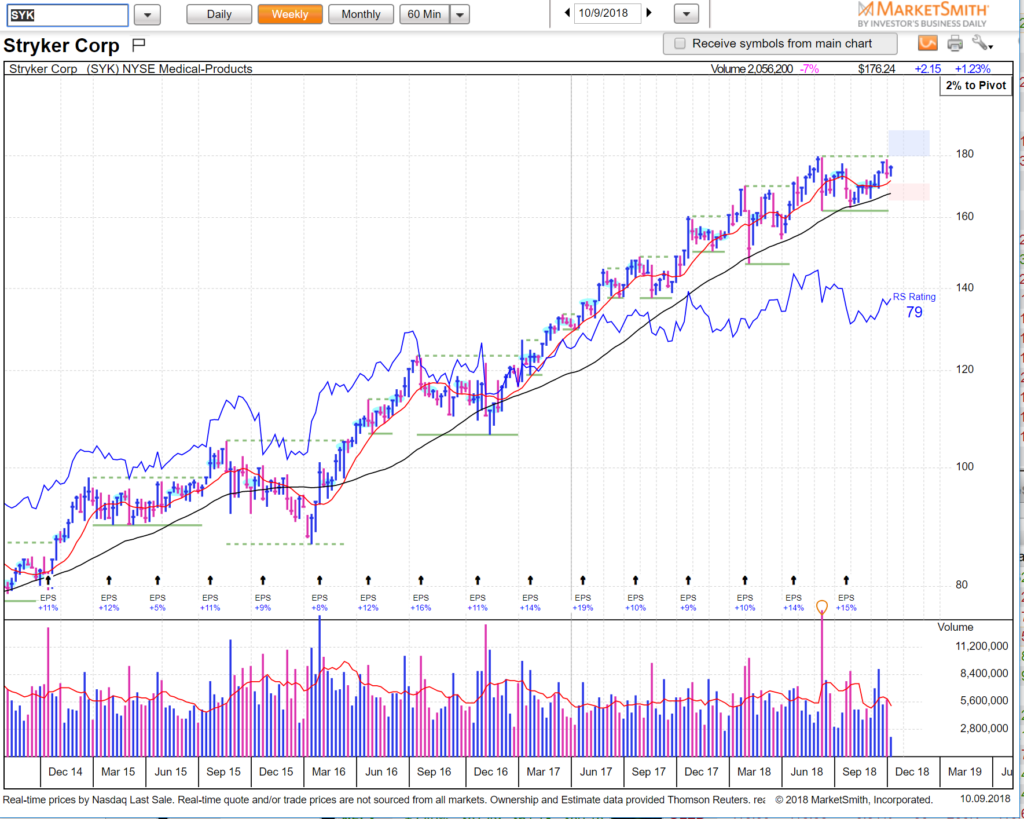

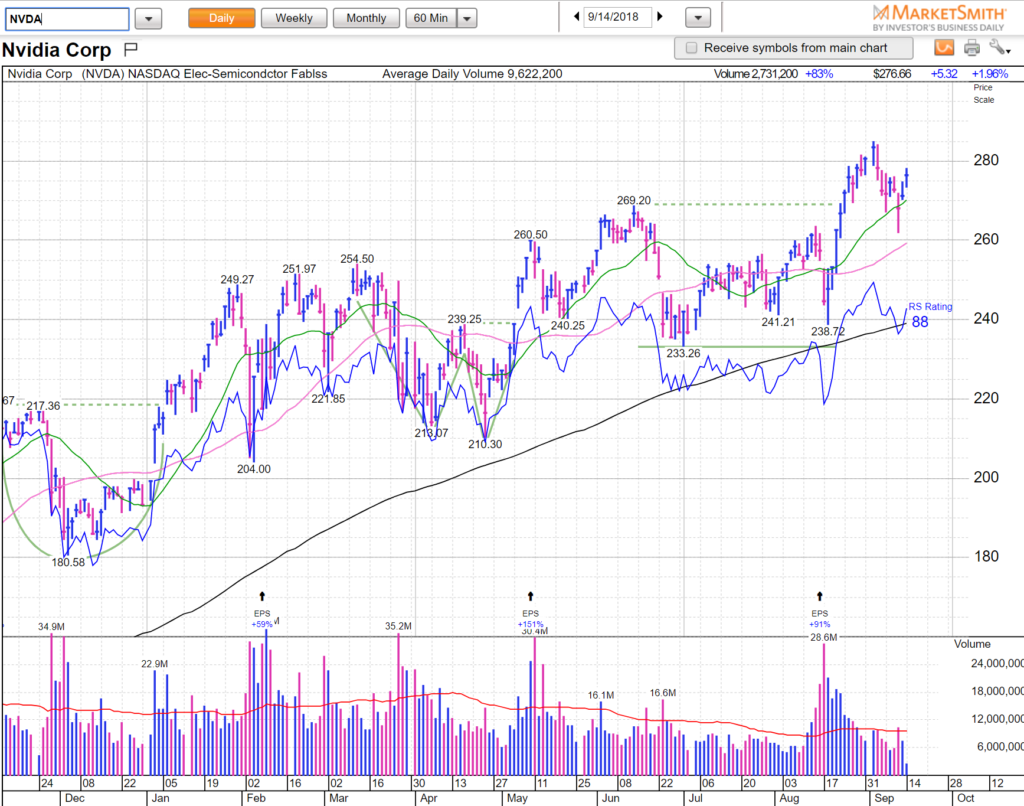

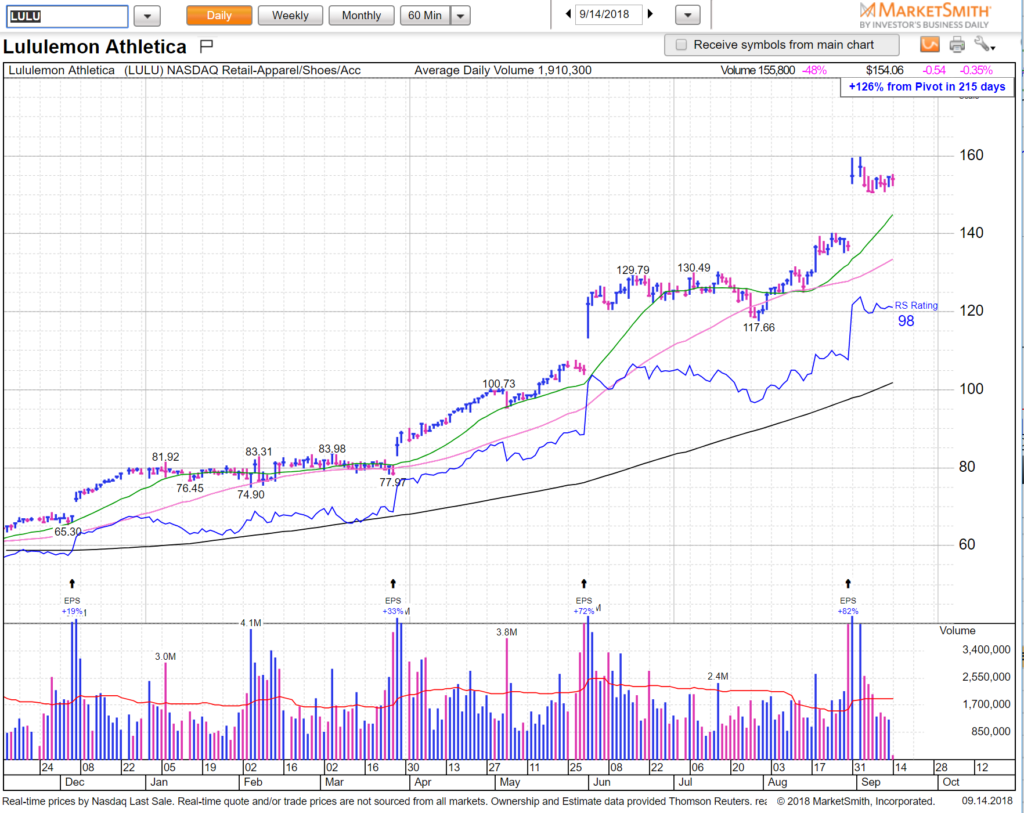

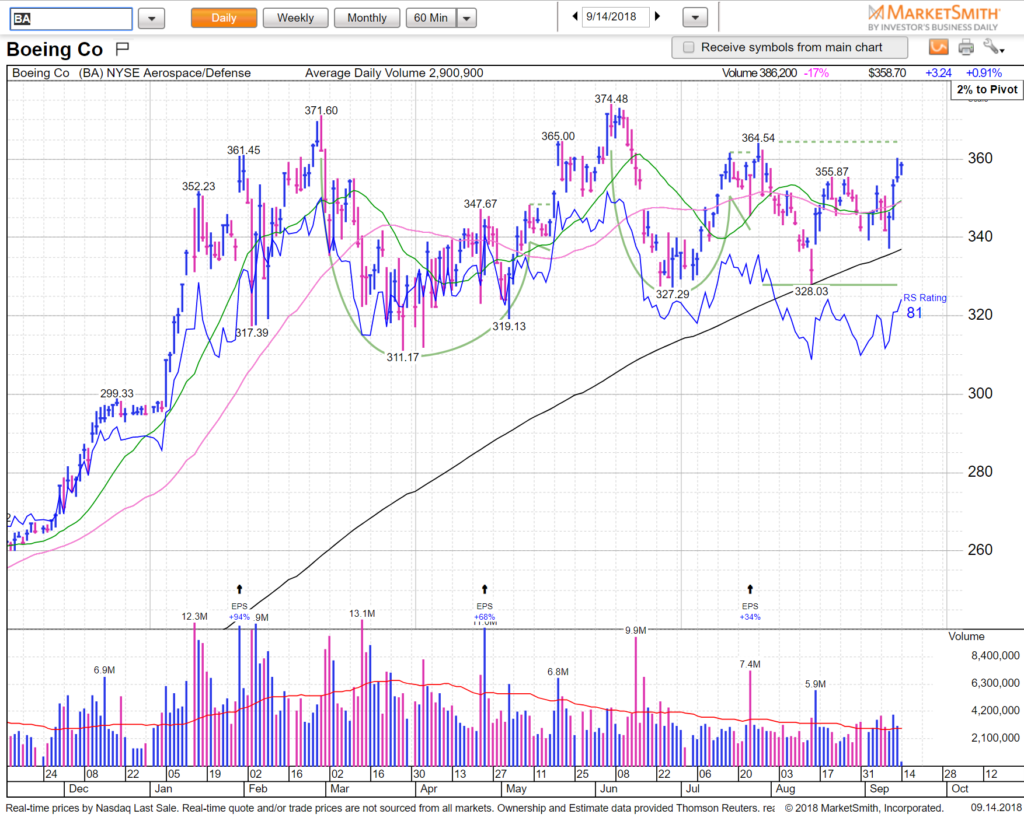

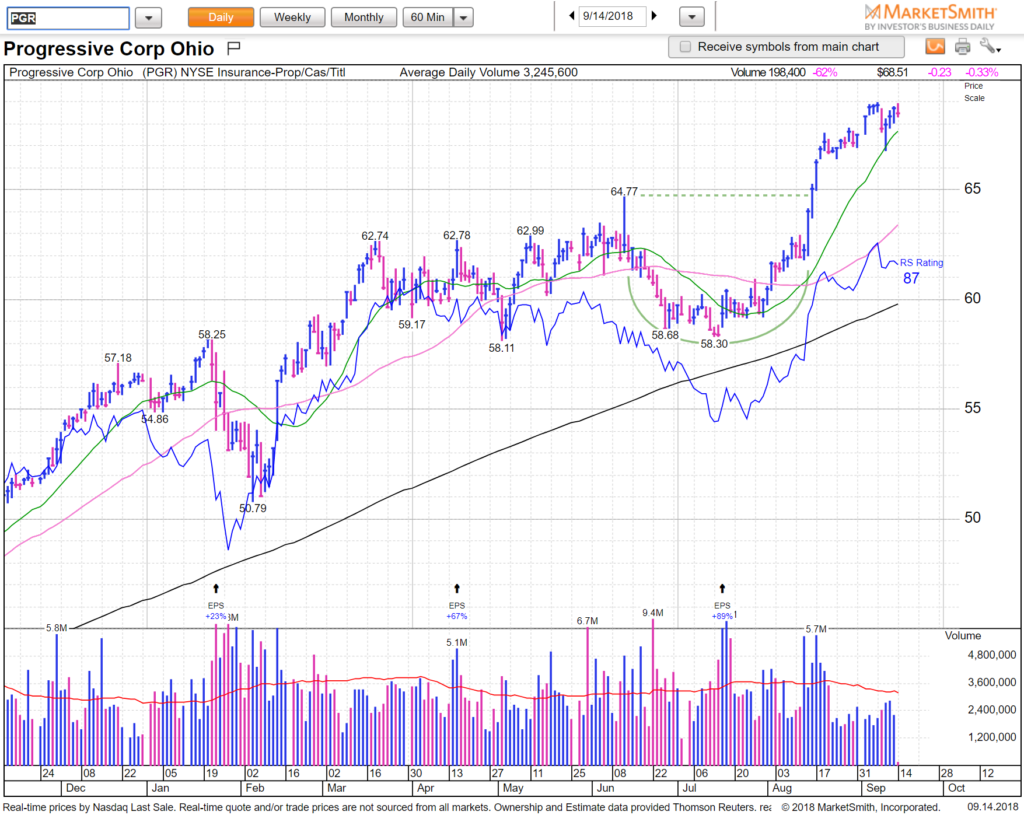

