#IBDPartner

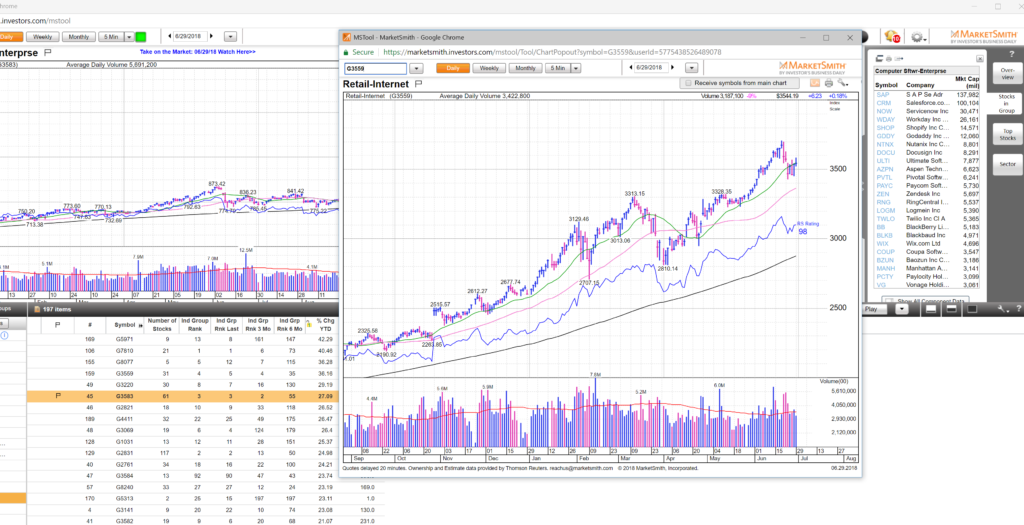

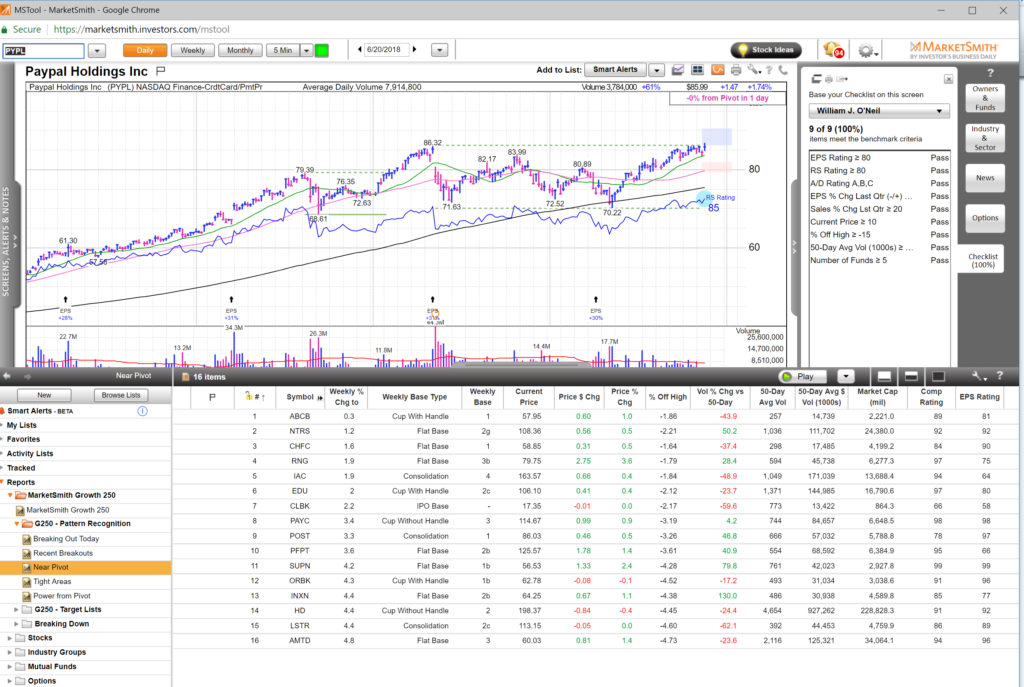

At least once a week we like to go through MarketSmith industry to get a feeling of market health in leading industries. This is what we do:

