#IBDPartner

One of the most important things we do on the weekends is to take a close look at the indices and leader stocks to get a “feel” for the tape for the coming week.

We often start out with MarketSmith Near Pivot Scan and IBD 50.

KL IBD #2 acts great and more importantly, as a gold stock, dances to a different rhythm than our fave momentum tech stocks. As long as that 20sma weekly holds the stock looks good. Gold stocks we prefer to buy on support rather than breakout.

PANW IBD #20 sold off into support — we like to keep a close eye on software stocks as a tell for the tape. It held 220 support, now needs the follow through.

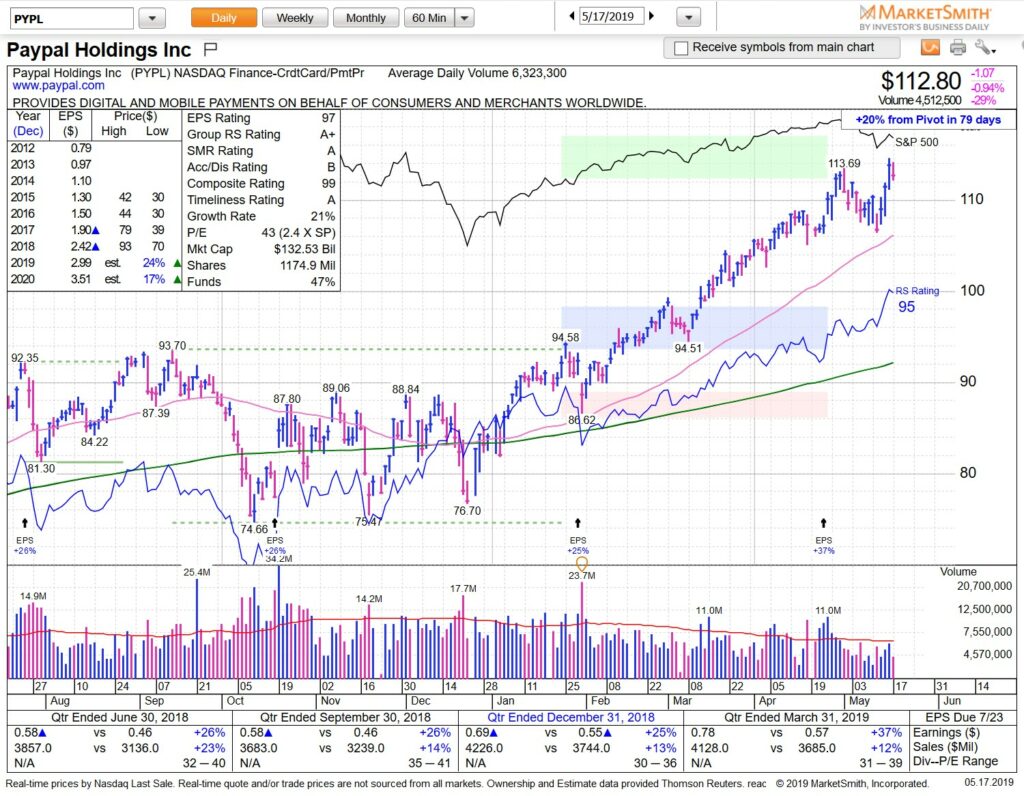

PYPL IBD #7 looking good. Quite a bit away from 20sma weekly and has a high base– we would prefer to get a pullback on this one on 50sma daily near 106.

