#IBDPartner

In our job there’s one thing that never stops and that’s the hunt for new ideas. Over the years we’ve honed our mental recognition skills and now only need around 3 seconds to discern between a chart we instantly have potential interest in and a chart that is an instant pass.

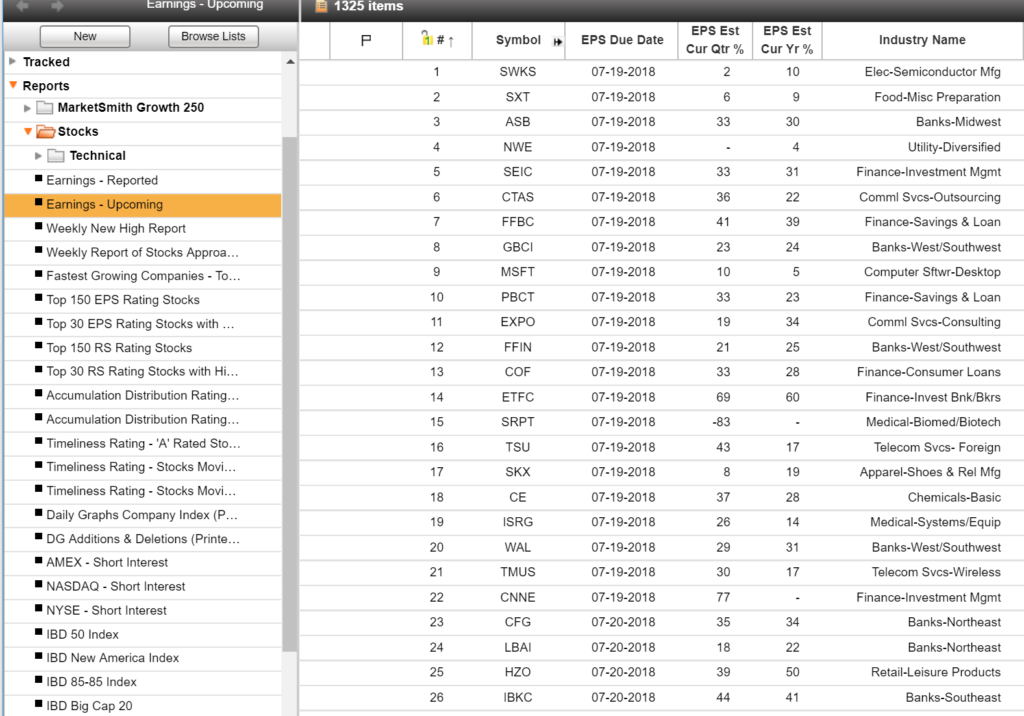

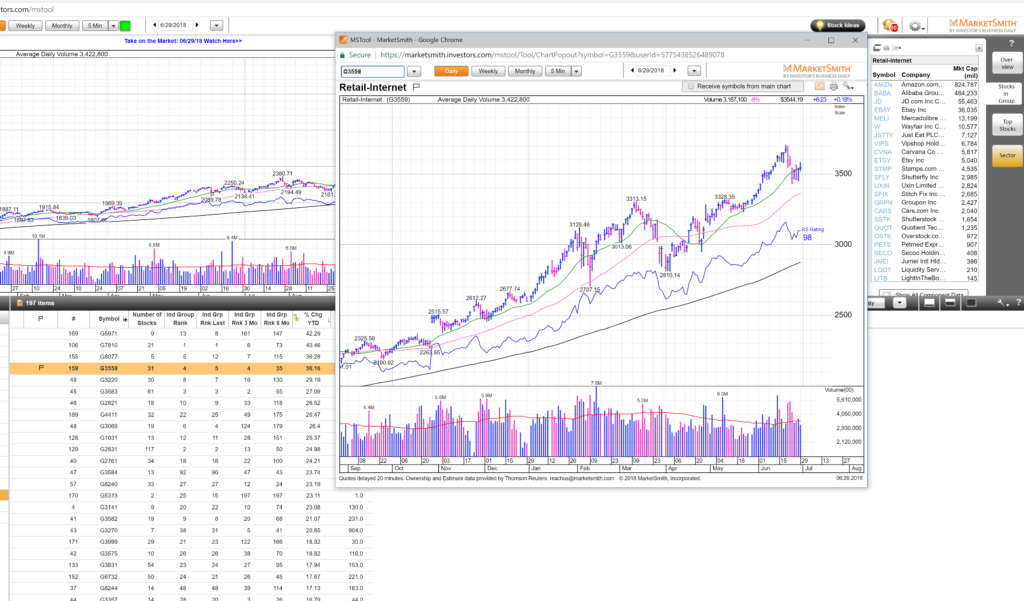

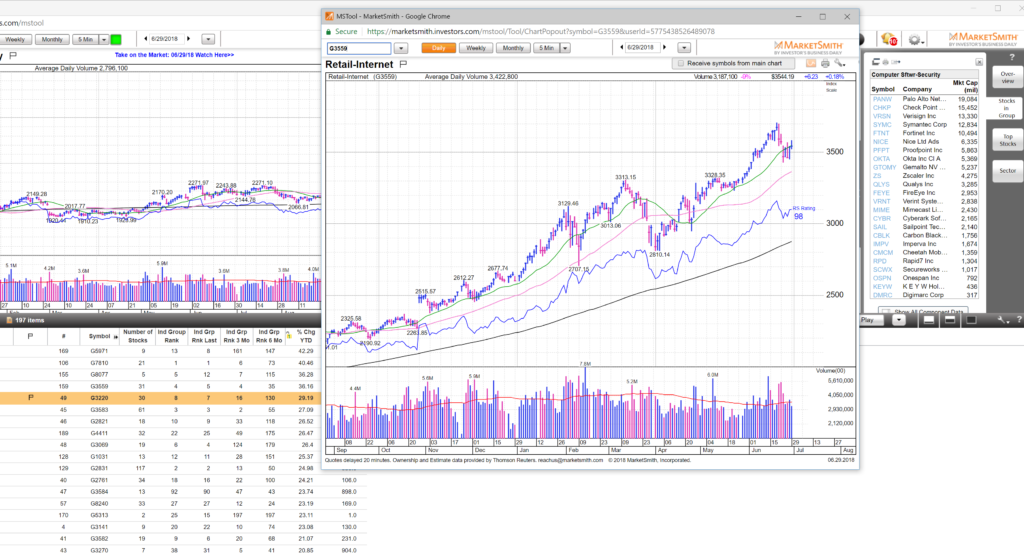