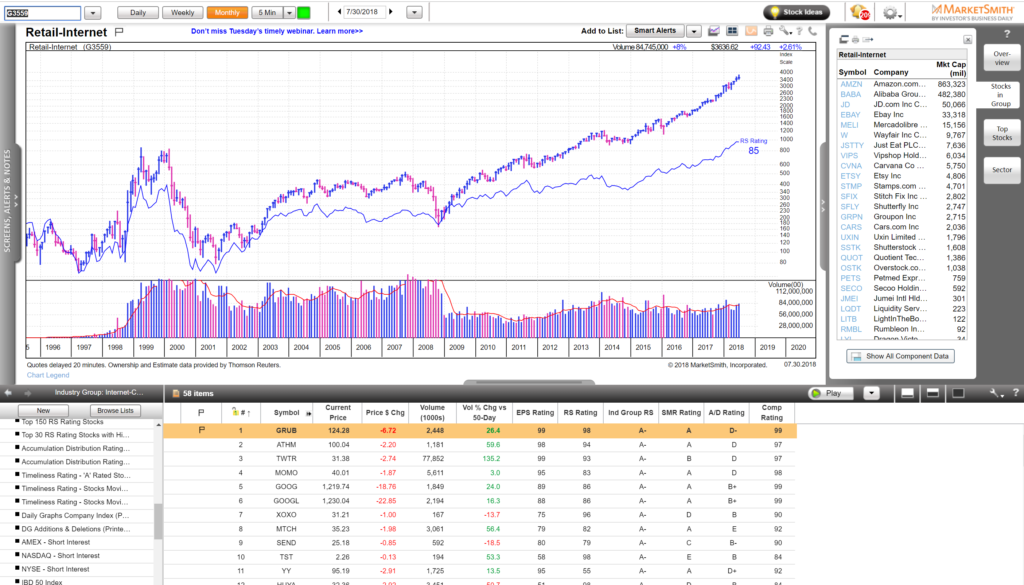

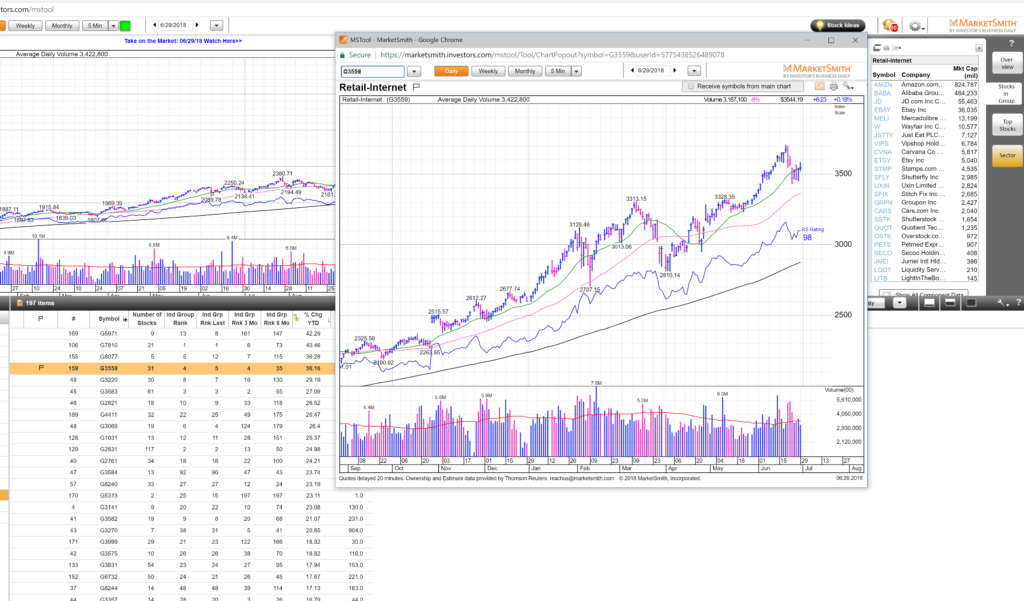

First up — Retail Internet (for the MarketSmith crowd G3559): Up 39.6% YTD with the clear leader AMZN but also BABA and recent trader favorite SFIX. We like to then go through the charts of all the components– in this case 32 stocks. Within 15 min we get a feel for one of the leading sectors of the market.

