#IBDPartner #Promoted

Love the quiet early Sunday mornings before the family wakes up: Start up the computer, make a hot cup of coffee, and open up MarketSmith to look through scans for the week. The first scan we go through is the IBD 50.

To become a consistent trader you have to learn to strike when a decent amount of balls line up (having every ball line up conversely can be a negative, but that’s another post). One of the balls is IBD. When our stock is in the IBD 50 — it gives it that extra level of confidence, and trust us, at this stage of the game (once you have the trade managment down) it’s all psychology.

We’re usually very early in our stalking and holding — here we are already in $BABA and $NFLX and you would think it was this week, but it was posted May 04.

If a stock has decent potential but it’s not ready, we add it to watch-list. Ideally, we like to add early and then watch it for days before actually entering. Why? Because you get to know the stock behavior — and we can’t emphasize how important that is to a trader. To a certain extent you get to know the personality of the stock, how to treat the stop, whether to wait for breakout or get in early for anticipation — this is the small advantage we still have over computers.

Let’s go over 7 of our favorites in the 50:

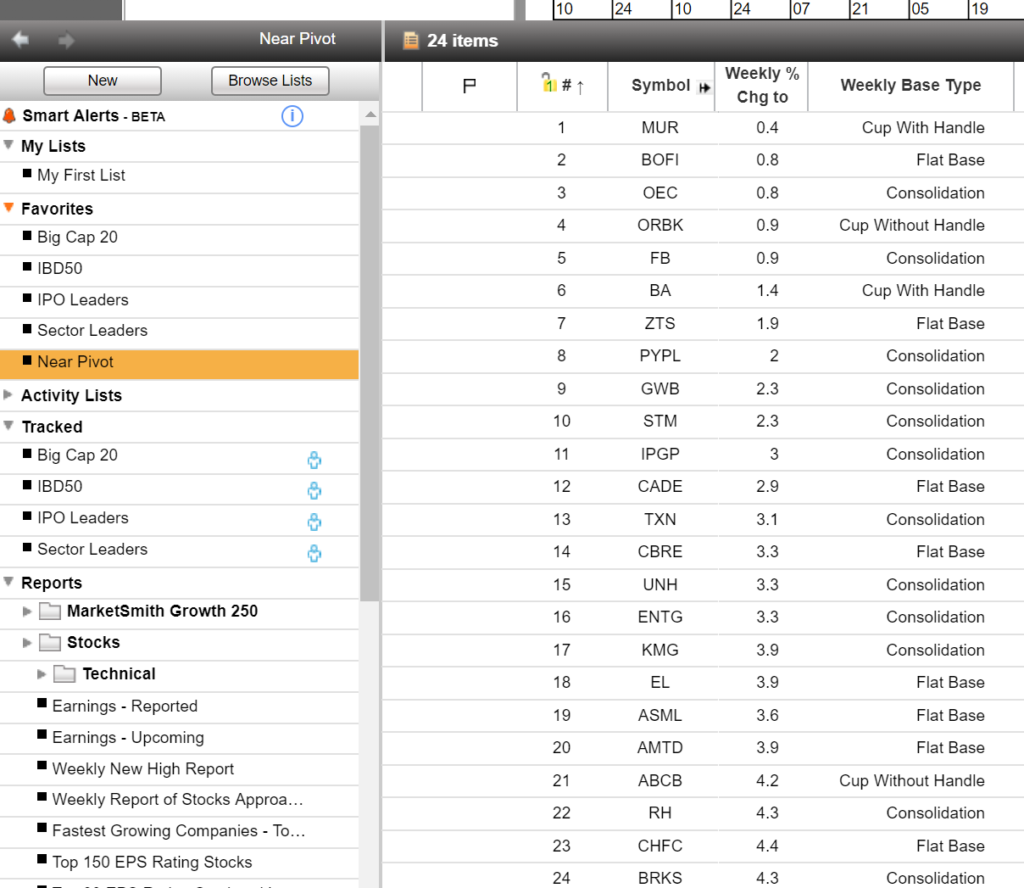

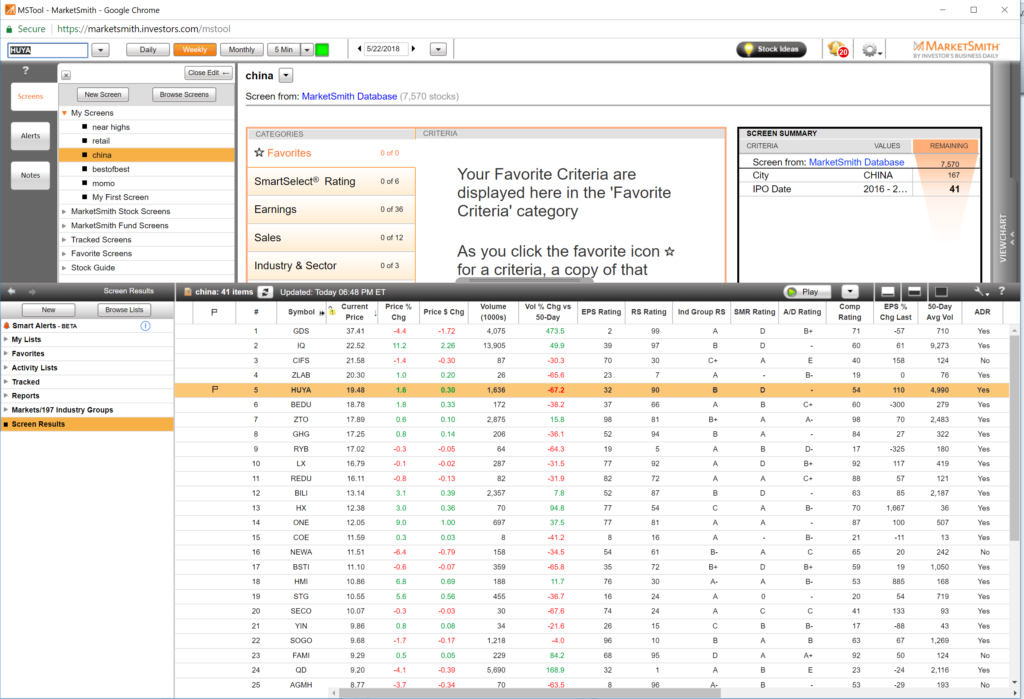

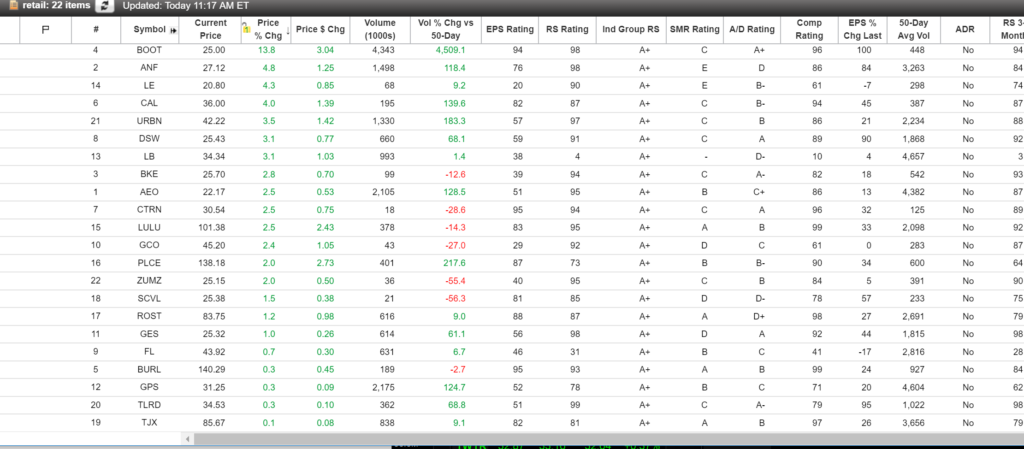

First a visual glimpse of how MarketSmith actually works — relevant scans for any type of trader, but especially momentum traders like ourselves, and trading ideas and alerts. We like to go through the Near Pivot list to take a look at stocks before any potential breakouts.

1. Momentum trader dream here — look at all those beautiful scans on the left to choose from.

2. Automated recommendations on entry, stop, and target. BZUN a good example here up already 11% from pivot (red highlight is stop, blue is buy zone, green is target). We also came up with BZUN in our HCPG scans — always good to get the IBD nod. Again, balls lining up.

BZUN IBD #3

GRUB daily down from buy spot but weekly looks strong. Keep on watch-list. GRUB is IBD #4

