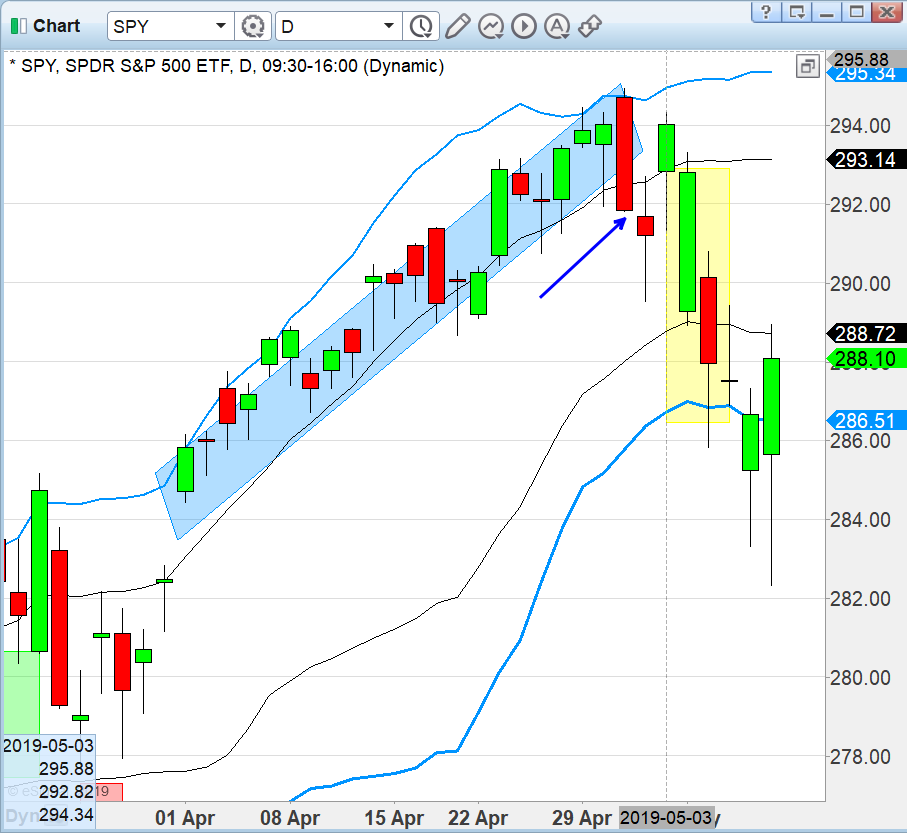

After 21 days of bliss in the sweet spot for trend-traders we got a break 7 sessions ago with volatile headline follow through.

