#IBDPartner

In our trading accounts we don’t usually hold through earnings (in contrast to our less-mentioned longer term accounts that are cost-averaging into ETFs and some go-to stocks such as AAPL GOOGL).

Some of the best moves can come immediately post earnings — they often are harder to catch but when you do they can be golden.

$NFLX is a great example this week with an open and rally from the 20sma weekly:

Fantastic hold on the 20sma weekly (345) but the short term 60min/9EMA (370s) has been the wall for now.

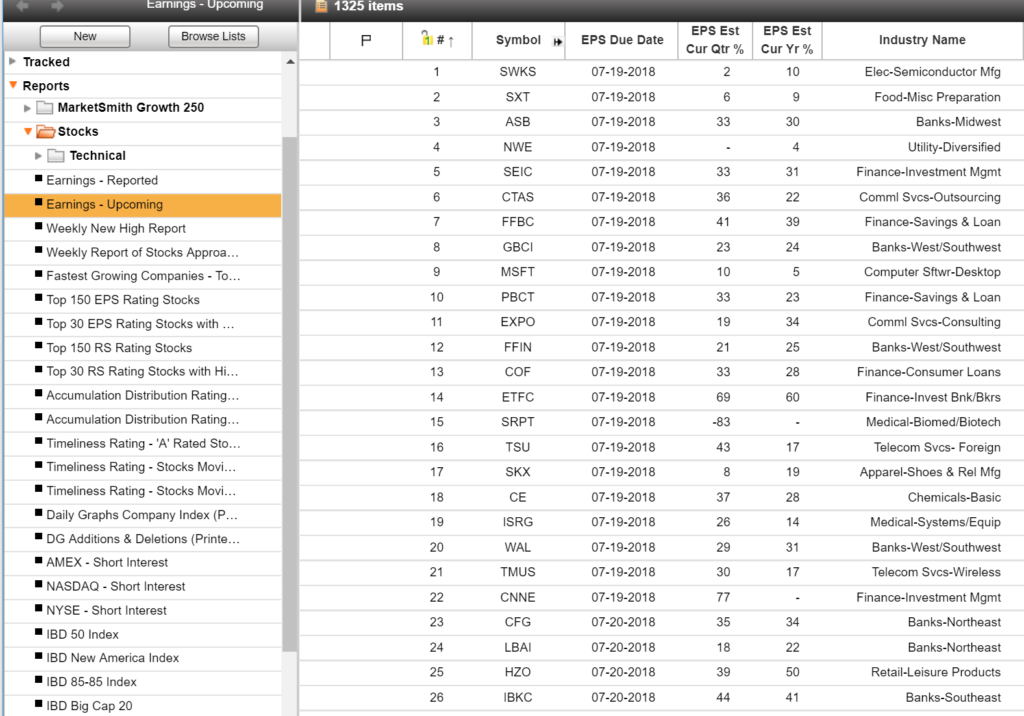

Two ways we trade around Earnings. 1) Using MarketSmith scan we look for Earnings-Upcoming and strategize around potential trades at support/resistance levels. This is a more difficult strategy — basically looking to act on the open post earnings. Often lots of volatility and on average out of every 5 ideas probably only 1 triggers.

2) More preferable: we look through the Earnings Reported section and look for potential patterns setting up a few days/week out post earnings. We love trading stocks around a week out post-earnings knowing the numbers are already out, traders have taken positions, and patterns are setting up.

Hit Earnings-Reported on MarketSmith and sort by ESP last Reported

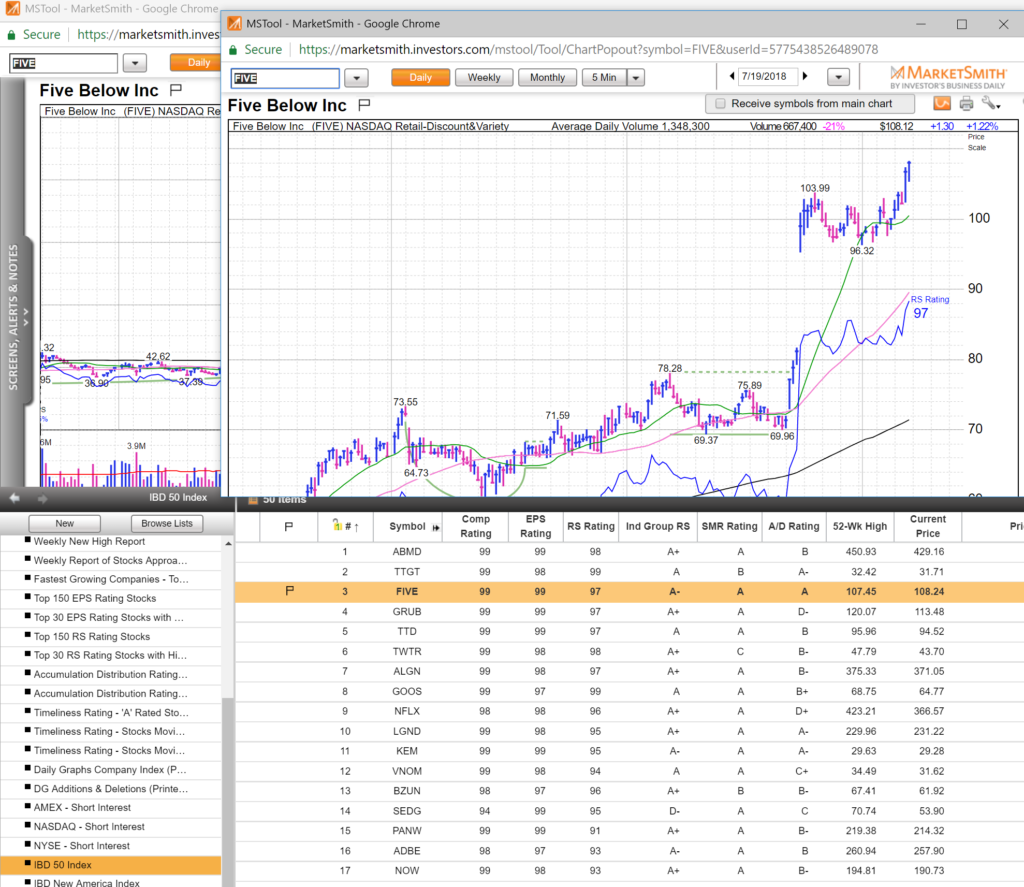

And of course every weekend we go through the IBD50 list to get a feel for growth and momentum in the tape.

There are some parts of trading that will get easier with time — honing in on risk management, entry/exit strategies, etc but the grind to find new candidates and new set-ups never ceases. We like to take Saturdays off and look forward to looking through charts with fresh eyes on Sunday morning. For us having at least one day off without any charts has been a good idea to a) not get burnt out b) get some distancing effect for objectivity.

See you on the streams! HCPG