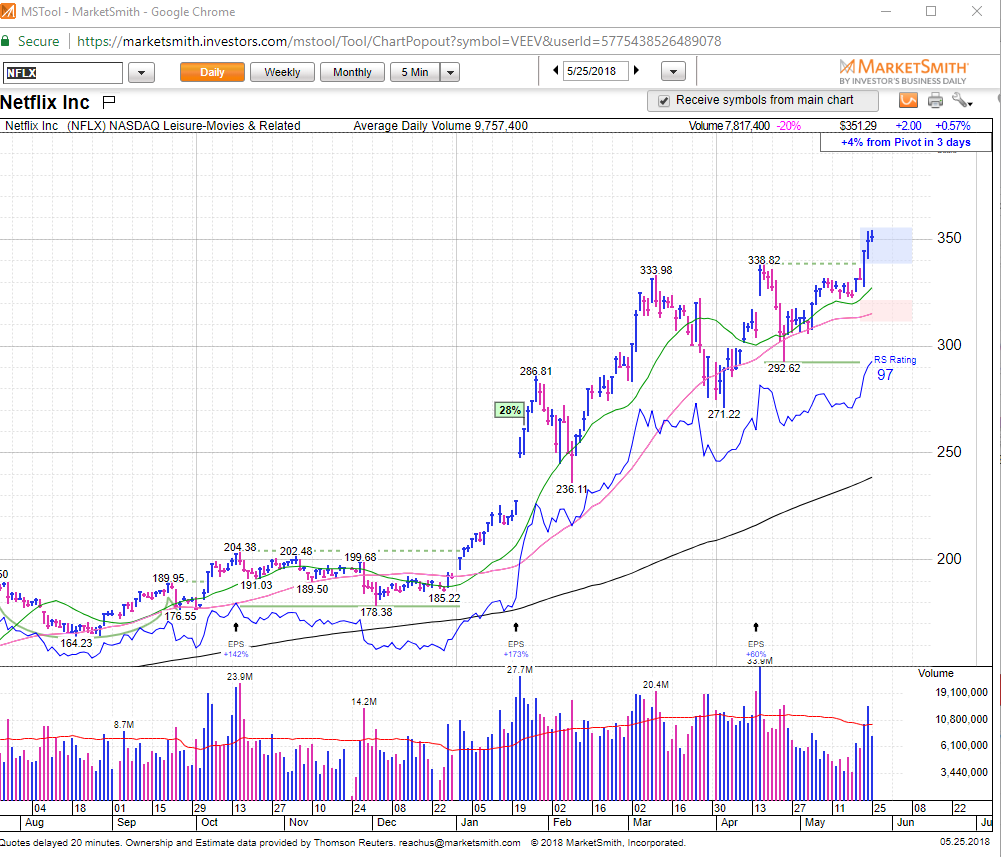

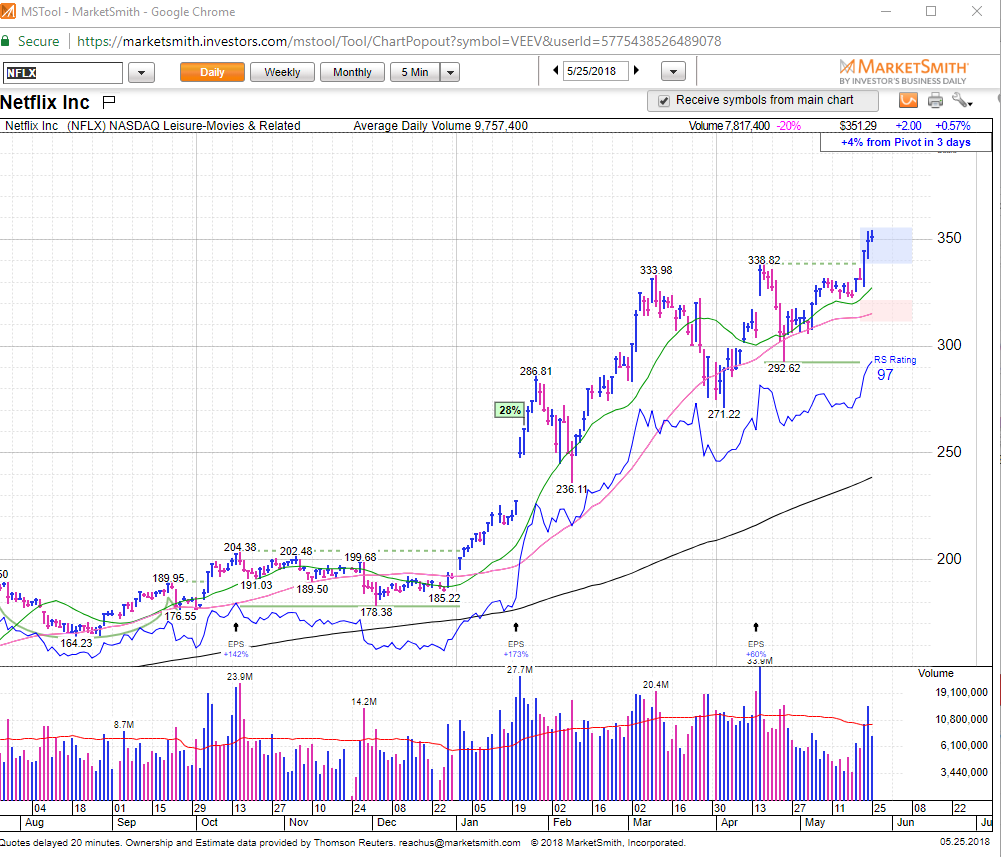

NFLX we are swing long — what a rock star this stock is. NFLX also IBD #14 and has already triggered their pattern recognition/alert.