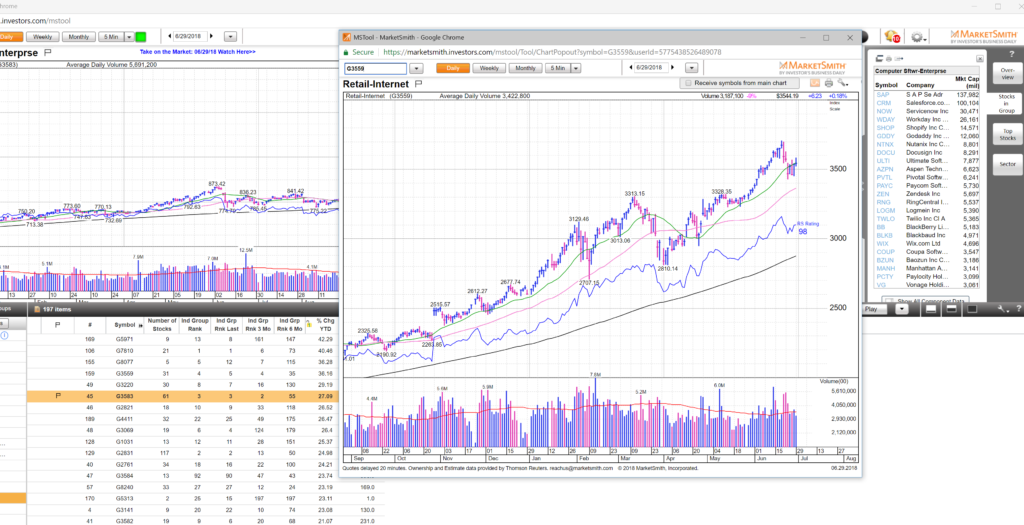

What we like to do at least 3-4x a week is to go through MarketSmith’s G250 pattern recognition stocks, in slide mode, timer on 3 seconds. As soon as a name interests us we write it down without pausing slide. Once we’ve gone through the scan (also use this for our favorite Near Pivot) we take a closer look at the names we have jotted down and do another cleanse.

