We started trading in the late 90s as active CANSLIM type traders, trading the new IBD 50 adds and momentum stocks on the list. Our guess is that most people who were actively trading at the time will feel a nostalgic shared moment and nod their heads reading that piece of shared memory.

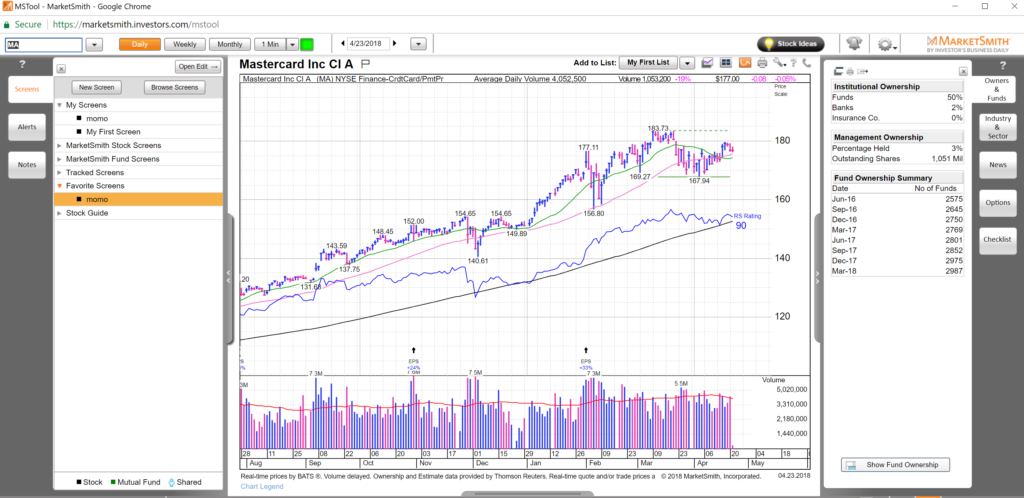

Trading was a national obsession back then and you couldn’t leave a cab or a Dr.’s office without talking stocks, it really was all we could think about all day long. Fast forward 20 years and it’s still a passion, but a more muted one as the energy for the career also has to fit along with family and children and all those other things that come into play once you leave your 20s. Our time-frames now are longer and we don’t have the same manic obsession to trade at all times and often are found content sitting in swings. Coming full circle, but from the other side, we’re also quite happy to announce HCPG partnership with IBD and Marketsmith. IBD we have known well for many years, but MarketSmith is a newer product for us and we’re having a lot of fun exploring it and making it work for us. We’ll have future posts to show how we are integrating it into our research.

Market seems to be on hold waiting for a catalyst — typical range bound tape. SPY 255-270 has held now for over 20 sessions.

Weekly shows it best: stuck between 50sma on bottom and 20sma on top. Dips are being bought and rallies are being sold — typical of a range bound market. We bought some stocks on Thursday, sold most of our positions on Friday and are left with a few half positions coming into today. Be nimble in this tape or any profits you have will likely evaporate. Not fun, but definitely part of the business.

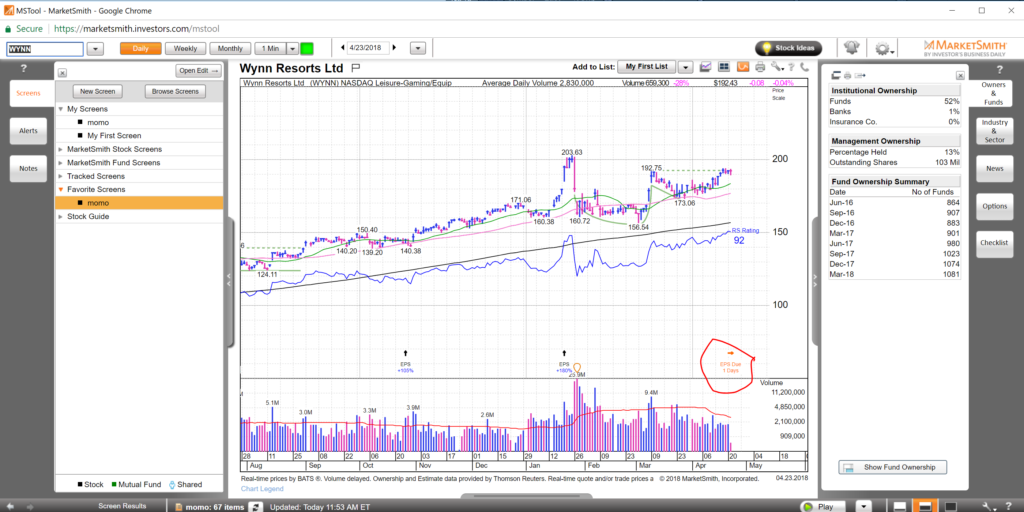

Two projects we have for today: one take a look at selective stocks that have earnings this week. Our absolute favorite trades are post earnings on stocks with strong patterns– especially in a tape like this with very little momentum. This is your typical weak sauce tape where nothing can get going and indices often bob up and down every day.

So it was time to fire up the espresso machine, bring out the iPad, sit on the deck and go fishing for new ideas. We were quite surprised at how much we liked the MarketSmith mobile app — looks fantastic on the iPad Pro. Here is a page sample of stocks in the “Near Pivot” list — you can either do Full Chart, or Multi Chart and look at several at the same time. We like to go through this page fast, with a notebook writing down notes on stocks that potentially will interest us for further research. After looking at literally hundreds of charts a day for 20 years you learn to see patterns fast, all we need is an initial 3 seconds. If it passes that test, we jot down the name.

If you want to try it out (mobile and PC) click here MarketSmith trial

Couple points in general about this current market:

- We think it’s quite possible it’s going to be similar to 2015 — large consolidation zone, versus a new bear market.

- Shorting in the hole has not worked well — what has worked is buying dip (not sure if it would work again, we would not be buyers on another trip to 255 SPY. We would wait for confirmation/follow through next time meaning we have a lot less confidence in that support) and more than anything else, selling rallies. As we have regularly told our readers in the past few months, STAY NIMBLE. Sell that half partial right away into the next day gap up/rally. We are not seeing follow through in this market. Once that changes, adapt, but until then… quick trades.

- There’s no momentum in this market up or down, typical of range bound tape. One potential strategy that we have been doing is to go through the earnings schedule of the week and look for stocks that have solid patterns, and then look to trade them the next day. Easier said that done, some gap down, some gap up too much, some gap up and fail, but there are some good risk/reward potential trades in this strategy.

We’re trying to tap into reserves of creative energy and bring back blogging (we used to blog regularly 2006-2012 — basically once we started Twitter/StockTwits we ran out of steam for blogging). Key to writing now is to just start. Just open up a draft, put down some words, and go from there. What we’ve realized is that writing has often little to do with the romantic scenario of being inspired — it’s like anything else in the long run, you just have to grind it out.

#promoted #IBD Partner