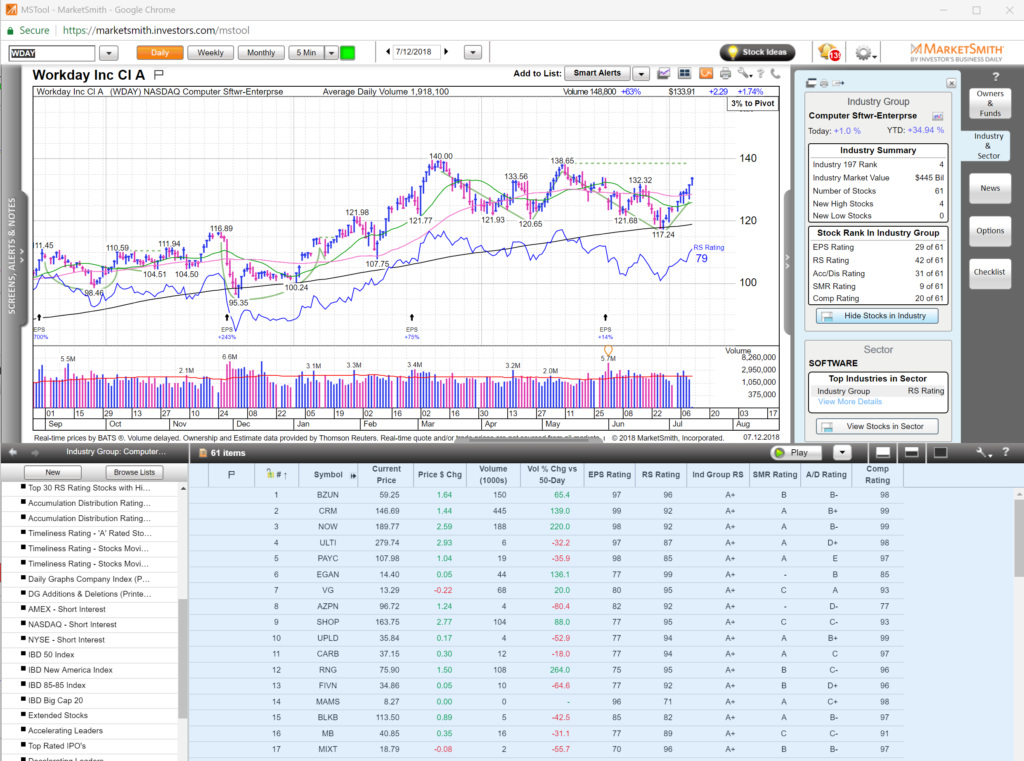

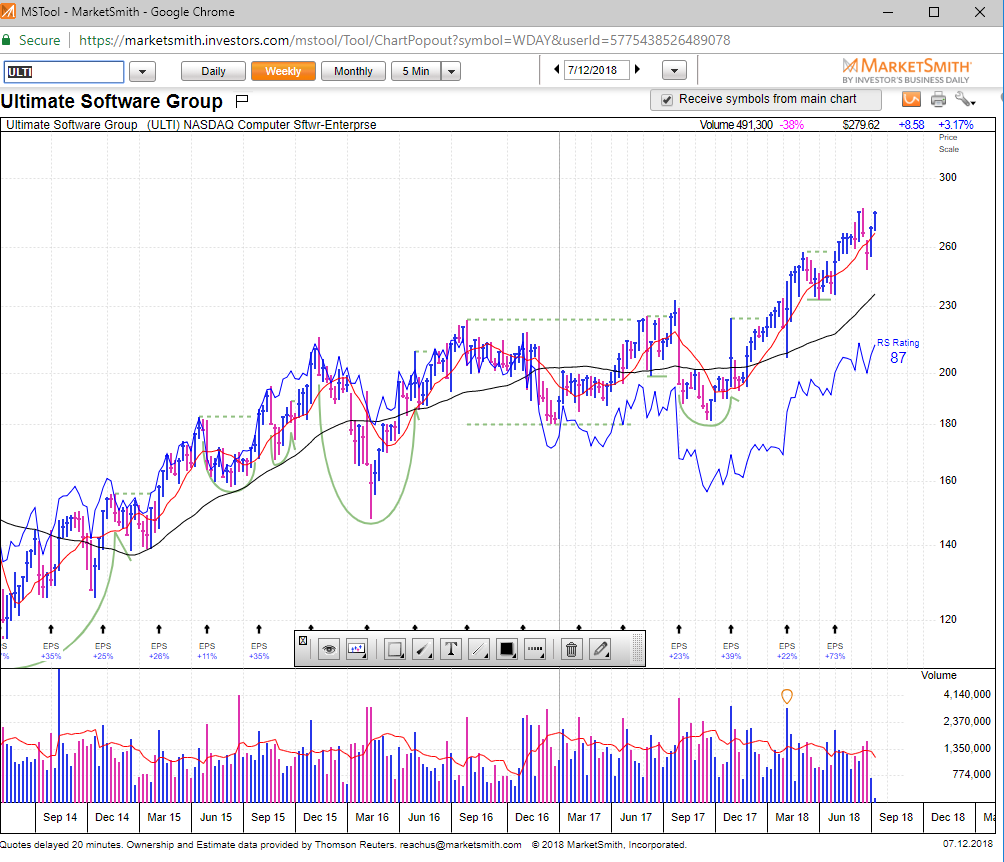

Two other examples: Computer Software Enterprise which is G3583 including some IBD type favorites BZUN NOW CRM PAYC WDAY SHOP NTNX PVTL : up 26% YTD. This sector includes 60 stocks– again we go through them individually to get a feel where this sector is going.

