#IBDPartner

We usually are less active in the summer as

a) for our type of trading there usually are fewer set-ups

b) when there are set-ups the momentum for a breakout is lacking.

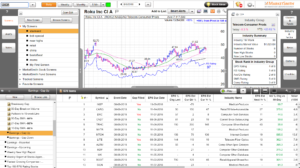

The exception to this is trading immediately post earnings. We’ve had 3 good post earnings swing trades this summer: NFLX on reversal on 20sma weekly support, AMD on 17 breakout, and TSLA on 332 breakout (all positions closed). ROKU TWLO ZTO three more examples from this week that we stalked for days before breakouts. We sometimes buy the breakouts on the next day (often they don’t set-up, but when they do it can be excellent risk/reward) but usually focus on for mini bases on the following days. These trades often last from few days to a few weeks and all worked thanks to the earnings push. All together in one earnings season we probably focus on only 10-15 stocks out of ALL the stocks in our universe — suffice it to say they have to fit pretty strict criteria.

Summer schedule:

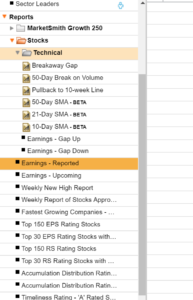

Using MarketSmith we scan for upcoming, look for set-ups for day after earnings. This is the stage we have been focusing on these last two months.

Note Tabs Earnings- Reported, Earnings Upcoming.

Next stage, mostly likely in September, a) will go through Reported and look for bases on the winners, or for those of you who like no gap fills, you can scan specifically for them (not our thing but a lot of traders like that). b) go back to Near Pivot and look for set-ups that are about to trigger.

Rinse, repeat, back and forth. During earnings season — focus on earnings. All other times– look for bases in the Near Pivot section.

Remember kids, in the end trading is just a job. Lots of homework and preparation, lots of humility, and lots of grind. See you on the streams. HCPG