#IBDPartner

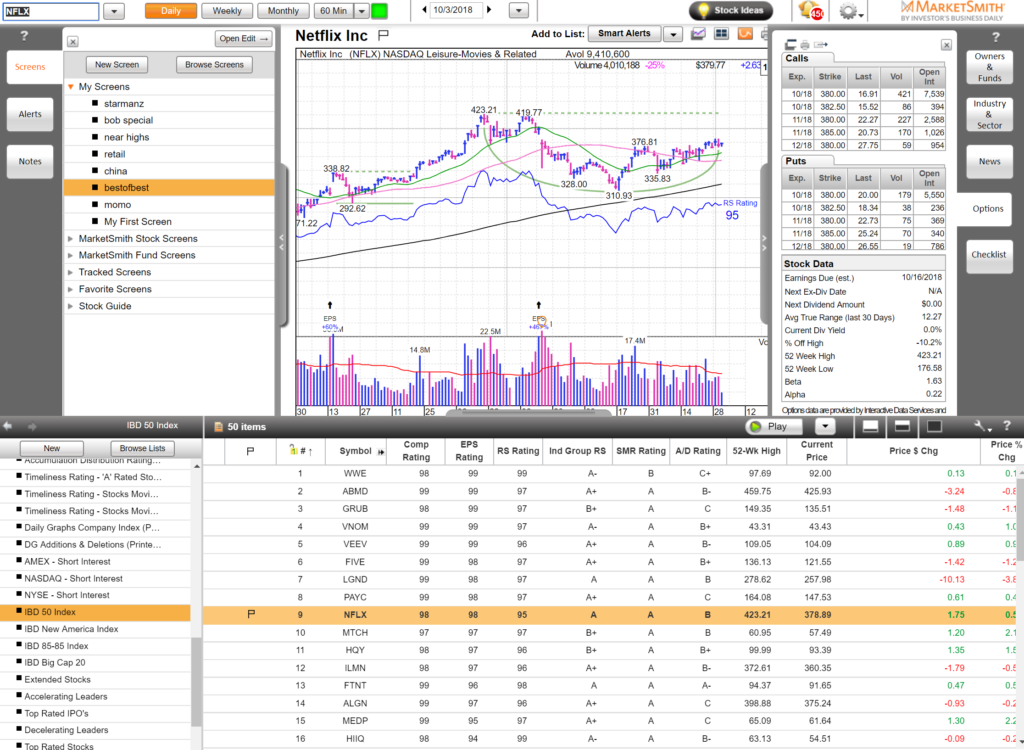

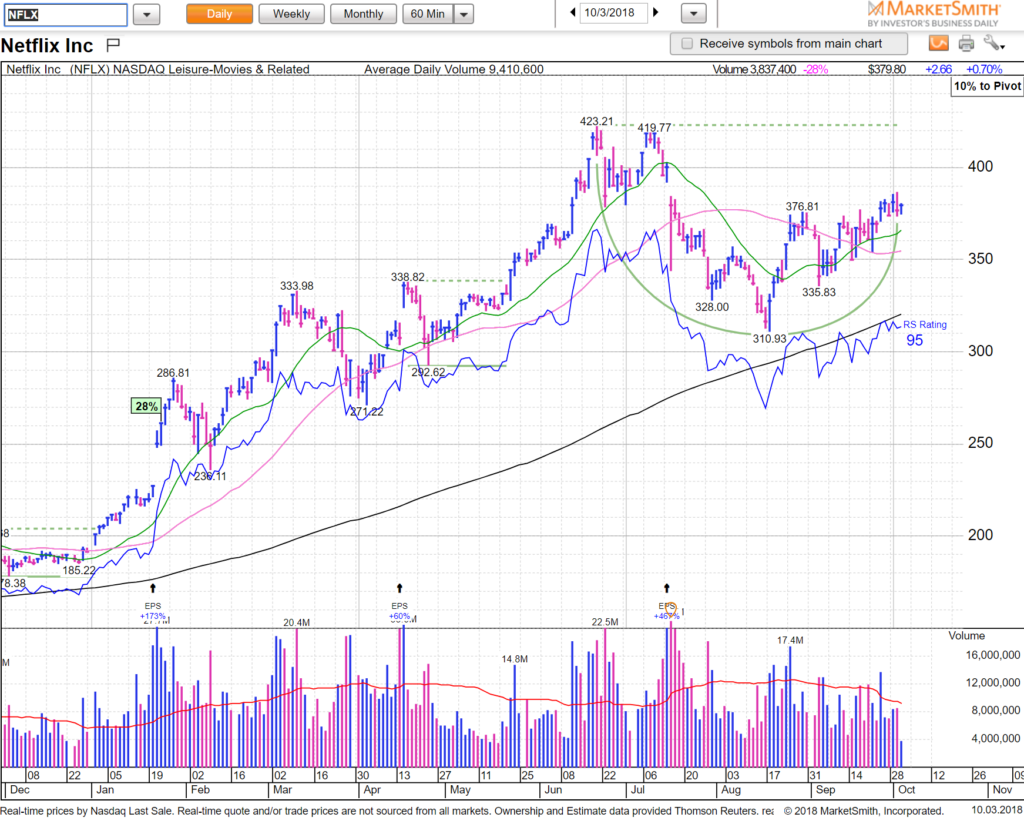

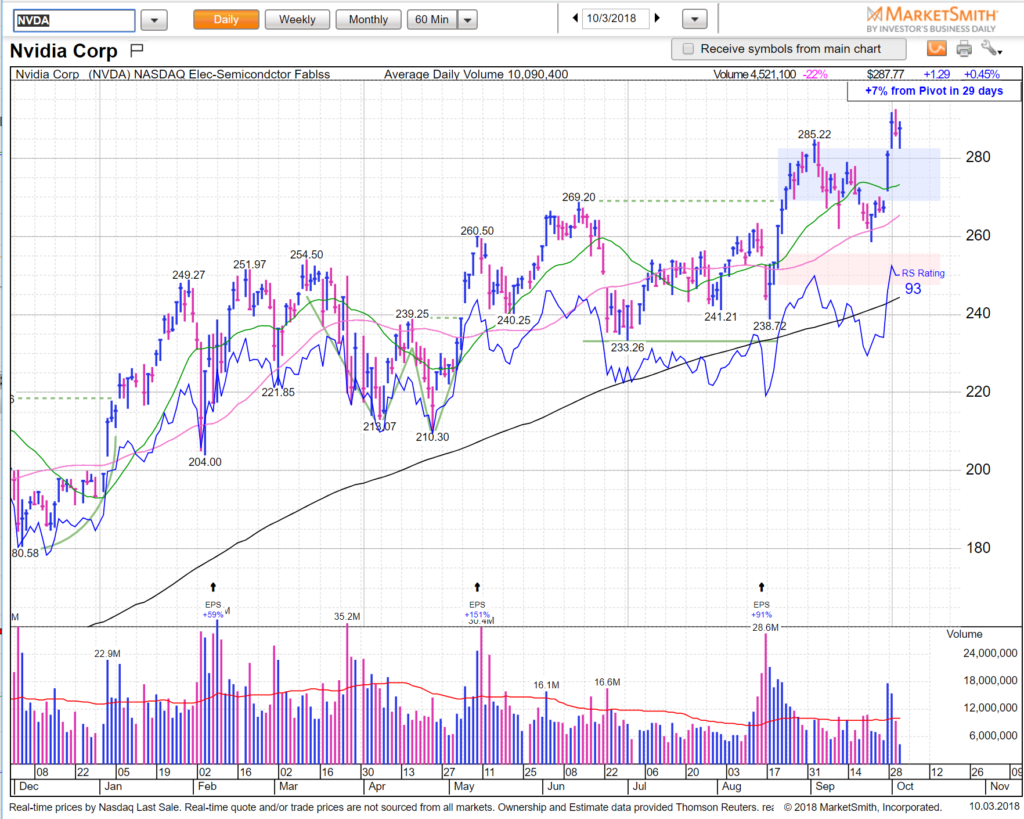

Growth names/ IBD 50 under pressure and MarketSmith’s Near Pivot scans full of stodgy defensive stocks like transportation, aerospace, oil and gas. Yikes. Is this the bond pivot-new norm? Hope not but as traders we have to be ready for the twists and turns of the profession.