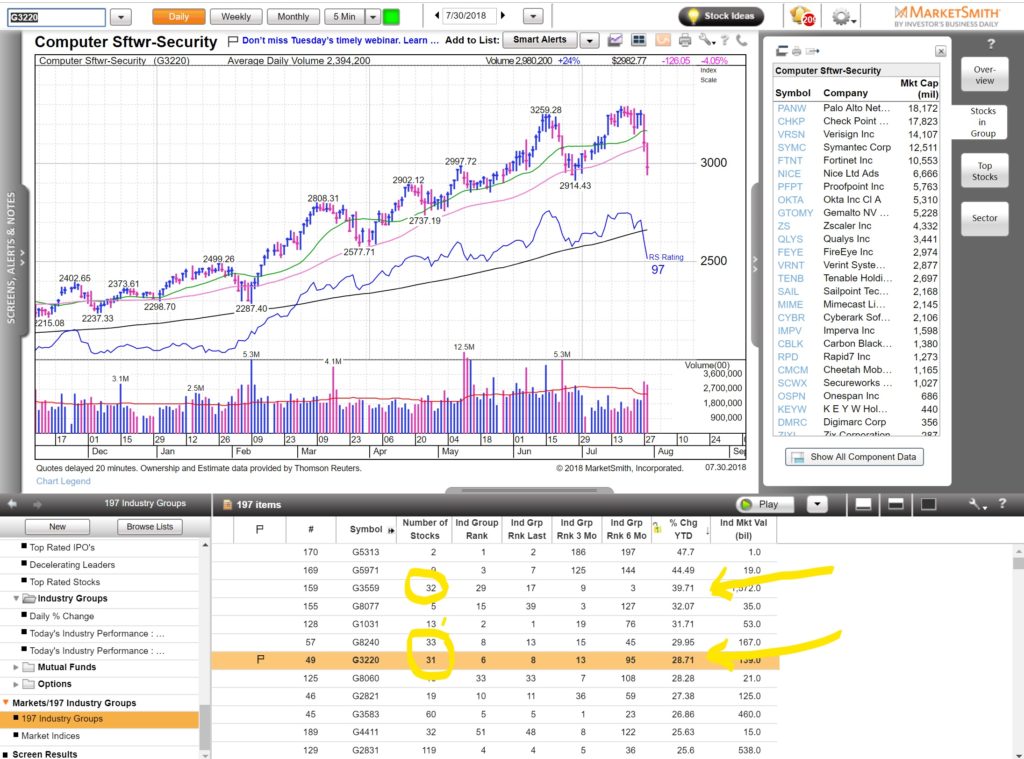

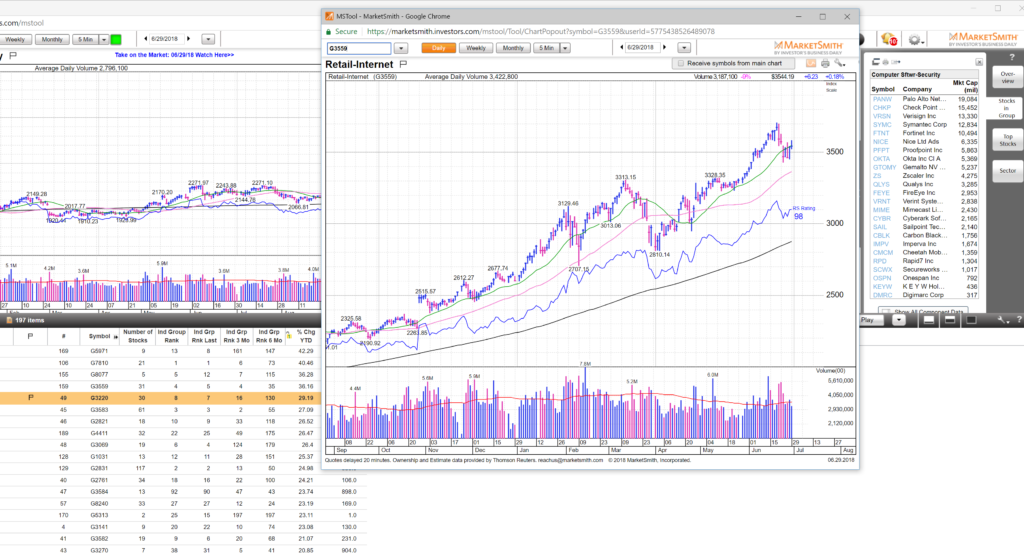

Another sector we like to check out is Computer Software Security– G3220 with 31 stocks. Some recognizable names in sector that our readers will know PANW CHKP FEYE

Two other sector standouts that we will go through this weekend Medical Products and Consumer Services Education up 30% YTD.

We don’t do this every day but do like to go through at least once a week — nothing will give you a better feel for the tape than going through the charts of the leaders.