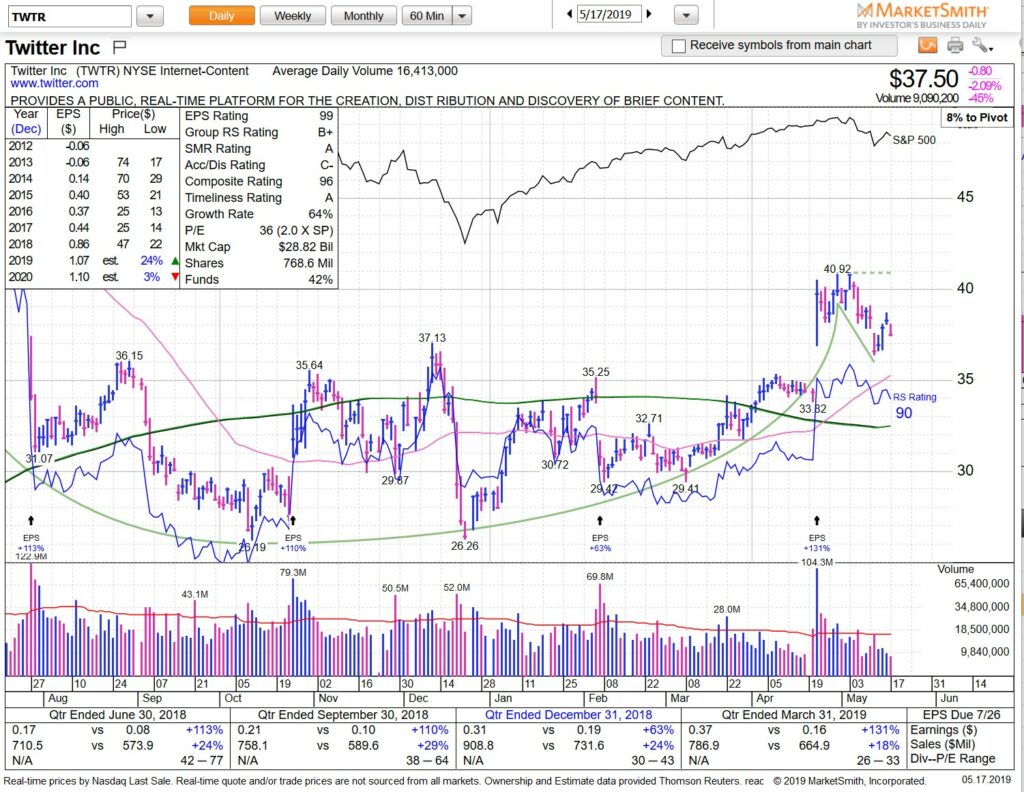

TWTR IBD #10 holding the gap — in this type of range bound tape we prefer to buy support and sell into resistance. This means we are looking near 35-36 for support trade.

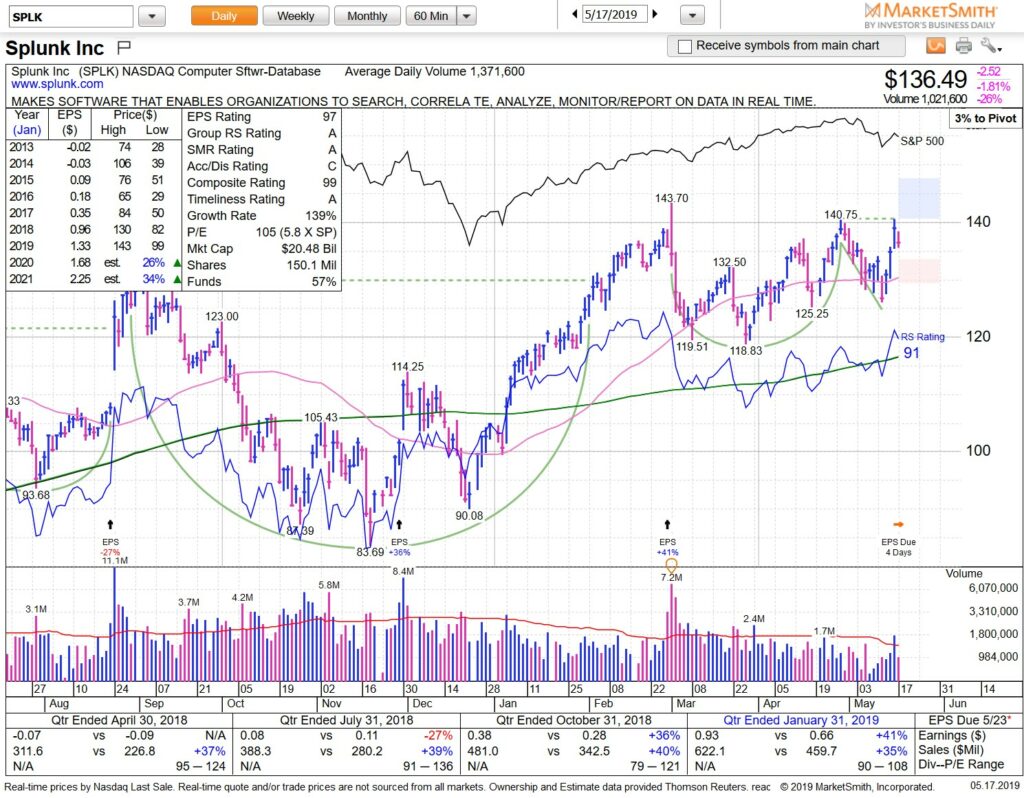

SPLK Near Pivot Scan from MarketSmith bounce off 20sma weekly and setting up. Even if you are not interested in the stock keep on watch-list as as tell for how well breakouts are working, especially in the software leader sector. If tape changes from range bound back to breakout/momentum we want to find out early — and having a stock like SPLK basing near highs will help.

