#IBDPartner

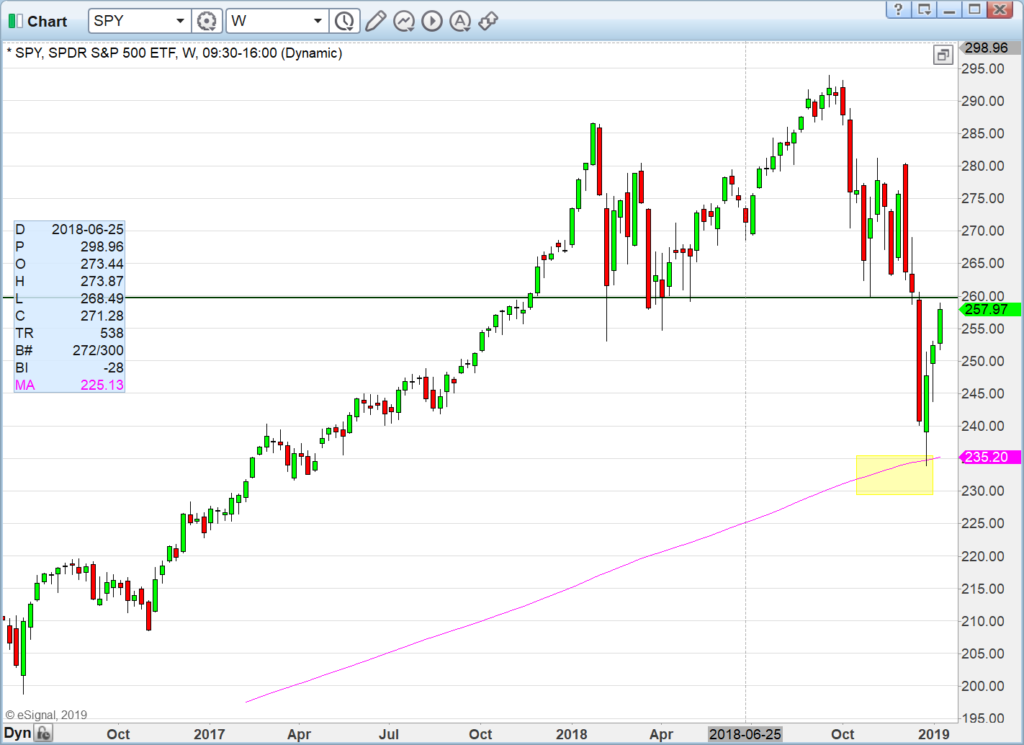

Since the last time we posted the market has taken off from The Last stand 200sma weekly up over 10% on SPY and now close to major resistance. The picture says it all: 200sma touch holds perfectly and now has rallied all the way to 260 target that we talked about back in December. From 260-280 major congestion.

We have a few scenarios in mind:

Ideal one: pulls back somewhat near SPY 260 resistance to scare the bulls, invigorate the bears, and then rises back up to attack resistance without being overbought.

Bearish one: back to lows

Most frustrating one: goes thru resistance without creating any bases as the stretched elastic just keeps getting more stretched. Just like how support was meaningless on the way down (except for the final one which thankfully stood fast, the 200sma weekly) resistance has been also meaningless as market has climbed up 10%. However we are hitting 260 in overbought status so we do expect at least some chop and not a smooth uptrend like we have seen last 4 sessions.