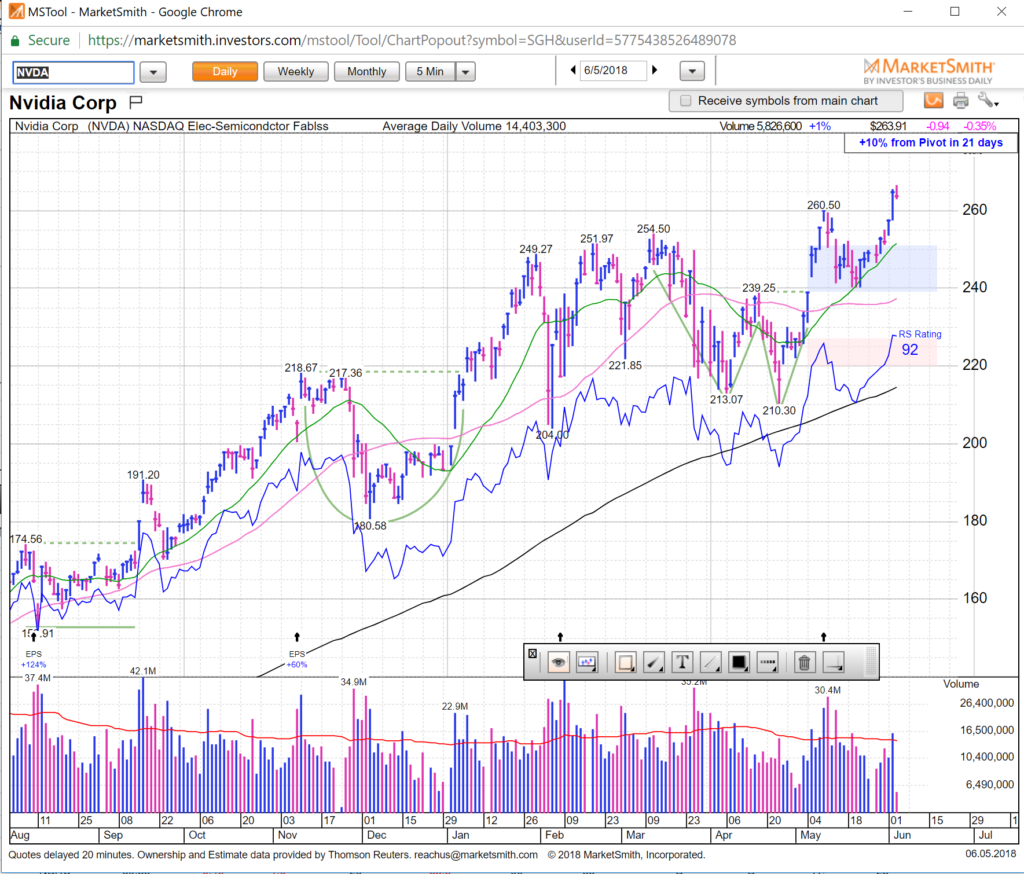

NVDA we area long on 240 reversal (which was also bottom of buy zone on MarketSmith). NVDA also IBD #21