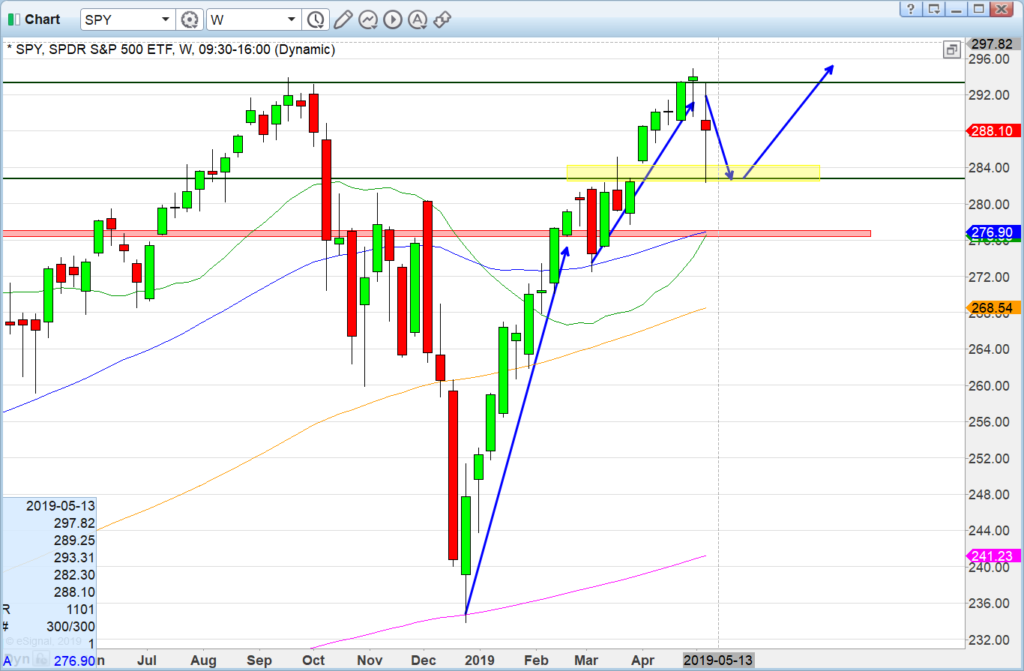

We talked about our ideal scenario on April 20 (with updates) with retreat, gap fill, and then new highs. We have now step 1 (retreat), step 2 (Friday gap fill), and are long for a bounce. Will we see new highs? Not sure but being long $SPY under 283.5 with original 1 point stop (we tweeted it real time on StockTwits) was a great risk/reward that we had been waiting on for a while.

Gap fill 282.5 — wait for buyers to show some interest. Pay up less than 1 point with stop on lows. SPY up 5 points from our entry on this size trade with original 1 point stop. As our custom we take off the active portion into the close leaving full swing on with trailing stop.

So here we are — we have the retreat from resistance, we now have gap fill. Two choices. a) the gap fill bounce is temporary and we will break it and go to next support magnet (red highlight) or b) we go back to highs/new highs. Of course there is also a third choice of making a new range between highs and Friday lows.