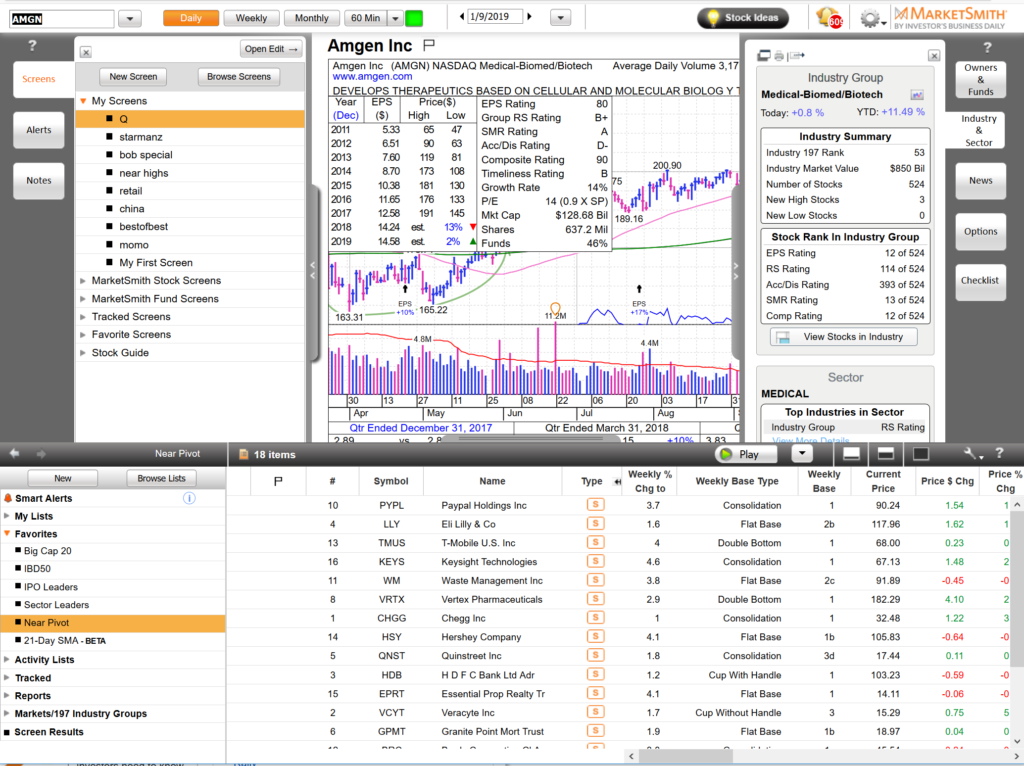

If market does now do some horizontal work it would create a plethora of set-ups from our Go-To favorite scan on MarketSmith we call our Q scan