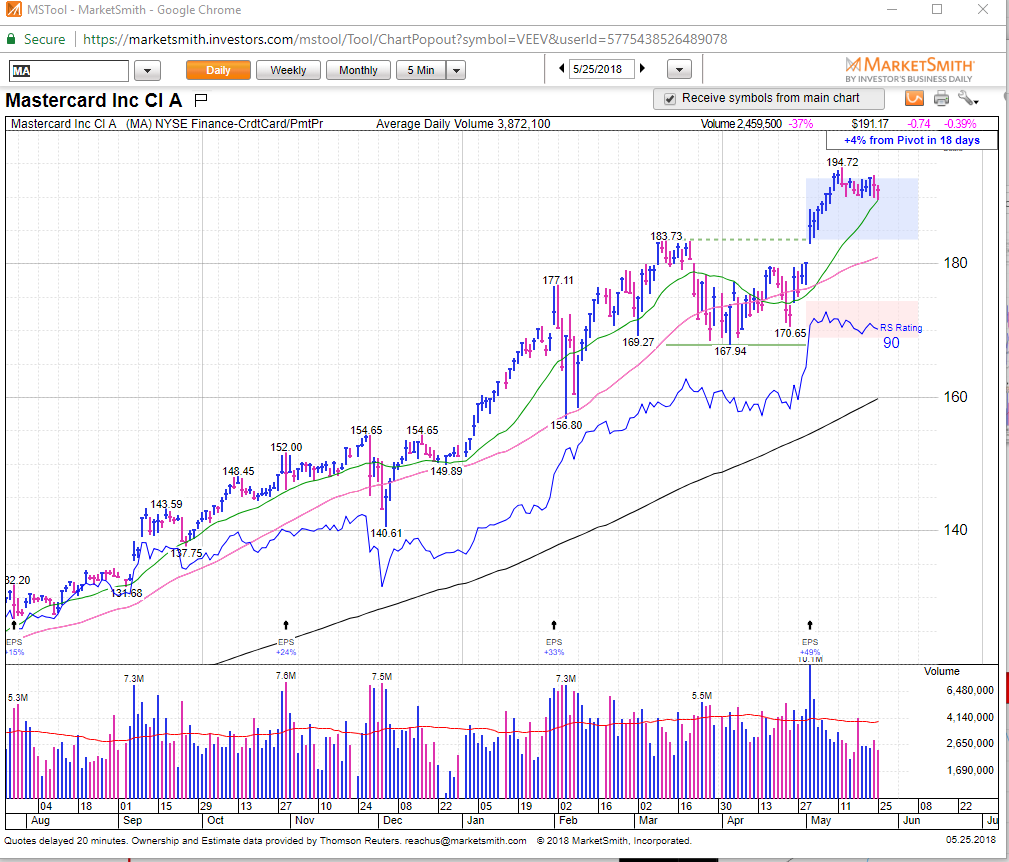

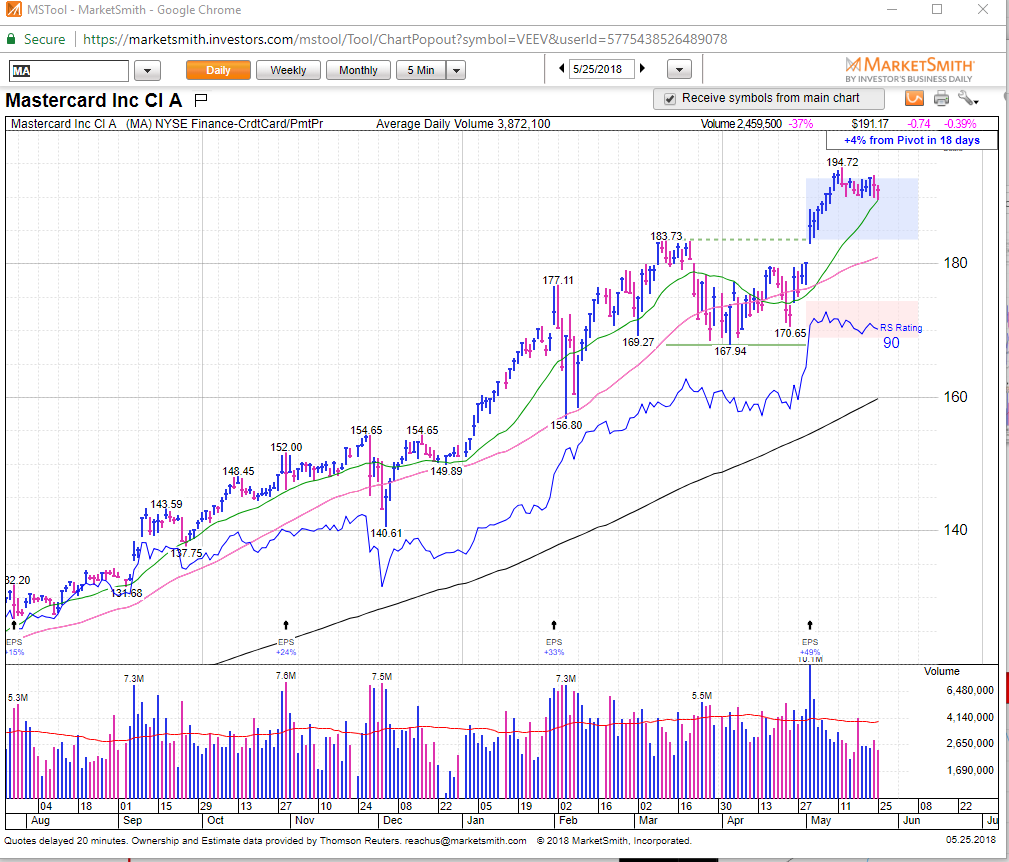

MA is IBD #31 — great daily, and look at that beautiful hold on 20sma on Friday. Wish we had seen that in real-time.