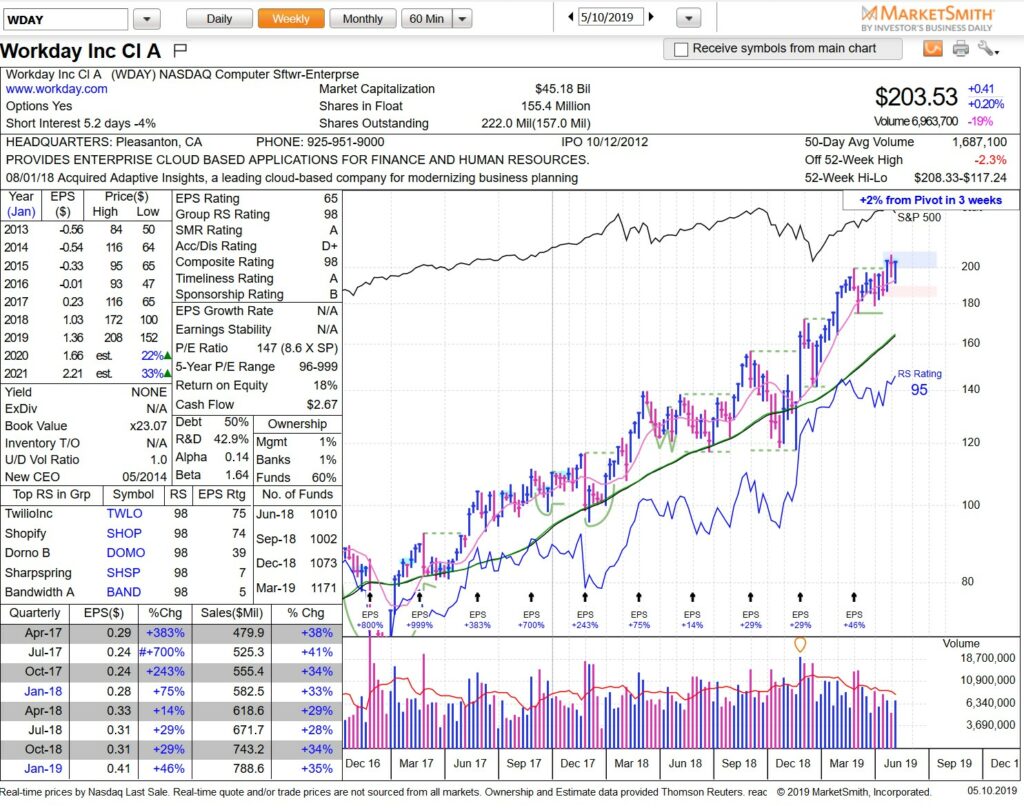

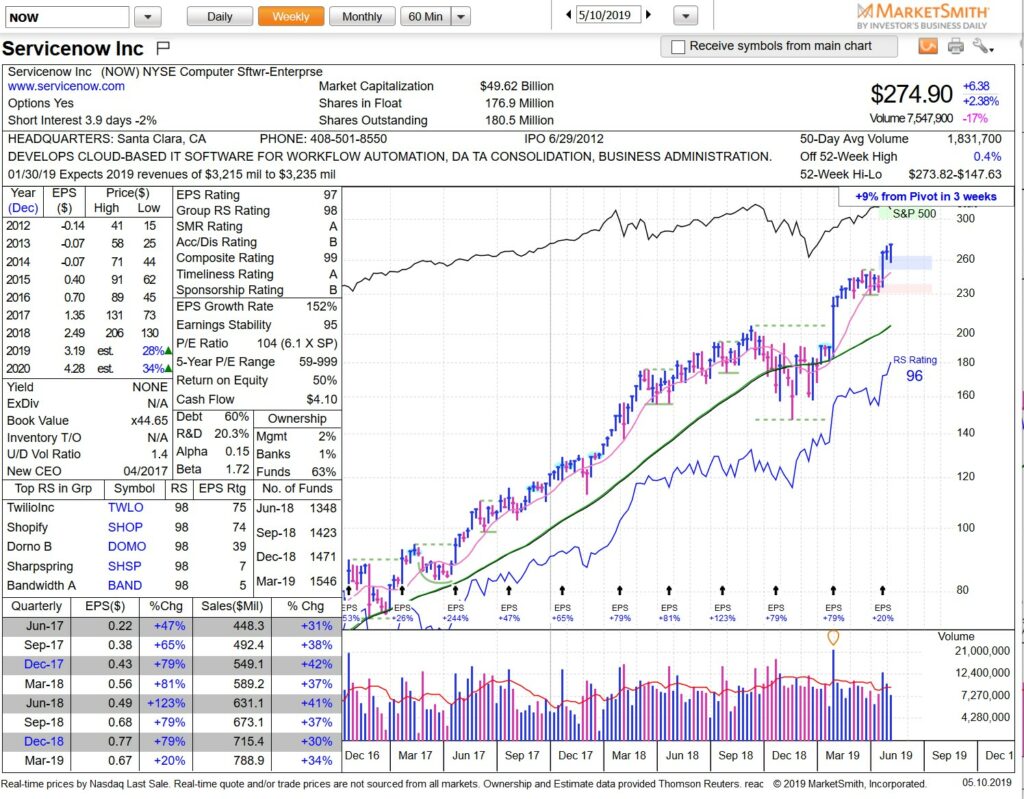

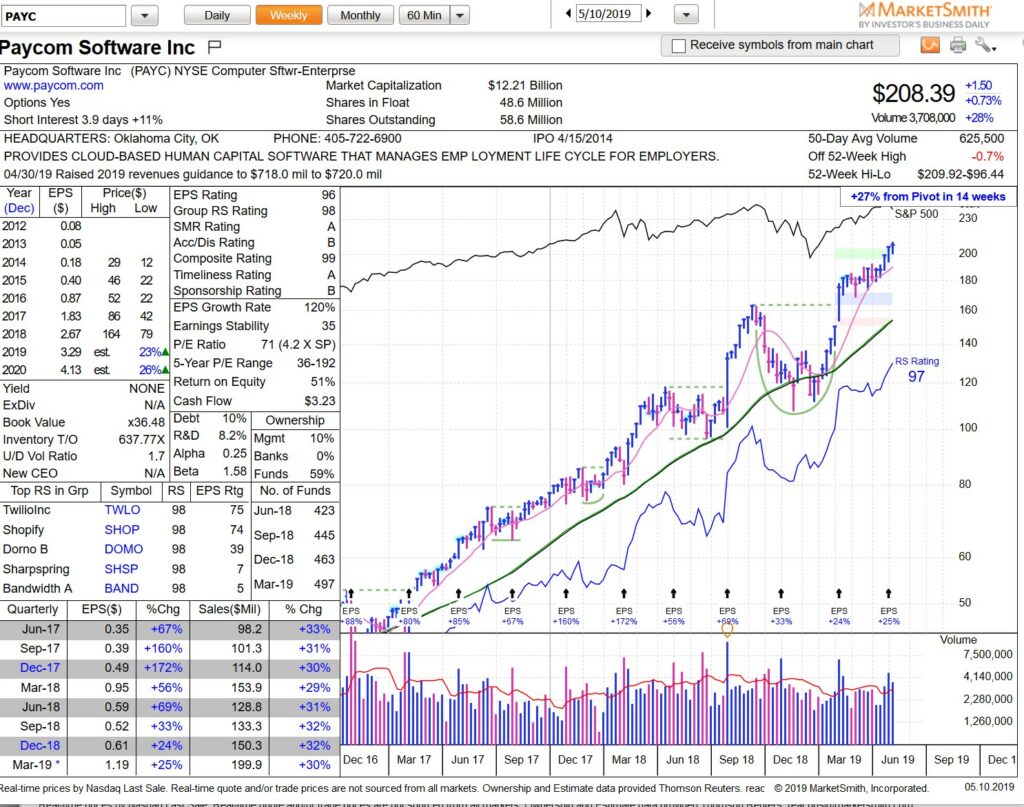

If it is choice 2 or 3 then swing ideas should work again. Looking at MarketSmith scans for new ideas we did find some common themes. One, it’s good to have software strong. They are clear market leaders and if they are hanging tough, that is good news for broader tape.

WDAY for example, IBD #50, didn’t even hit the 20sma weekly and already back near highs.

NOW #IBD #6 at highs and didn’t even hit 20sma on daily. Incredible strength.

PAYC IBD #8 also at highs with every dip bought by investors.