Here are a few ideas for your lists:

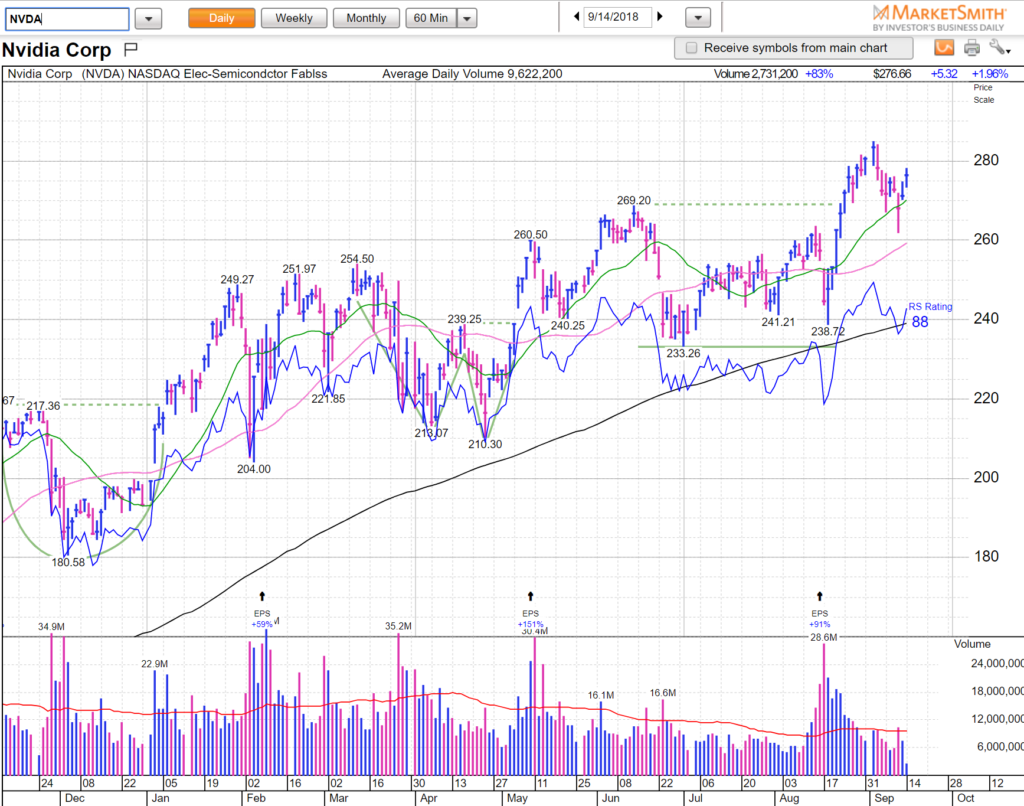

NVDA was on our newsletter last night for trend-line break and doing well today. We liked how it held the 20sma and then set up a trend-line break.