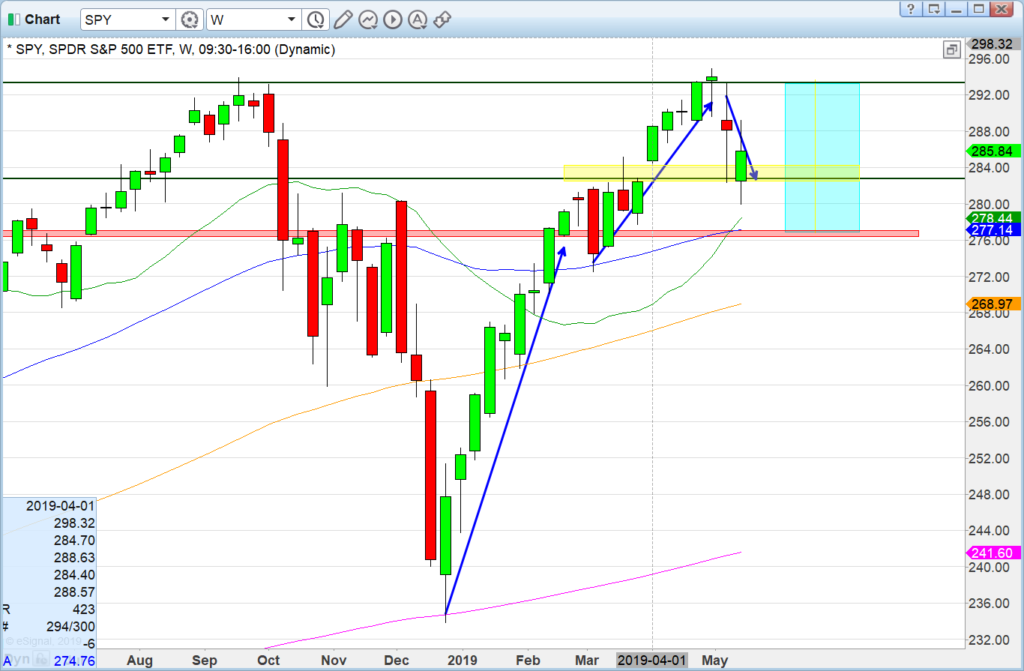

SPY bouncing around in blue zone — range bound tape meaning thus far best strategy has been buy support, sell resistance instead of buy breakouts/short breakdowns. Also quicker exits than usual.

Close under the 50sma on Friday did not give the best look but we’ll see if there is follow thru this week. We prefer weekly look for indices.

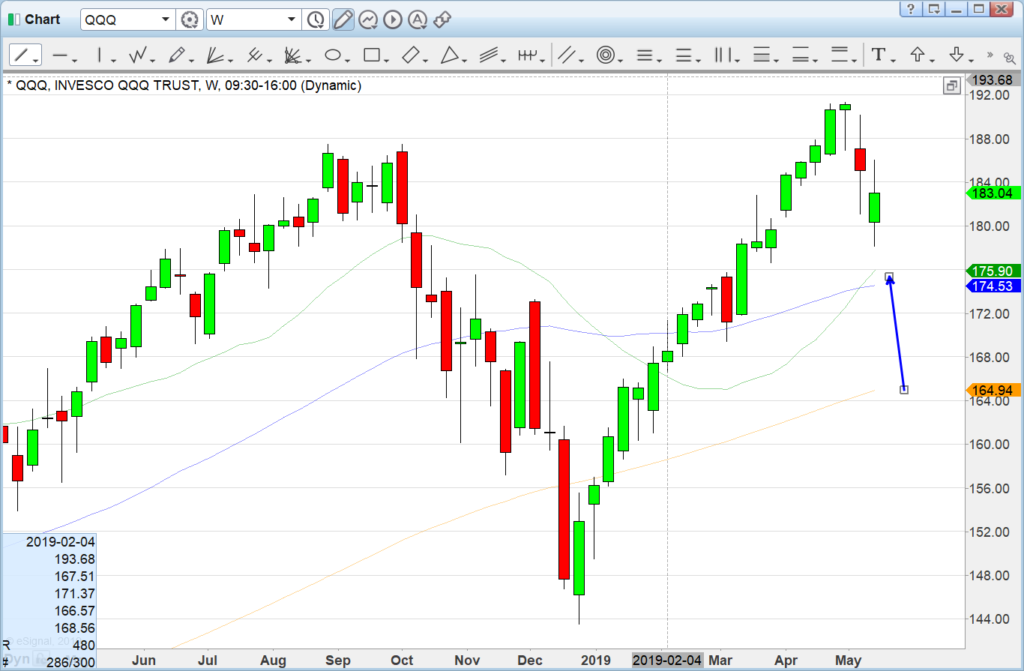

QQQ same thing with a close just under 50sma. Again though without follow thru it’s not that relevant.