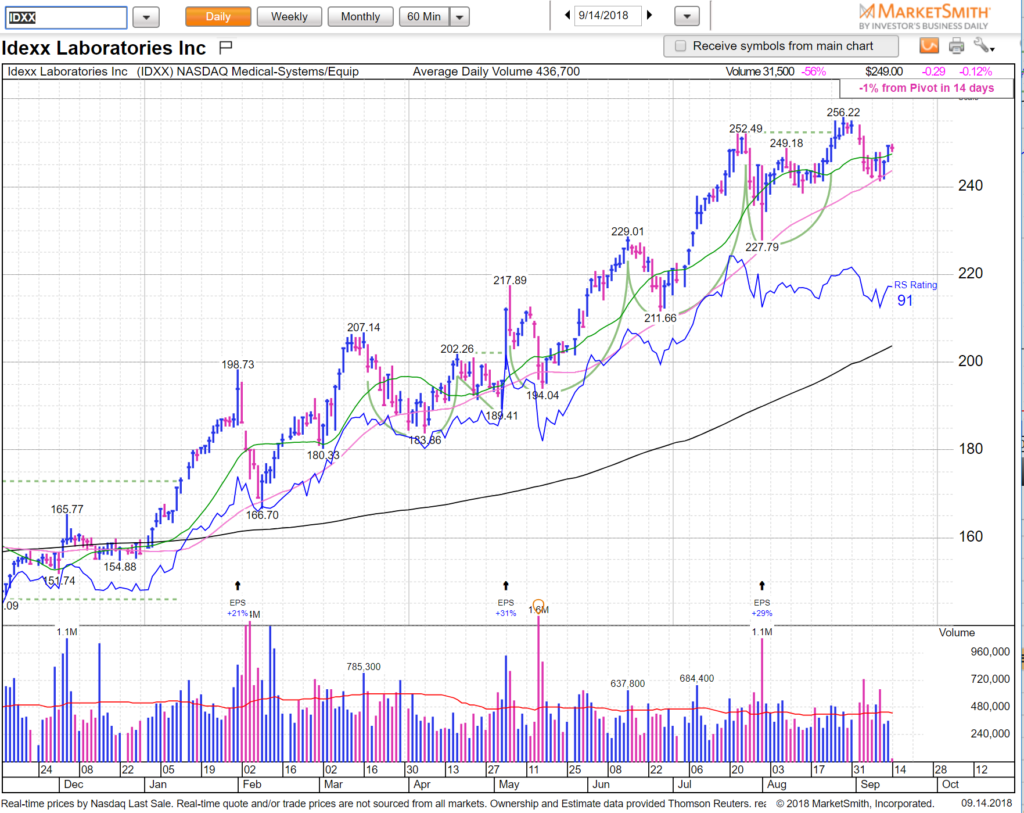

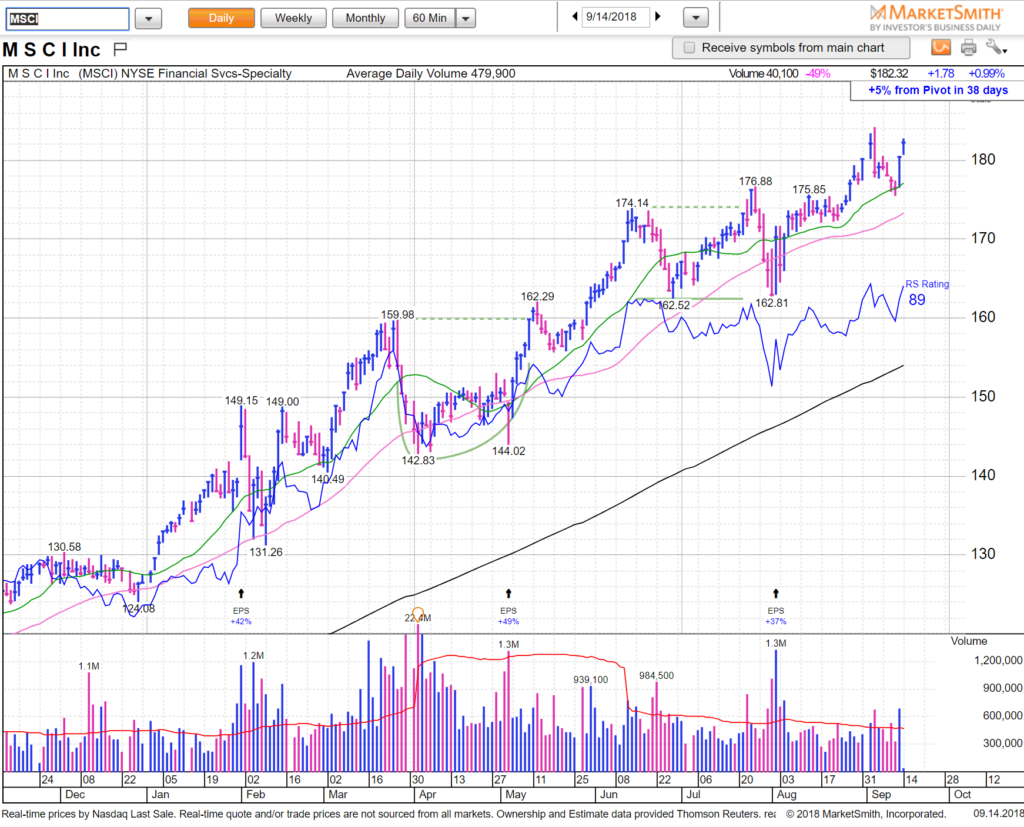

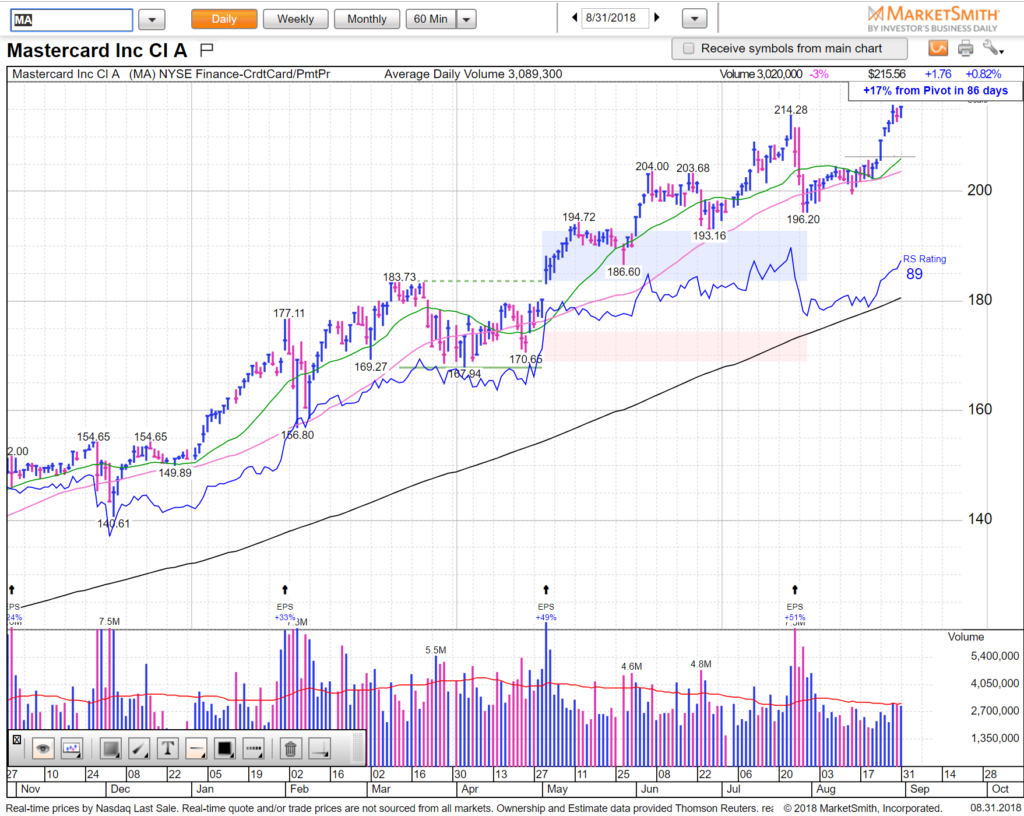

We looked through some ideas from our MarketSmith scans this week:

Our favorite 6 all look good but need a bit of time to set-up — we’ll have them in our newsletter when the time comes.

ANTM a bit more basing near 280 would do the trick.

AWR big move last week (for this stock) — slow but strong. Would like some basing near 62

CHD solid bounce from 56 support — now needs to sit and set up a handle near 60

CLX back to highs and we like it here near 152 — again, big move last week and would love to see some basing.

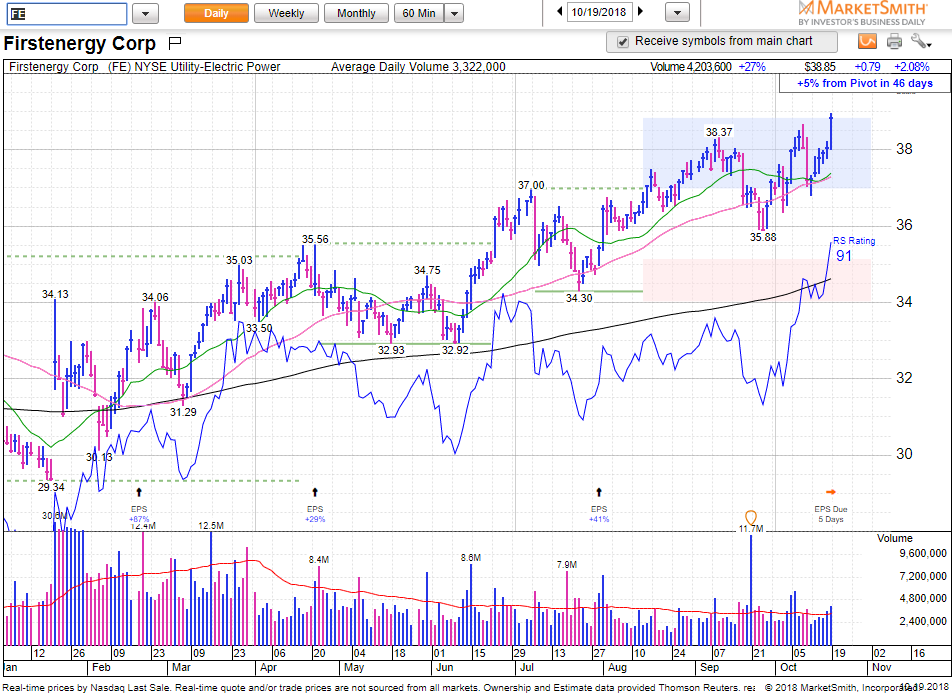

FE new highs — would love a few day pullback under 39.

All the above had big moves last week and for our type of trading — need some basing before we would jump on. We would prefer to trade a NFLX over a utility stock any day but you have to do what you have to do! See you on the streams. HCPG