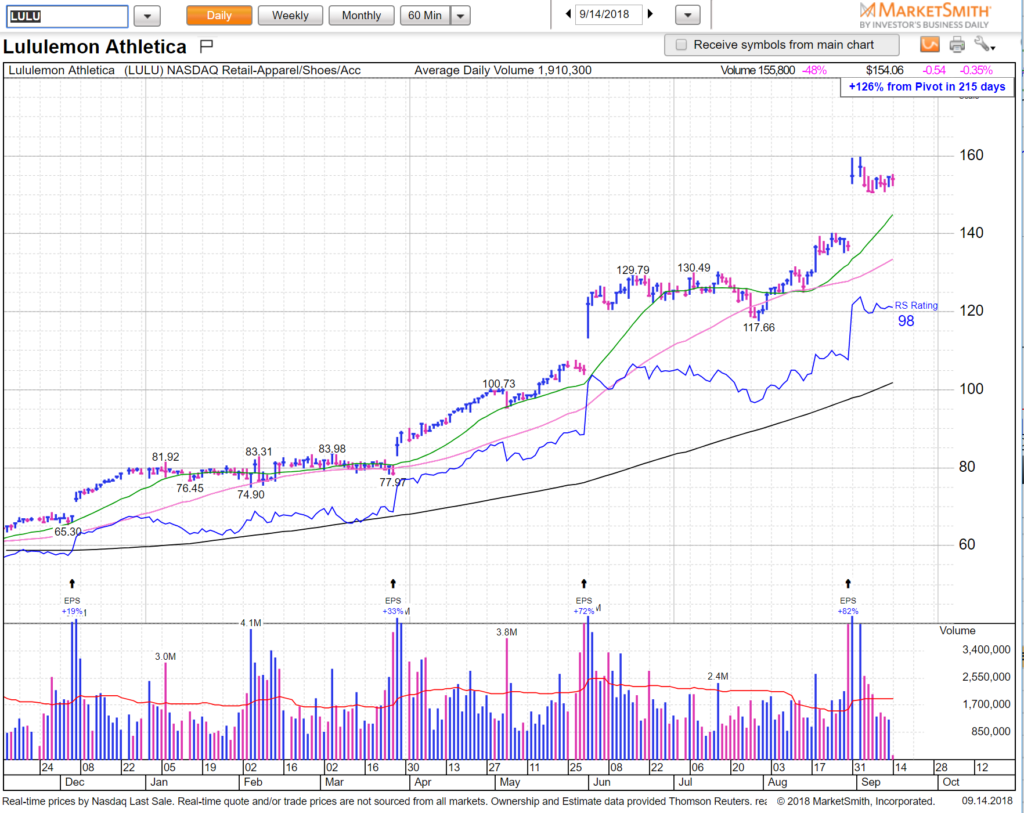

LULU high level base here — add this to your watch-list for a move to 160 hopefully soon or even better if she pulls back to that green line (20sma)

BRK.B fantastic longer term base here that breaks out over 217

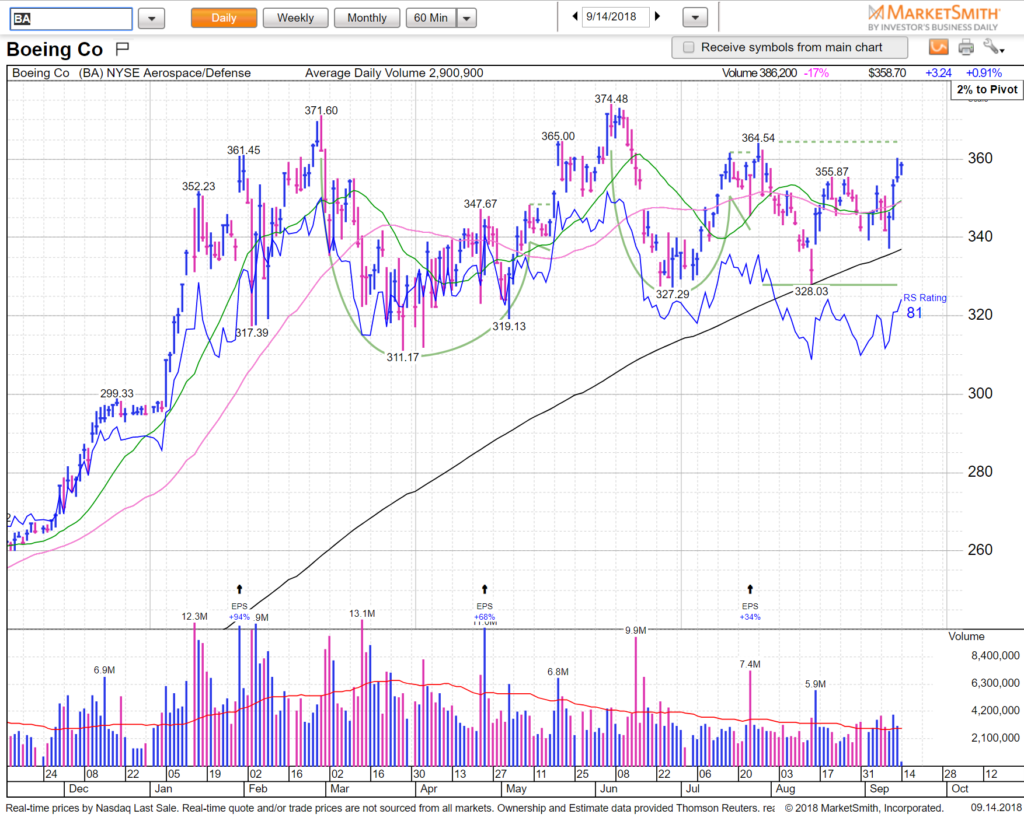

BA we like this pattern — all these notes on chart are done via MarketSmith automatically. Over 364.5 gets interesting.