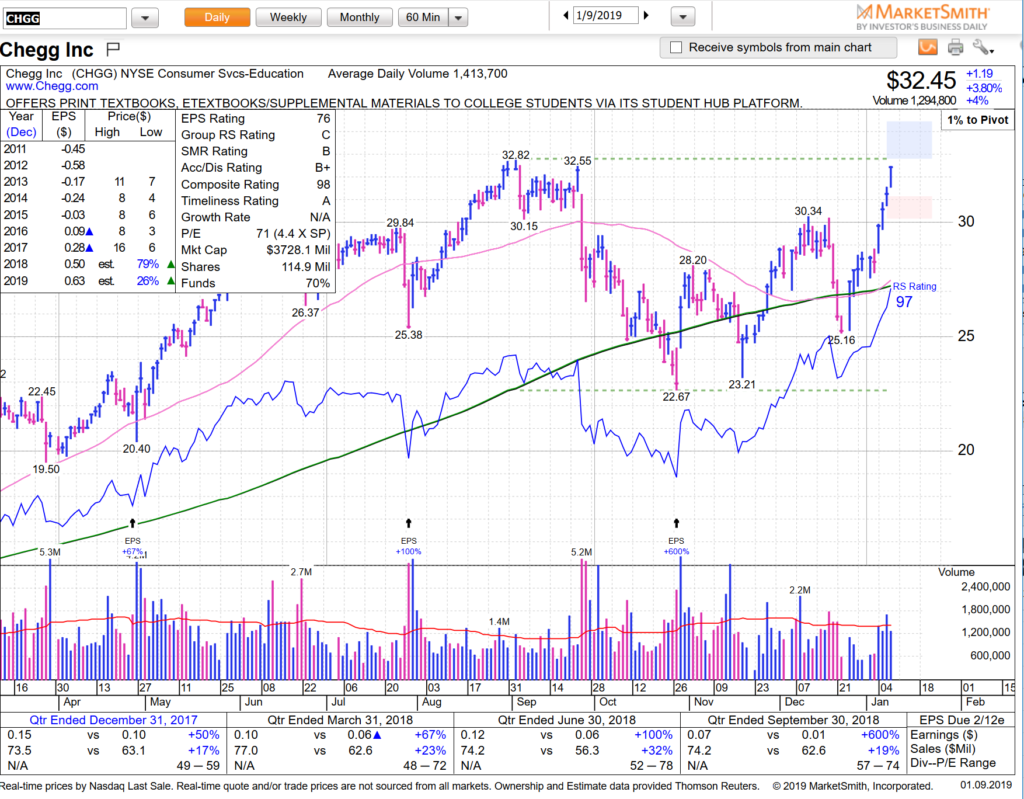

All the charts below need to now form bases/handles but have great potential and are acting like leaders. CHGG we already posted on Sunday and is up 8% from that tweet. Now at highs if it can get a handle (pullback to 30-31) it would be one of the sweetest setups in the market.

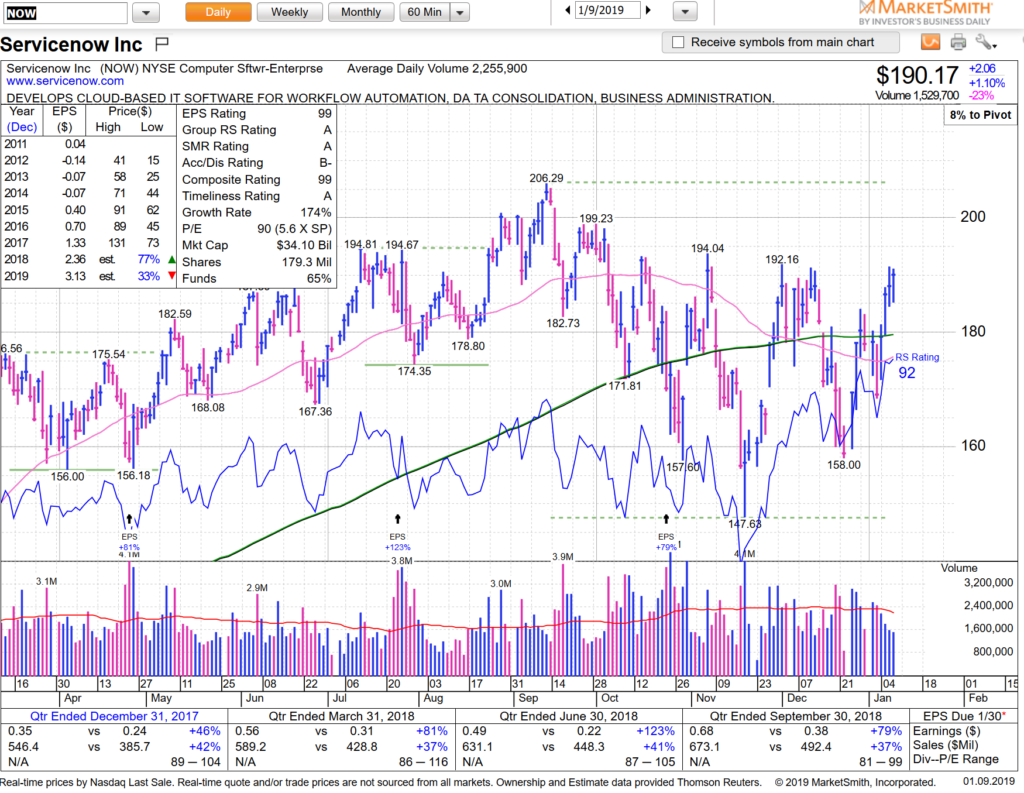

We’ve talked about NOW numerous times in last few months — one of the best stocks in one of our favorite sectors, Enterprise Software, and to boot IBD #6. Ideally we would like a base right here in the low 190s before breaking out.

