#IBDPartner

As per our weekly habit we go through the IBD list and MarketSmith’s Near Pivot scan to see what type of set-ups we can find; market grinding higher and we are finding less than last week but still some areas of interest. Let’s review:

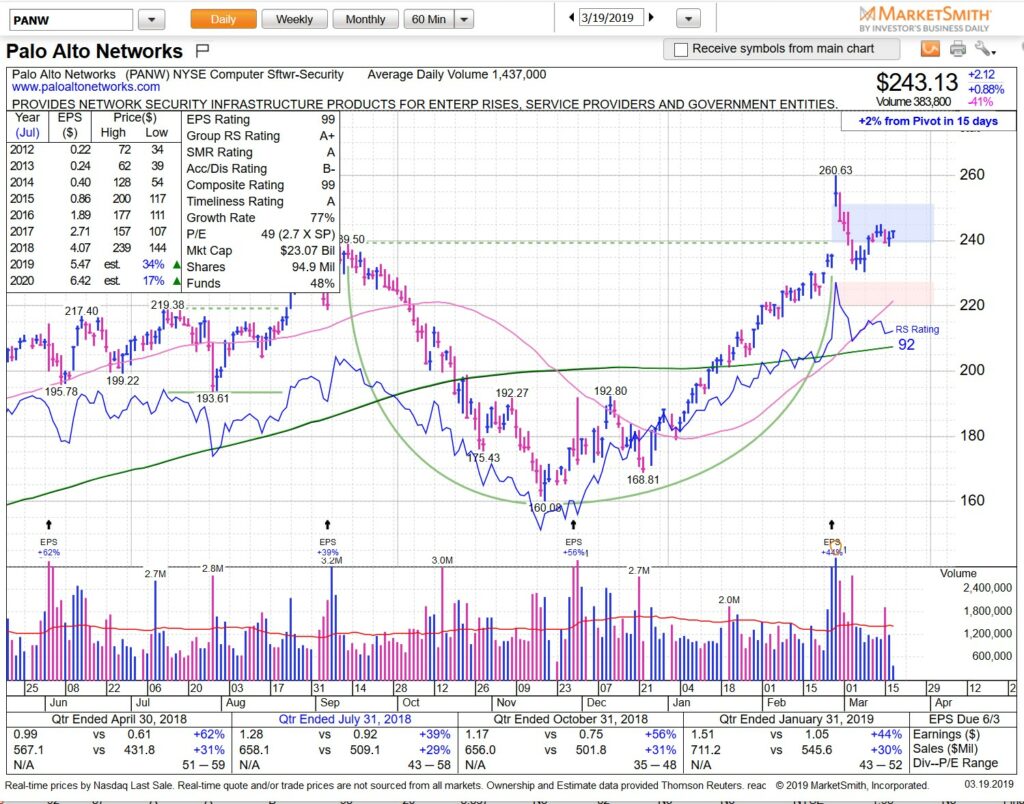

PANW is in the hot hot Software sector and IBD #6 — sitting on top of the 20sma so if you want to swing it entry would be here with stop under that 20sma near 238 for very aggressive short term and under 230 horizontal support for intermediate.