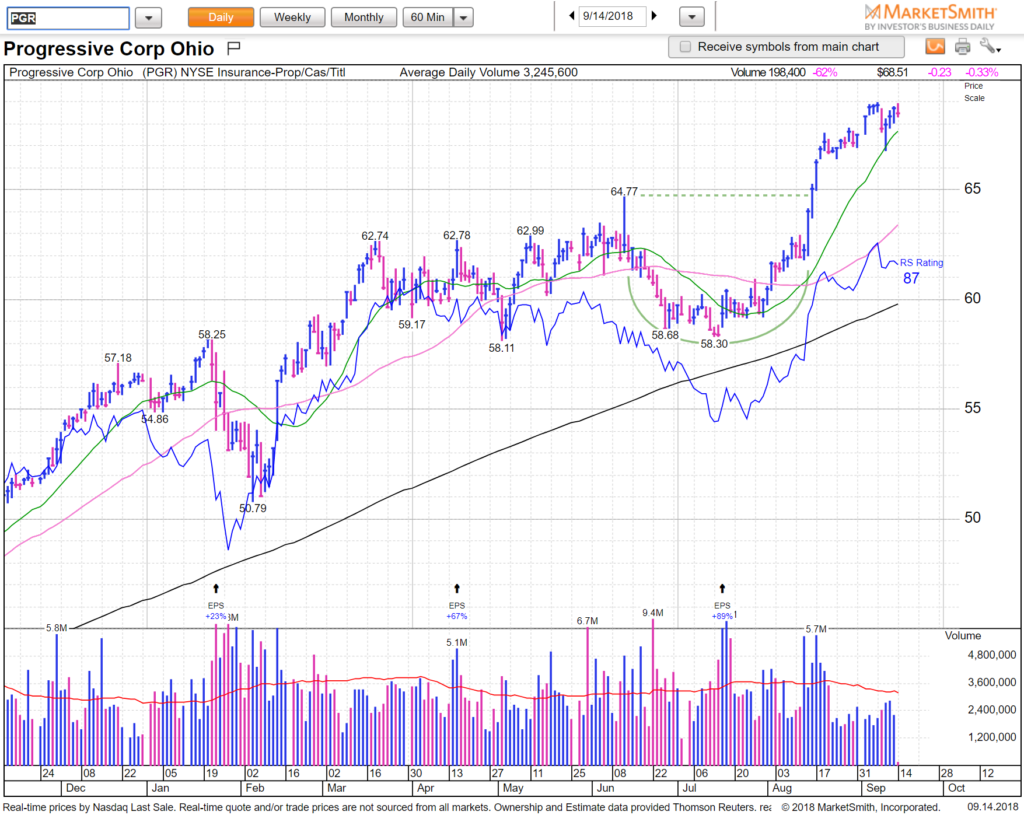

PGR just adding to show what a nice quick trade that pullback to ascending 20sma would have been — we didn’t see this on time last week to have participated.