Weekly has room to 175 for support trades to be valid — in fact we would love a bounce off 175

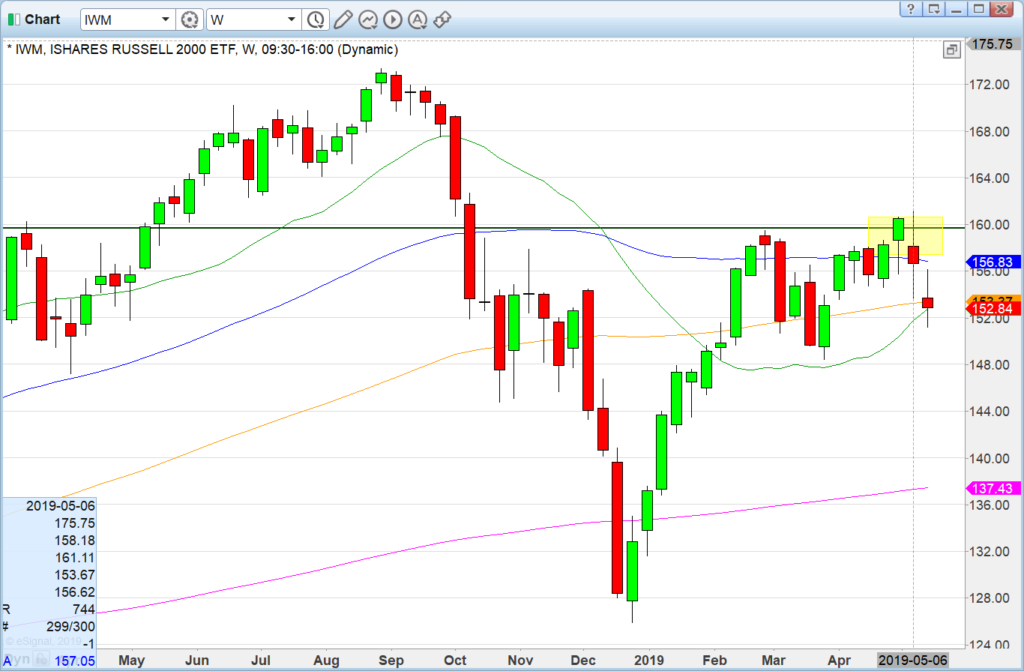

IWM failed breakout 3 weeks ago and now sitting on support. IWM and Semis somewhat canaries in coal mine so keep an eye on this one. Best case scenario for bulls is that this are holds.

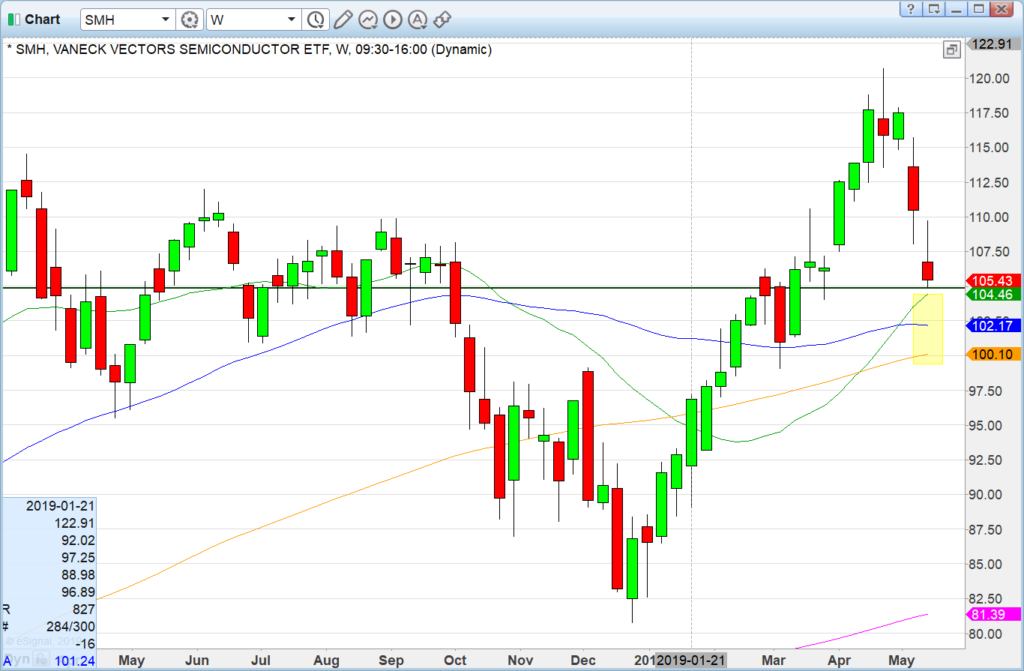

SMH right into support — has to hold this 100-104 area or things could turn quite nasty. Right now it’s a pullback to support but it needs to hold/bounce.

Not the easiest tape right now — quick and small not a bad strategy. See you on the streams. HCPG