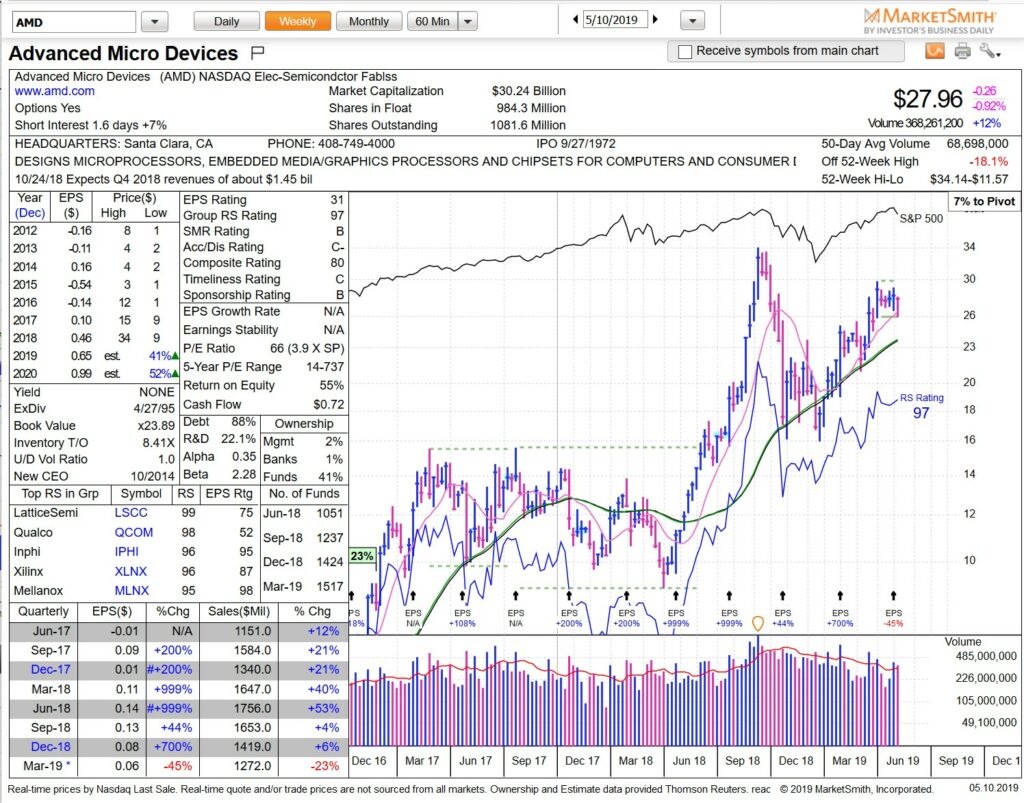

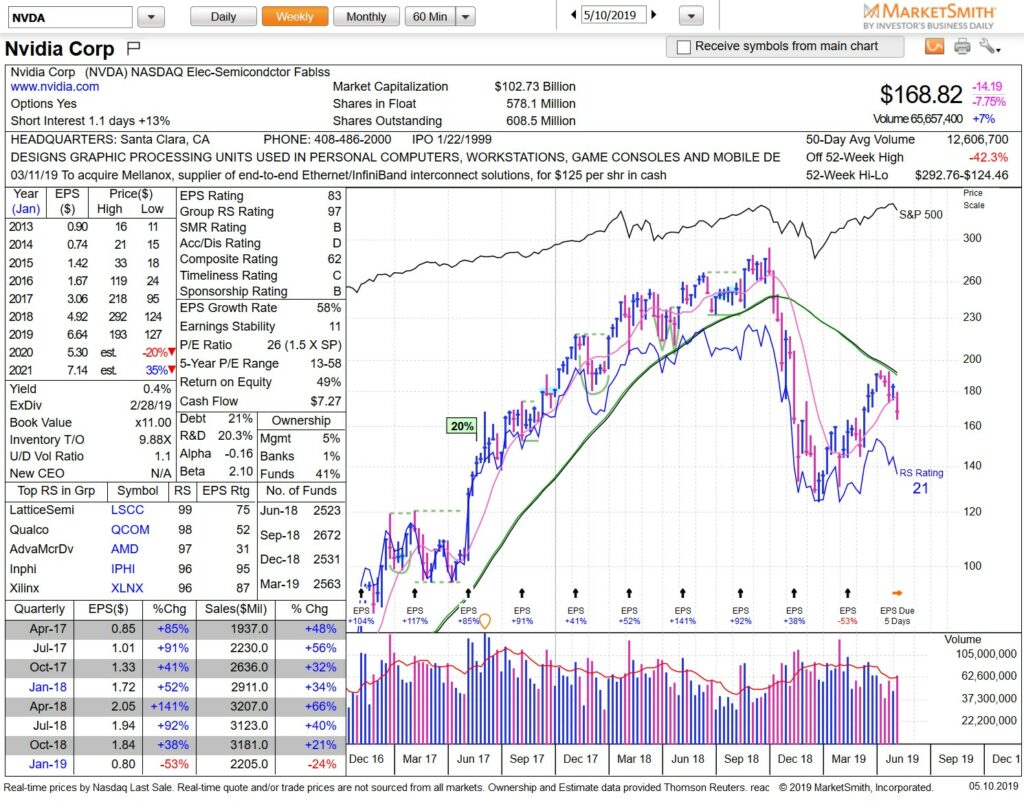

Second theme we would like to focus on is the semis. We wrote about the importance of 110 in our newsletter this week and in our posts on Twitter/StockTwits. Note how both days bulls managed to close back on the line. 110 is 50sma and horizontal support so good to keep it alive.

AMD has been on our lists for a while waiting for this weekly breakout. Nice hold on 50sma daily this week. Near 29-30 it could get pretty juicy.

NVDA broken for now but earnings this week could wake this monster. Needs to get to 200 to break thru resistance. Best case scenario: gap and base 190-200 to set it up for a run back to highs.

So now that gap fill held, software is holding, is the bottom is in? Speculating is hard enough, but in headline tapes it becomes even more challenging. We like the idea of gap fill bounce follow through but headline risk is real right now. We like our long entry and will stick by it if price stays above 284 area. One day at a time. See you on streams. HCPG