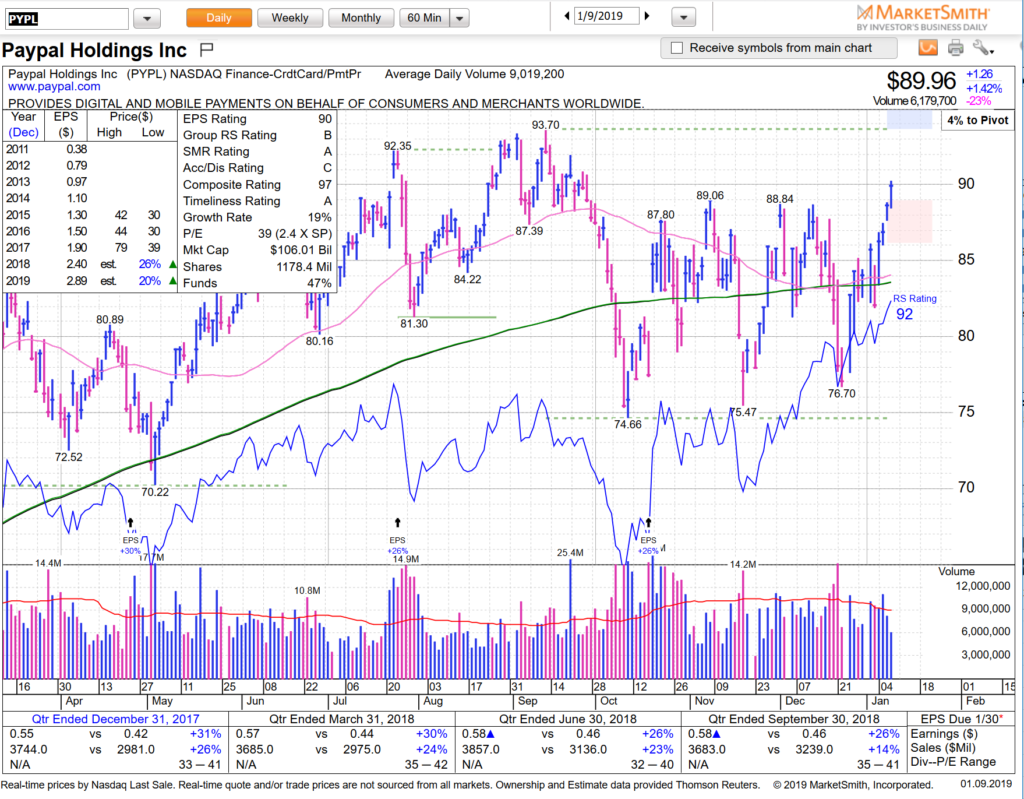

Our newsletter subscription runs thru PayPal and we know first hand how well the company is running right now — stock looks fantastic, and IBD #28. Same theme — we would like the stock to base out right here near 90 to set up. It’s already at upper BB and too stretched to buy right here.