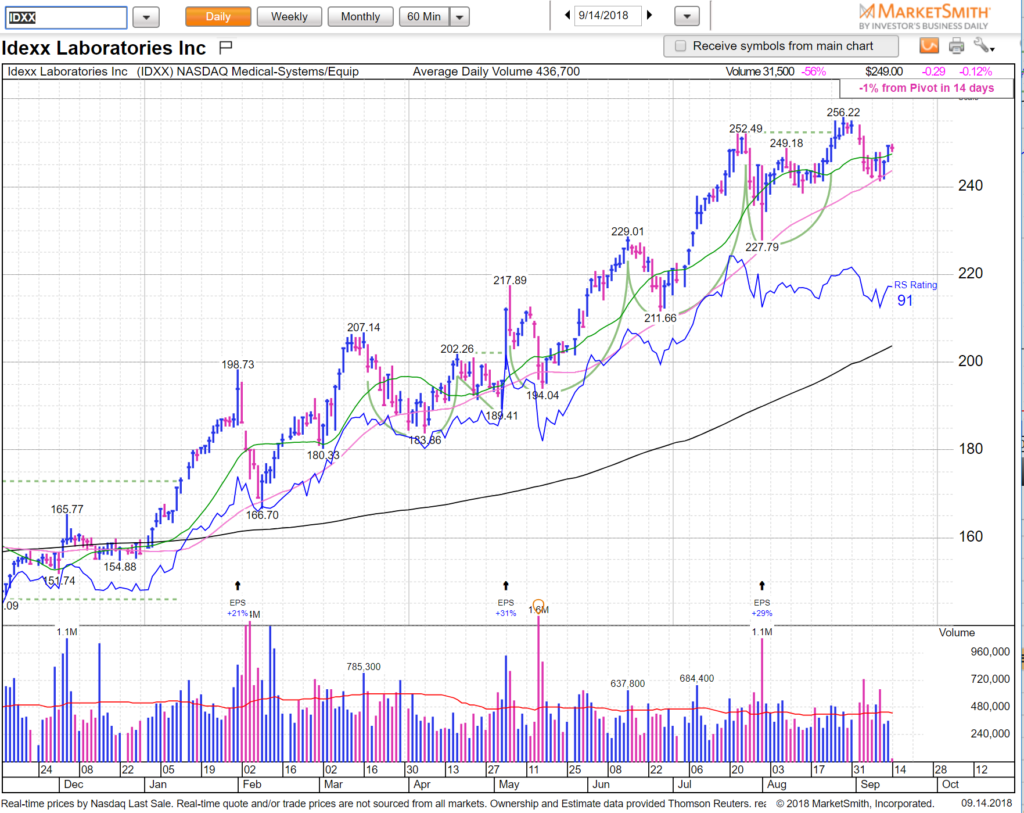

IDXX nice hold on the 50sma — looking for a move back to highs.

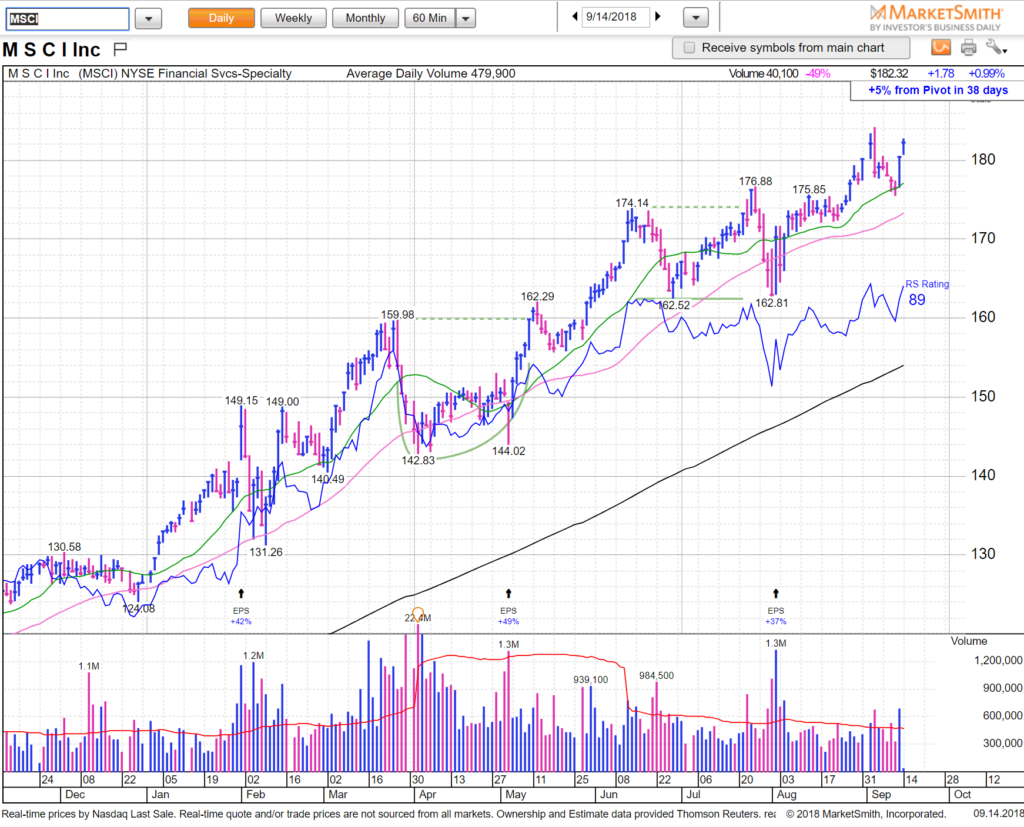

And MSCI which we talked about in our stream last night — what an incredible trend. Why haven’t we been long this stock? As Howard Lindzon says, “it’s all about data”. We missed the latest entry on the pullback to the 20sma. We won’t miss the next one.

See you on the streams. HCPG