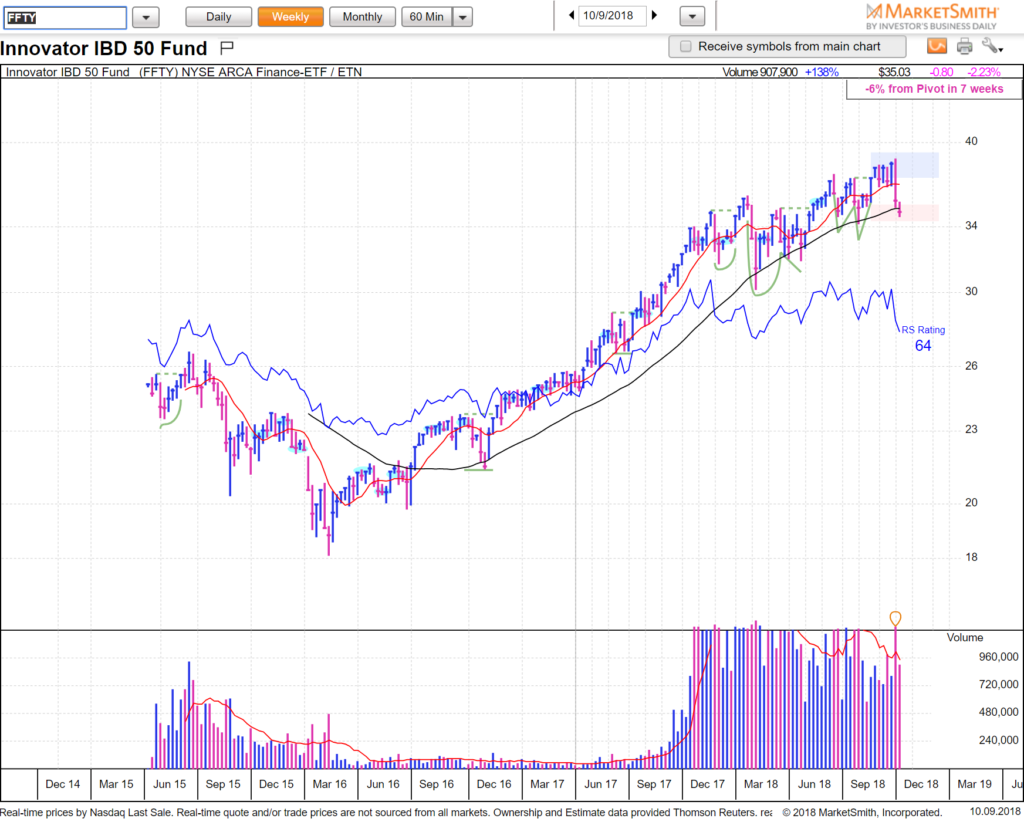

IBD50 own fund FFTY to us is important enough to always keep on watch-list. Finding support on the 40sma weekly (the default SMA on MarketSmith) but for this picture to stay intact buyers need to step in pronto.