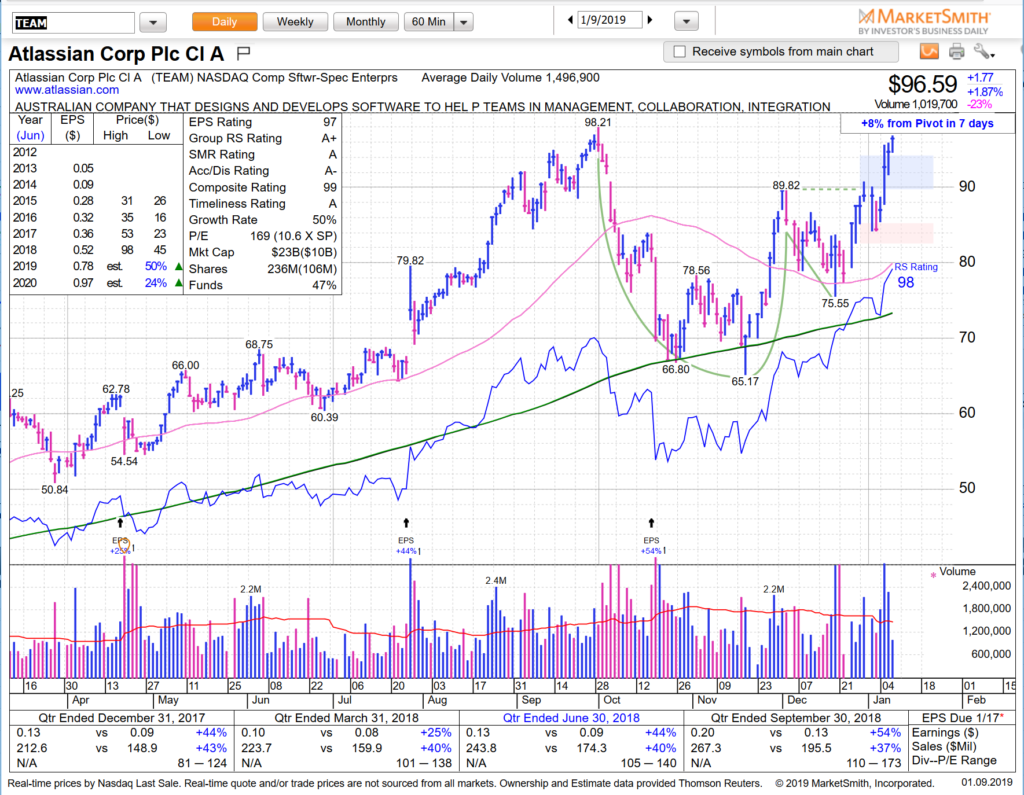

TEAM another one we have talked about many times — also Software sector and IBD #4. We had a breakout alert at 84 on the stock a few weeks ago in our newsletter and it’s now setting up again near highs. Just like CHGG this one needs a handle.

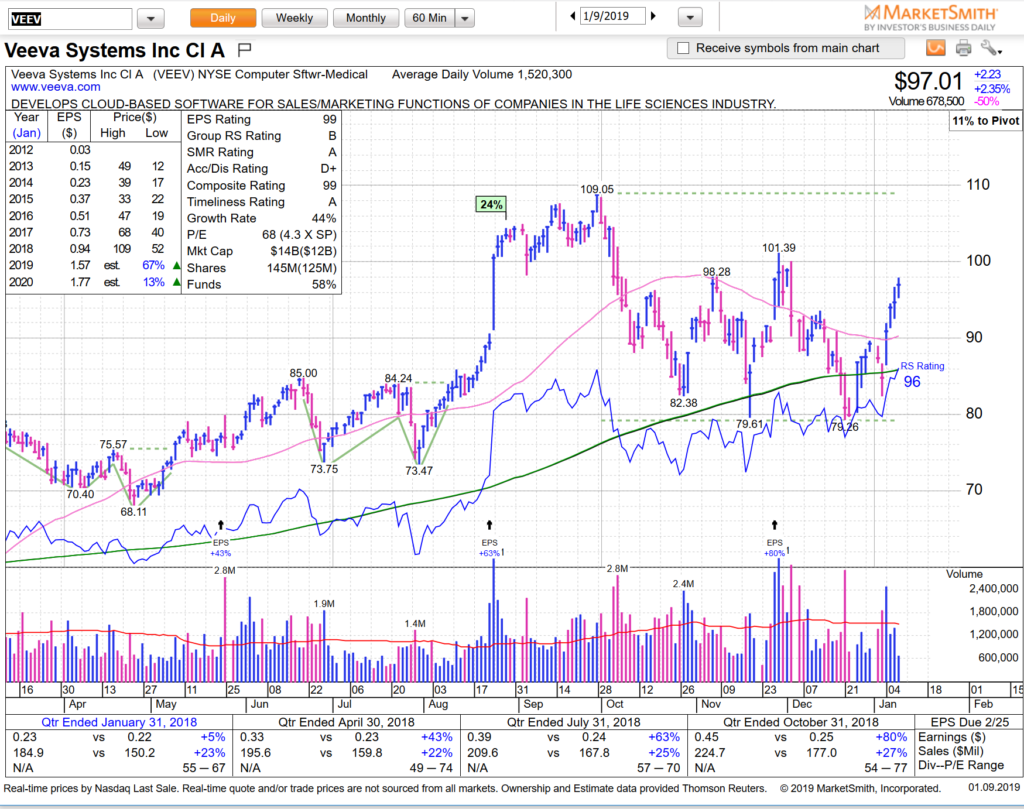

VEEV is IBD #2 and has had a big V type move from 50sma weekly — we’d love a base here under 100. Similar theme in all these stocks: big runs, leaders, now need to chill and set-up.

Keep the above on your radars– if we can get this market to at least churn around here we should be able to get solid risk/reward entries that don’t require chasing. See you on the streams. HCPG