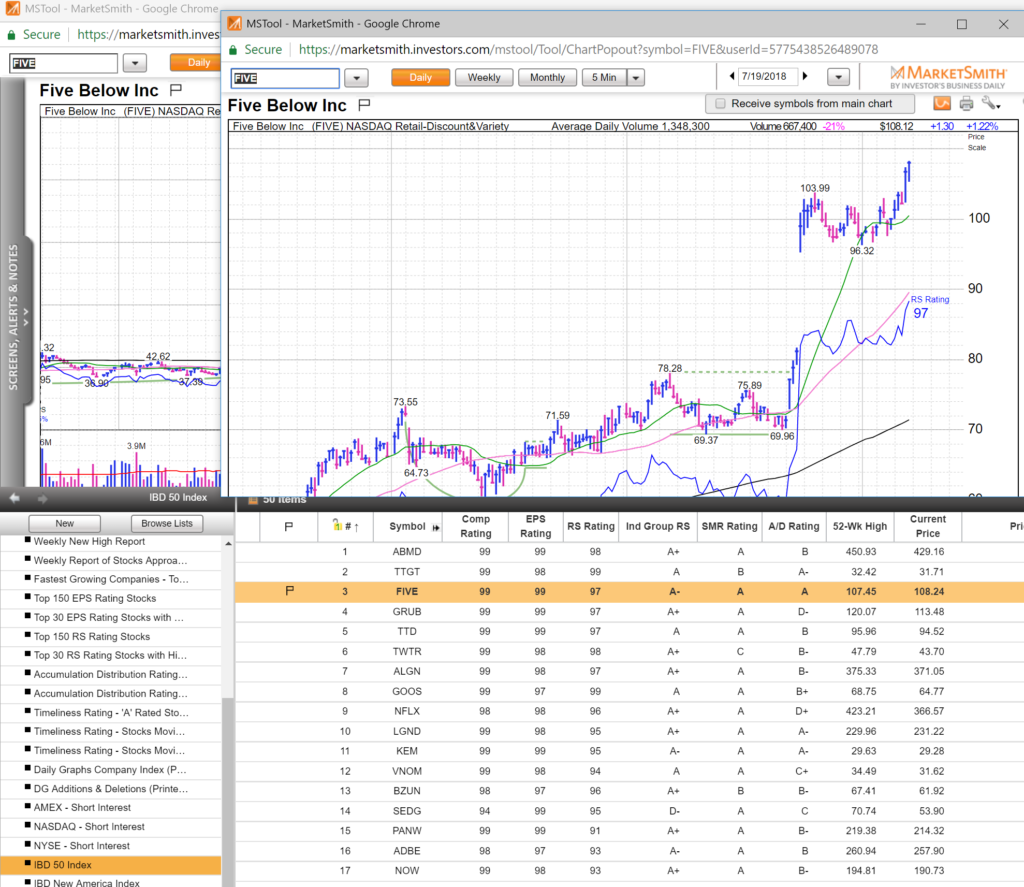

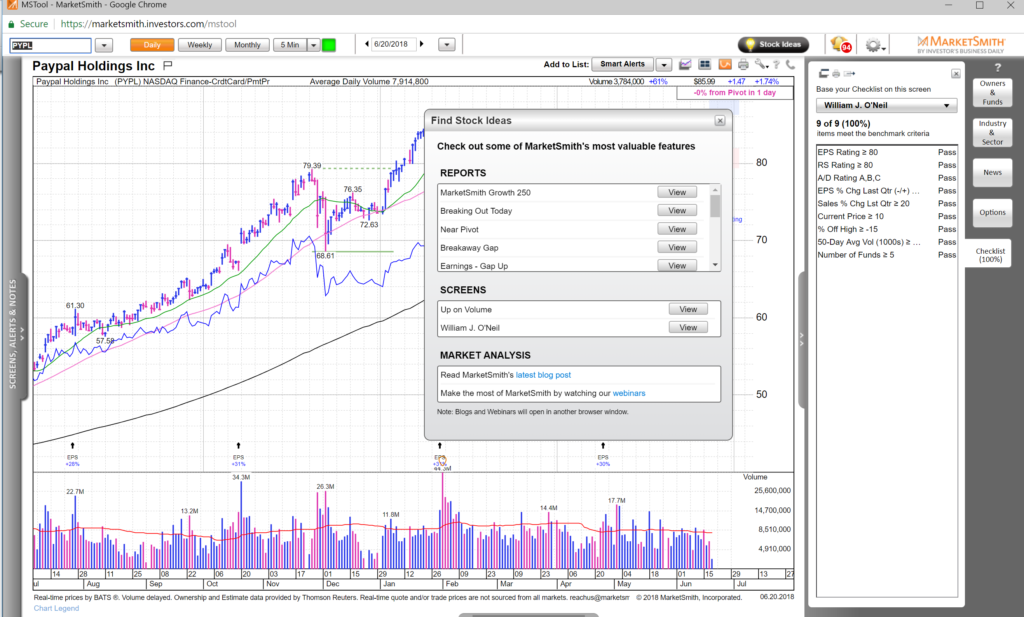

As for the market — QQQ held the 50sma today, and followed through again today while waiting for AAPL earnings. So far, good action.

BIDU on 50sma weekly — last support we like to pay attention to for healthy trend. Earnings out after the close — if the tape likes it tomorrow we’ll be paying attention to get long on a good risk-reward set-up.

See you on the streams. HCPG