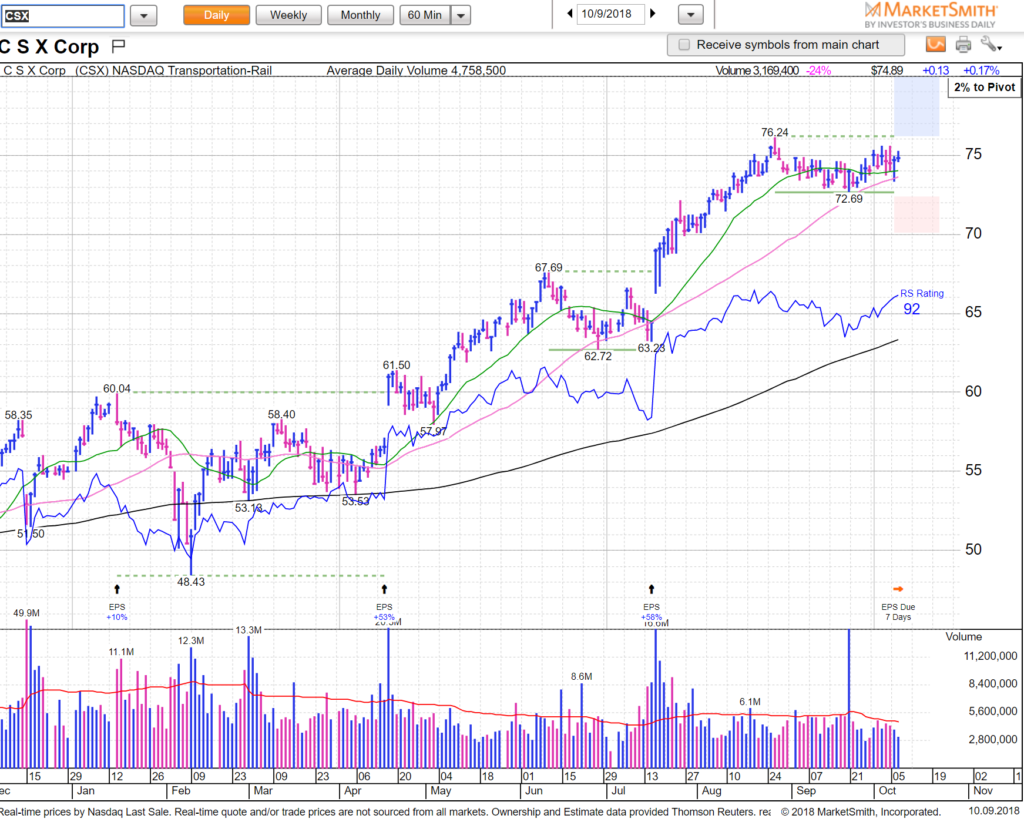

Instead of trading high beta growth names do we have to trade CSX type stocks now? Maybe. Nice base here as you can see breaks out thru 76