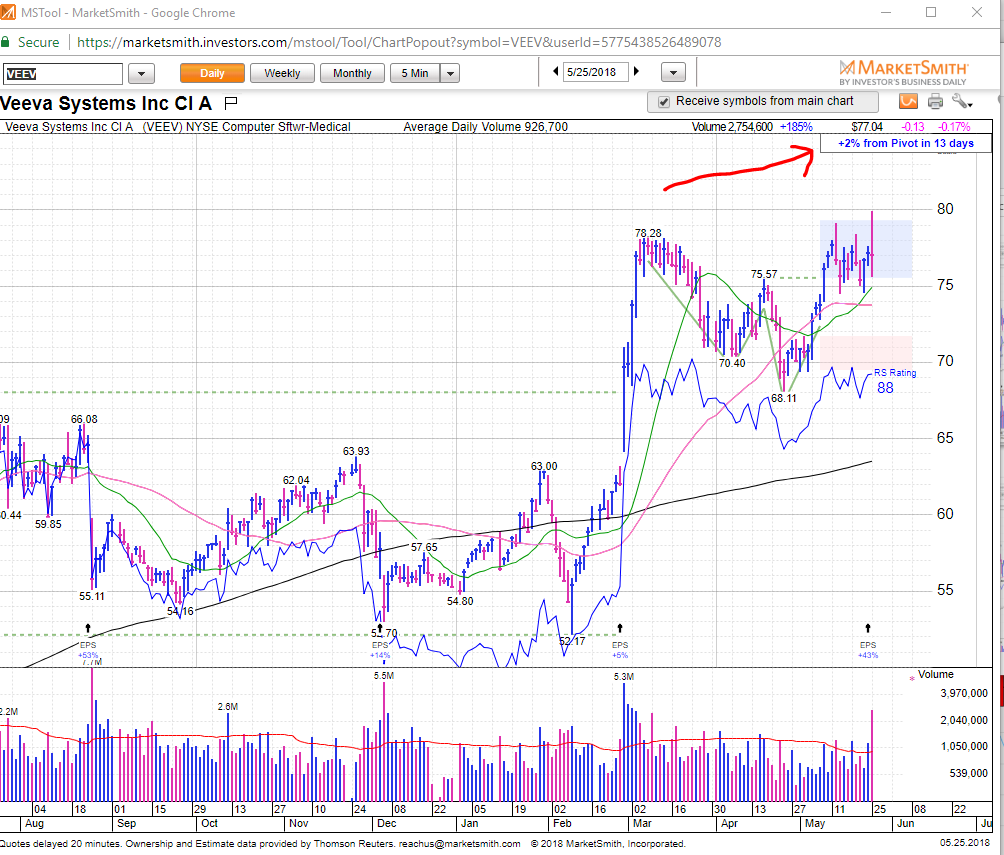

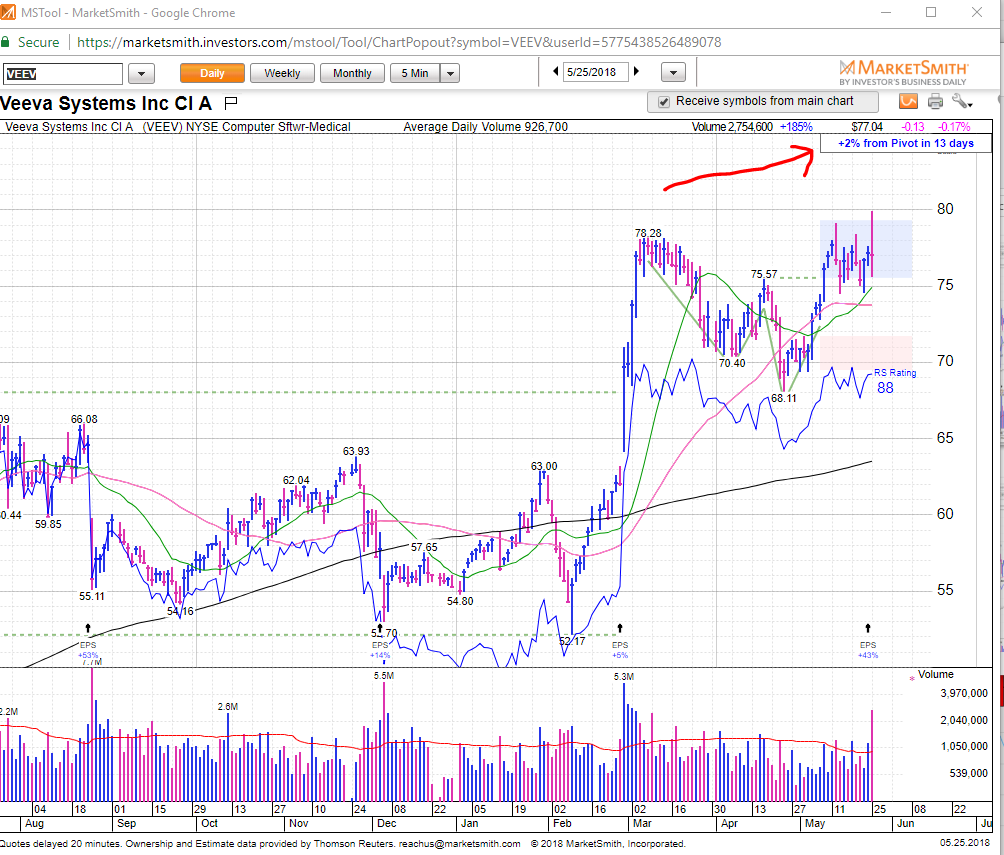

VEEV is IBD #39 and also in the buy zone. Great chart.

