We’ve seen this movie before — attention to Chinese IPO type runners while market itself feels fatigued. Banks and Semis ran today but they couldn’t get the market green. Feels like a summer tape before the long weekend. We’re a bit more cautious today — but still long. SPY 270 goes though and things might get more volatile again. For now though market in sweet spot, and IWM still leading.

#IBDpartner

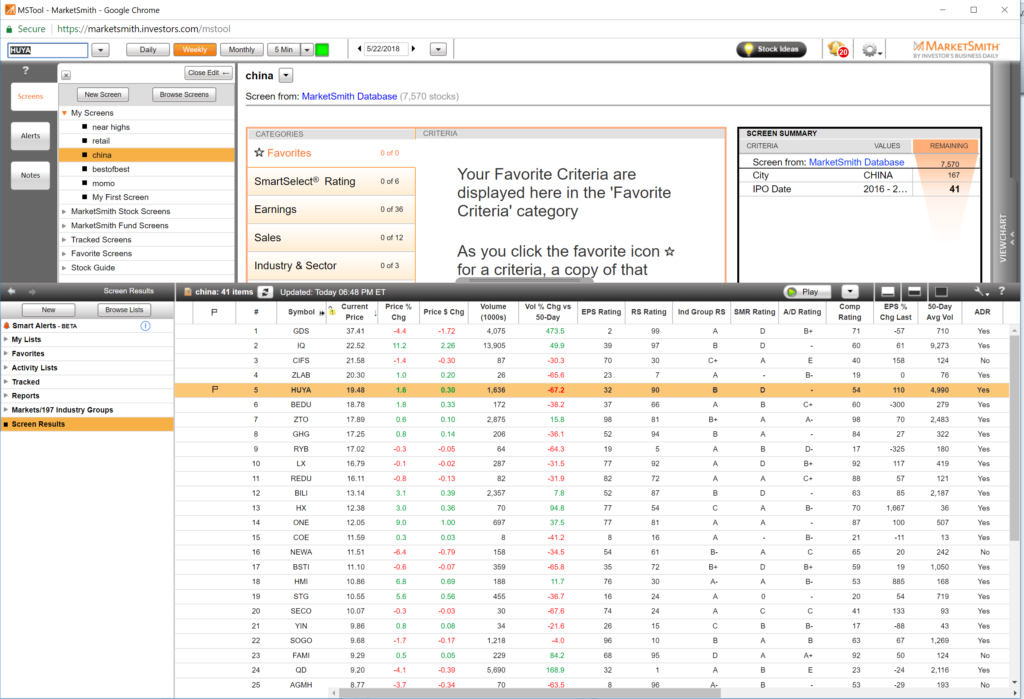

We wanted to take a quick look at Chinese IPOs — opened up our MarketSmith (highly recommend a trial here) and it took all of 1 minute to get out a filter, plugging in Chinese IPO — sorted by price:

This type of market is actually not our forte — we like bigger cap momentum stocks rather than these Chinese fluffer bots, but there are some good moves to be caught, like in IQ today which was trending on StockTwits as traders were hungry for anything that was moving.

IQ probably the best of the IPO bunch.

HUYA has some potential — we’d trade it on any Indy formation.

BEDU thinner but weekly somewhat interesting over this week’s high.

ZTO needs a base but decent chart here.

HMI breaking out of resistance:

Take a look at the scan and have at it! Market near highs going into long weekend — small caps often where opportunity is during these type of times. Small cap momentum stocks can be pretty ruthless if they fail, so please don’t chase!

In broader market — we’d like 270 to be defended on $SPY. Market can’t seem to make headway away from support, but not breaking down either. XLF SMH good action (we’re long both) and IWM still leader.