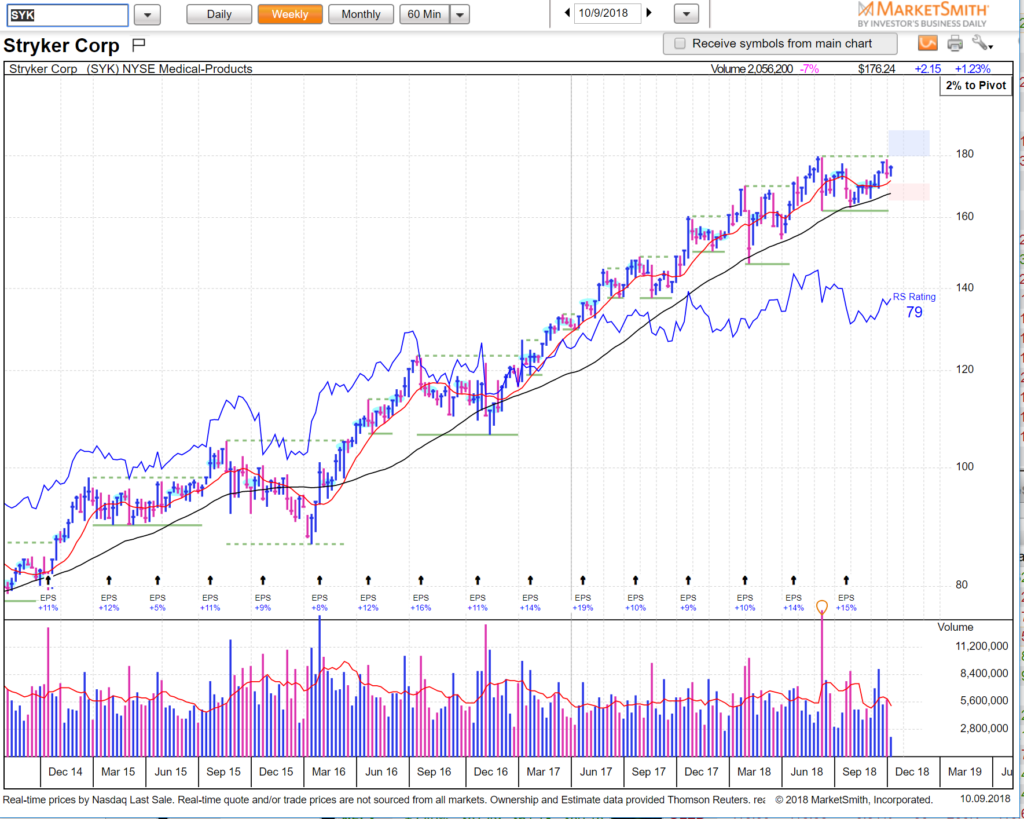

SYK gorgeous trend that breaks out 180

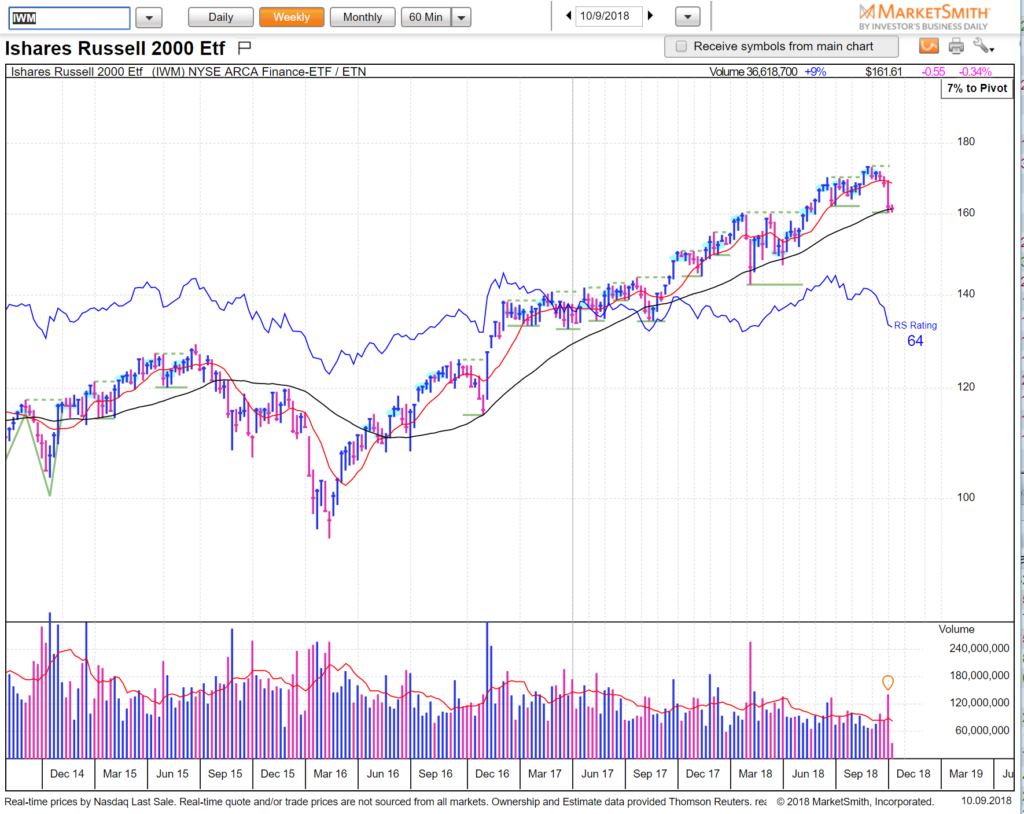

IWM, similar to FFTY, sitting on 40sma weekly. We always think of IWM as the canary in the coal mine ETF which often leads the way. If bulls want to keep the trend intact this is a good time to make an appearance.