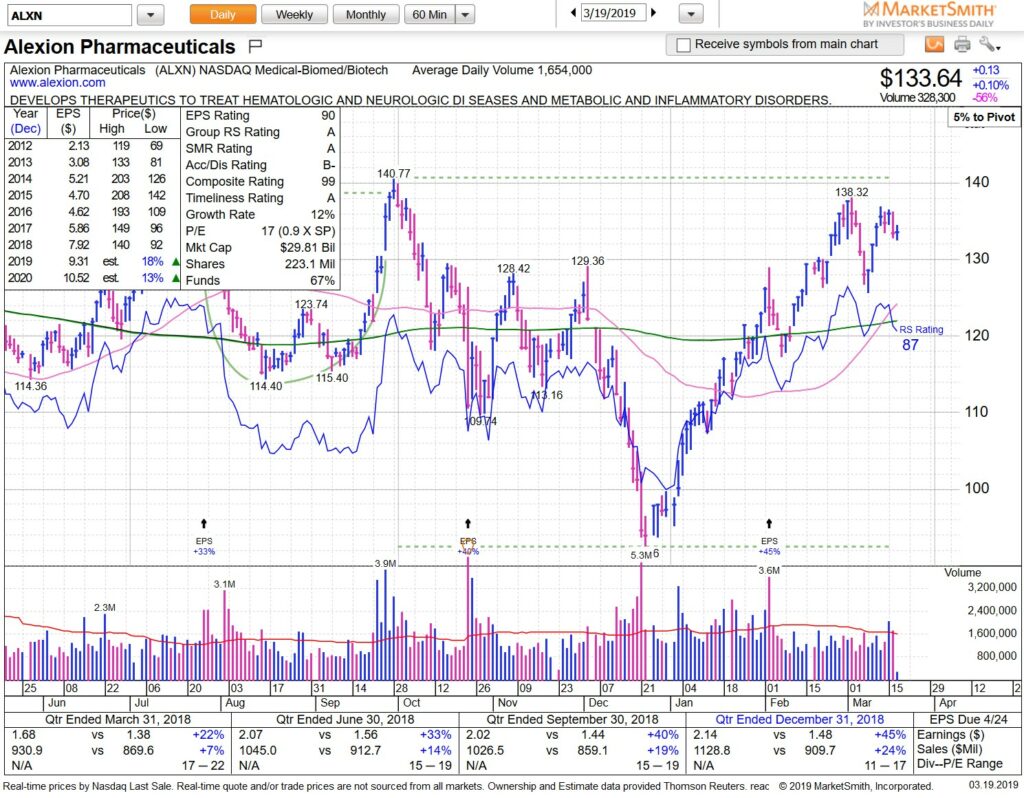

ALXN IBD #25 sitting under 138 resistance — we’d like to see some strength before we jump on this one — add to watch-list!

We rarely trade gold these days but KL has been on a tear and is IBD #1 so it has our attention. We like buying commodities on dips rather than breakouts so keep an eye out for reversal near 32 — our way of buying reversal is to set alert at support and then see if buyers show up. Buy it after bounce starts (say 0.5-1%) with stop below the support that held.

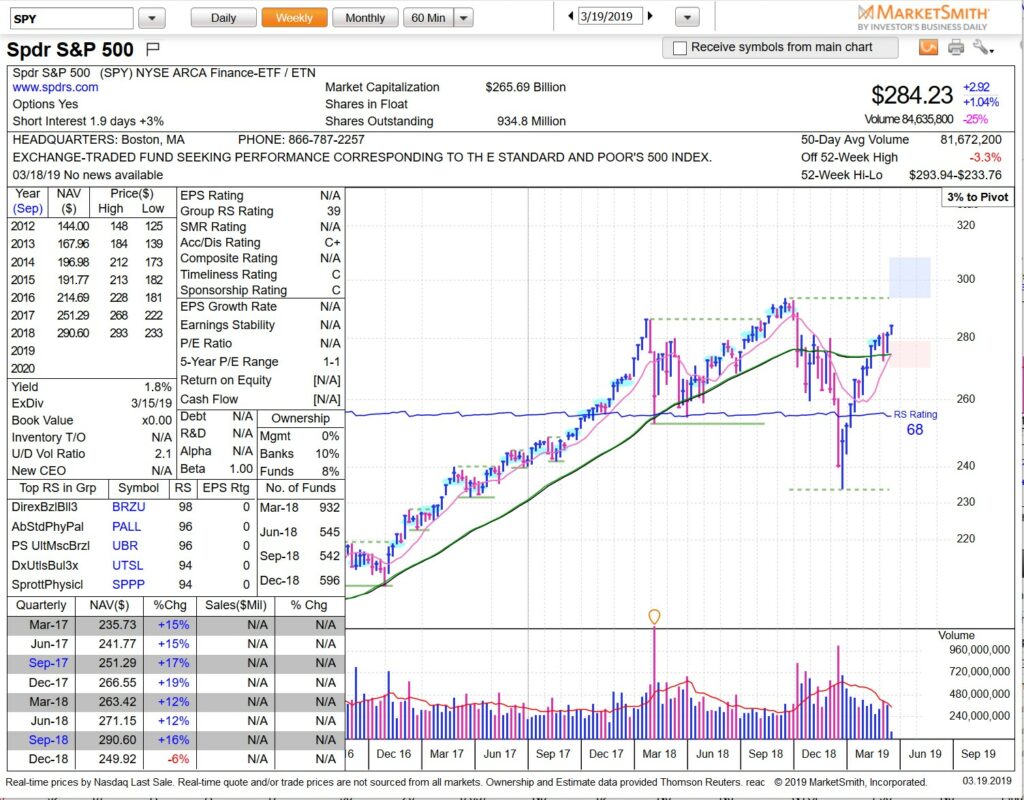

So far picture perfect on SPY with hold on 50sma weekly as it digested SPY 280. Bulls can’t ask for more — intermediate line in sand is that 50sma line at 274 on closing basis.

Good market for hanging onto swings — we have AMD NVDA FSLR GDDY IQ partials on right now. Hold, trim, trail stops, and be patient in this type of positive forgiving tape. See you on streams.