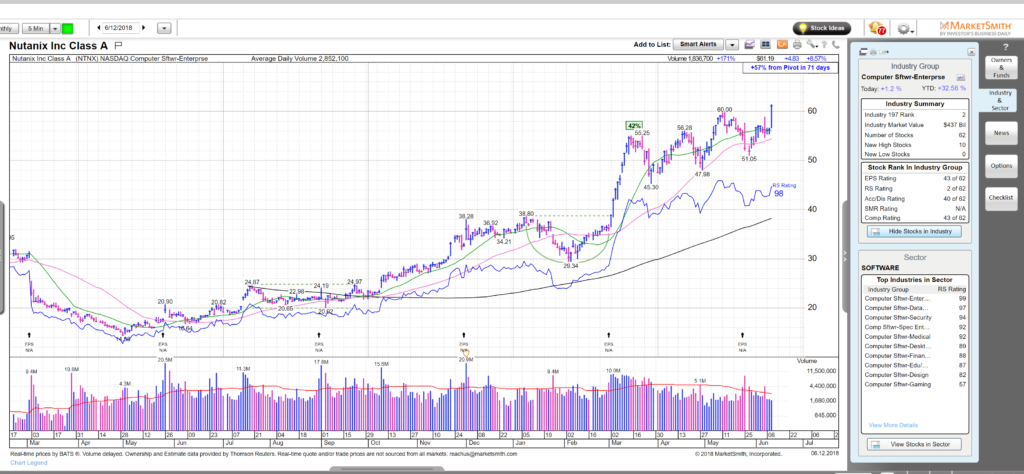

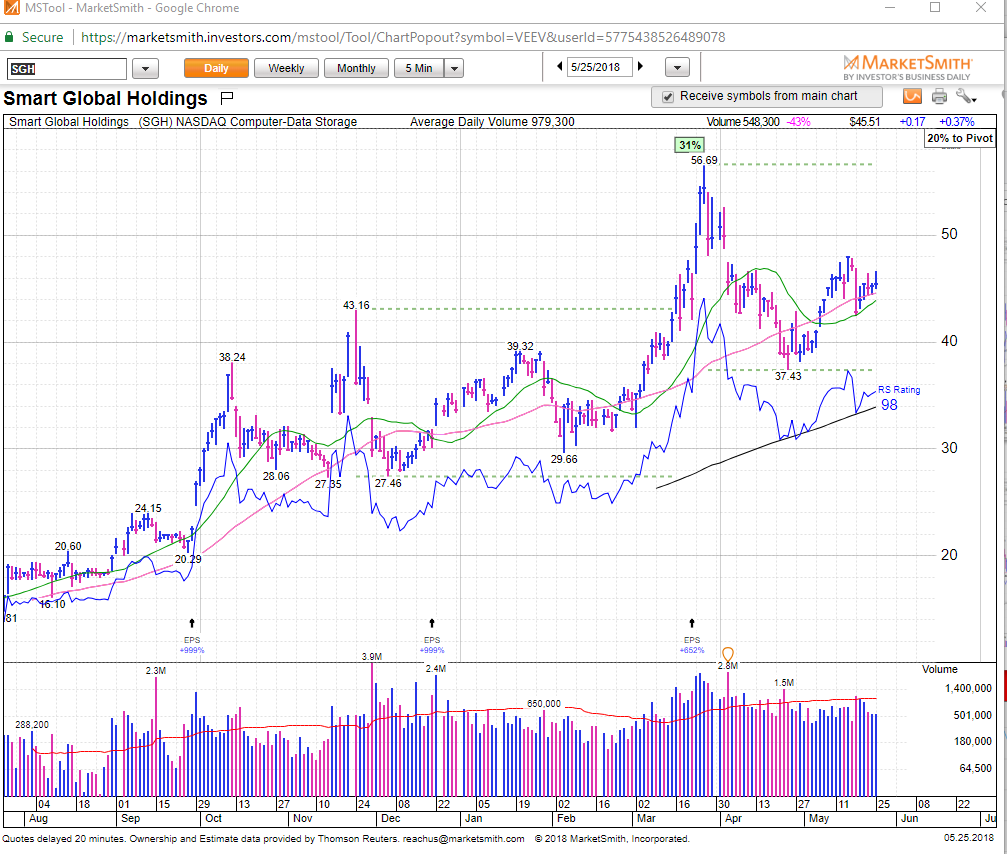

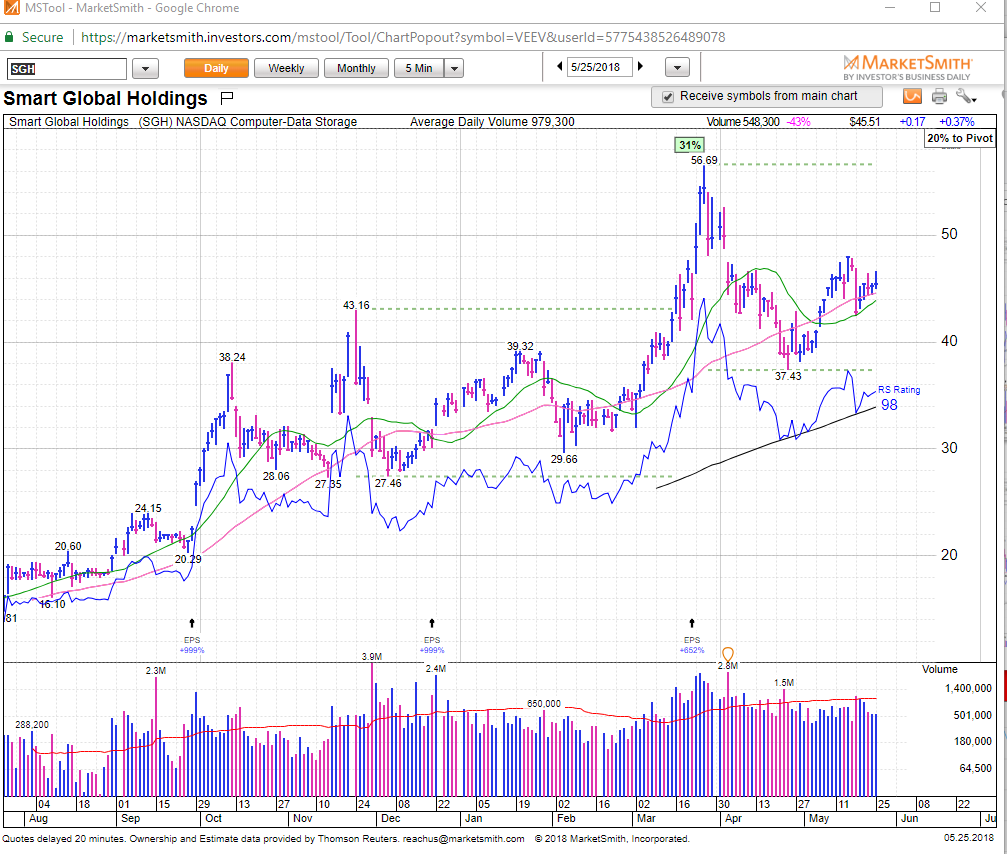

SGH another chart that looks good and IBD #42.