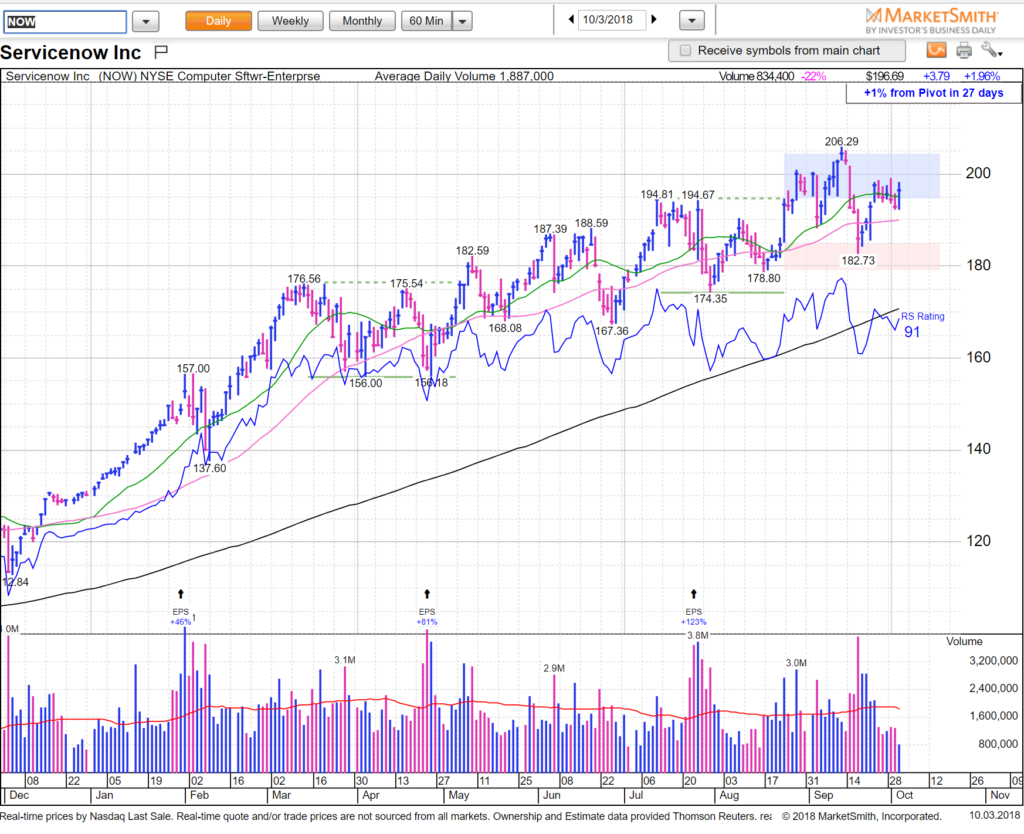

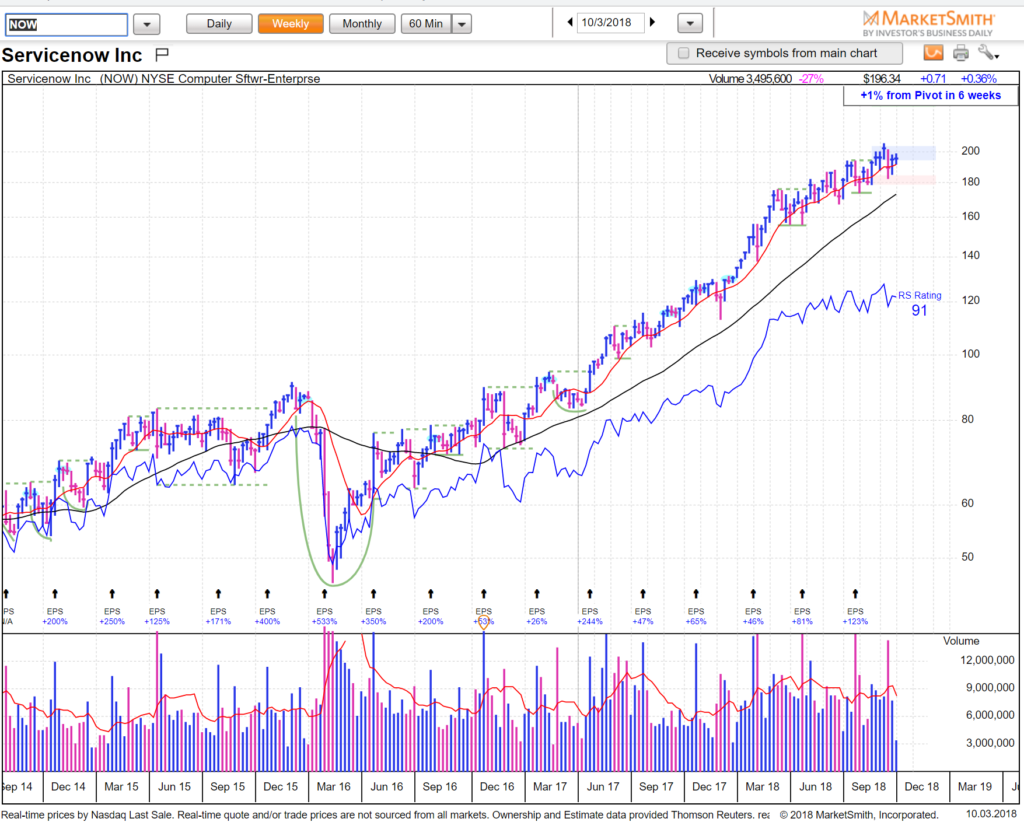

There’s always ways to make money in the stock market but there are easier ways (high growth beta names which follow the momentum script more readily) and more difficult ways (stocks which have higher chances of head-faking/chopping thus making them more painful to swing– oil stocks being good examples). Key to staying alive in this business and being consistent is to adapt. It’s too early to tell whether this is it and we’re in for a more defensive nature stock market but at least be aware of such possibility and do your homework. See you on the streams. HCPG