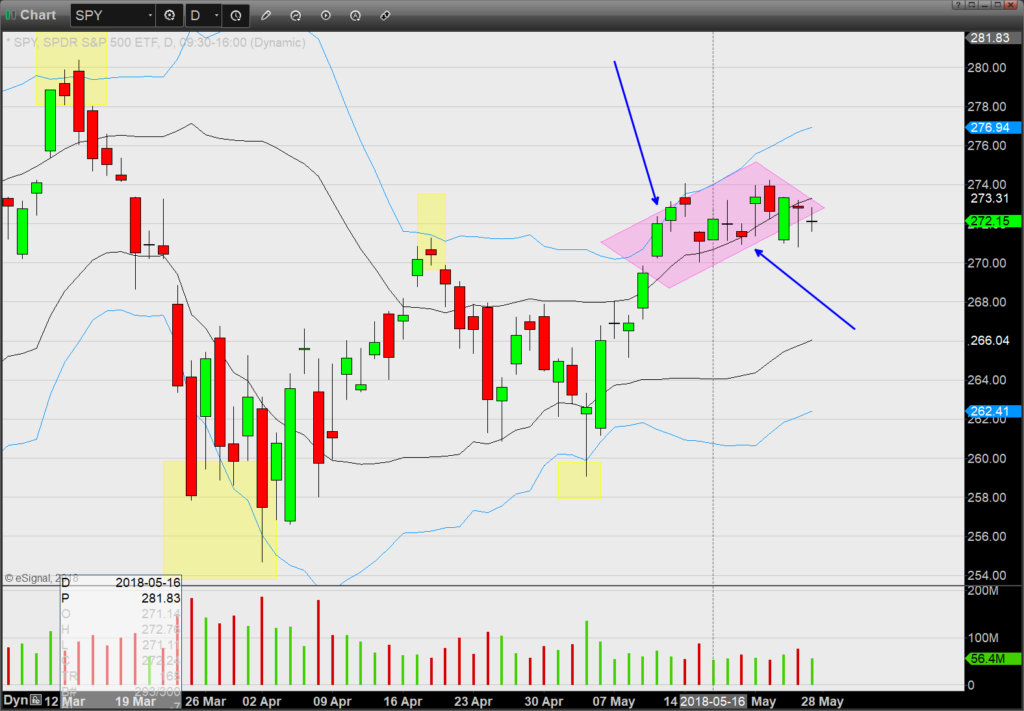

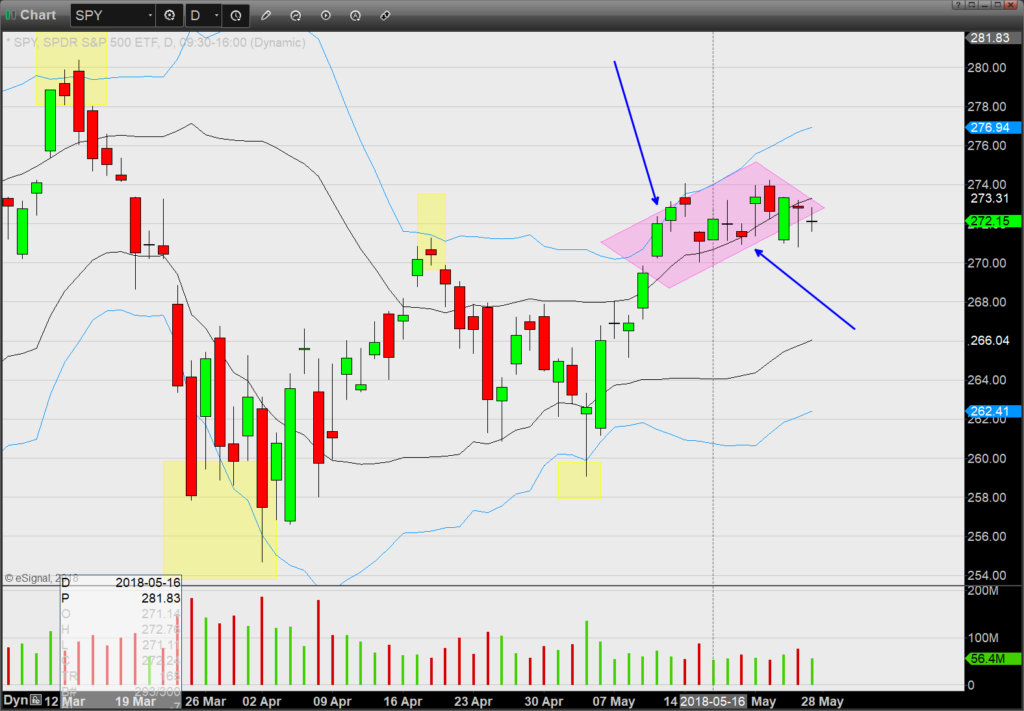

Should be interesting week. We come in with month long swings on SMH and then some positions in NFLX BABA NVDA FB. SPY has broken the sweet spot trend meaning we have lost that confidence in buying dip against the upper Dev 1 edge. The range is small but important. 270-274. Next time through 270 or 274 should finally break out of this 12 day range.

See you out there on the streams!